Week in Review

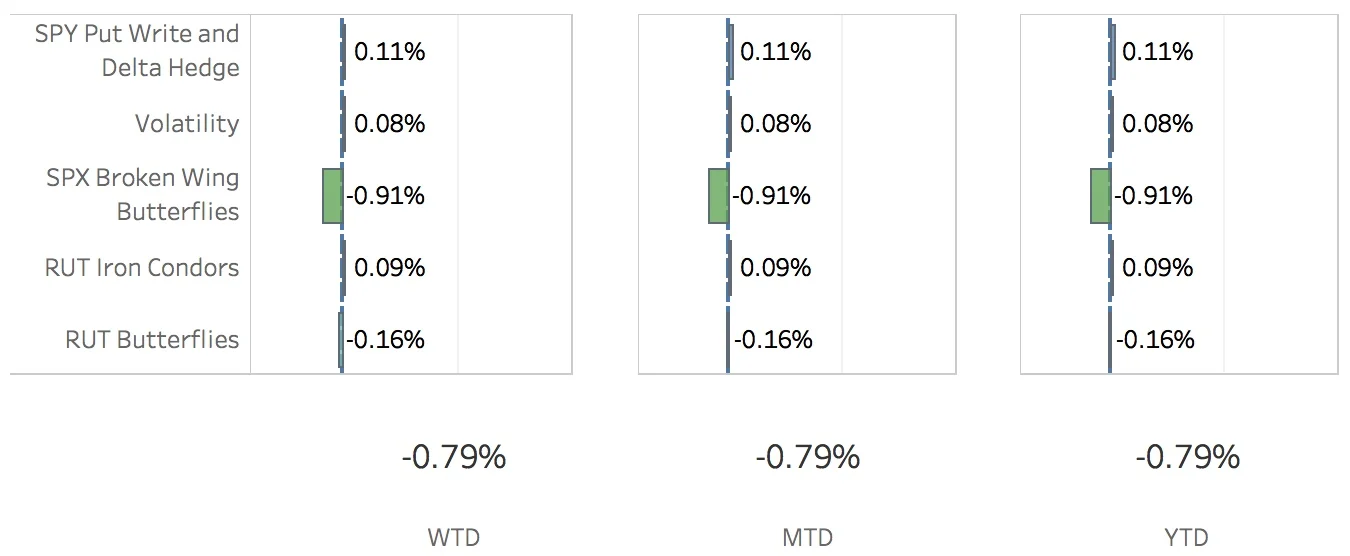

So, at the end of last year I decided to close out most of by positions just because. And with the new year beginning I opened up a bunch of new ones and promptly lost a crapload. Ok. Whatever. That will just make things a whole lot more challenging. The SPX (S&P 500) ended the week at 2743.15, up +2.60%, and the RUT (Russell 2000) ended the week at 1560.01, up +1.60%. The portfolio was down -0.79%.

The SPY Put Write and Delta Hedge strategy did quite well with the usually subdued SPX launching upwards this week. I closed out last week's put write and opened up another one expiring next week. I also added a delta hedge in the form of a couple of short puts. For the week, the strategy added 11 bps to the portfolio return.

The Volatility strategy had a nice opening to the year with some gains in the VIX calendar and in the VXX puts. The strategy added 8 bps to the portfolio this week.

The SPX Broken Wing Butterfly strategy suffered the most with the big push upwards in the SPX. I should be able to claw back some of those losses before expiration but not all of them. That's just the way it goes with this trade. It really likes markets that move slowly and that is definitely not what happened this week. For the week, the strategy subtracted 91 bps from the portfolio.

The RUT Iron Condors strategy did fairly well this week. I should be closing out the Jan 26 trade next week and will be adding the Feb 23 trade. For the week, the strategy added 9 bps to the portfolio.

The RUT Butterflies strategy had a bit of a shaky start to the week. For the week, the strategy subtracted 16 bps from the portfolio.

Contribution to Return

Trade Activity

- CLOSED SPY Put Write Jan 5 +1.53%

- CLOSED VXX Put Jan 5 -9.16%

- OPENED SPY Put Write Jan 12

- OPENED SPY Delta Hedge Jan 19

- OPENED VXX Put Jan 19

- OPENED SPX Broken Wing Butterfly Jan 31

- OPENED SPX Broken Wing Butterfly Feb 16

- OPENED SPX Broken Wing Butterfly Feb 28

- OPENED SPX Broken Wing Butterfly Mar 16

- OPENED SPX Broken Wing Butterfly Mar 29

- OPENED RUT Weirdor Jan 26

- OPENED RUT Weirdor Feb 9

- OPENED RUT Butterfly Feb 16

SPX Broken Wing Butterfly details

- OPENED SPX Broken Wing Butterfly Jan 31 SOLD -4 IRON CONDOR SPX 100 (Weeklys) 31 JAN 18 2680/2720/2680/2600 CALL/PUT @32.95

- OPENED SPX Broken Wing Butterfly Feb 16 SOLD -4 IRON CONDOR SPX 100 (Weeklys) 16 FEB 18 2680/2725/2680/2600 CALL/PUT @38.85

- OPENED SPX Broken Wing Butterfly Feb 28 SOLD -3 IRON CONDOR SPX 100 (Weeklys) 28 FEB 18 2700/2750/2700/2600 CALL/PUT @45.25

- OPENED SPX Broken Wing Butterfly Mar 16 SOLD -4 IRON CONDOR SPX 100 (Weeklys) 16 MAR 18 2670/2715/2670/2590 CALL/PUT @44.45

- OPENED SPX Broken Wing Butterfly Mar 29 SOLD -4 IRON CONDOR SPX 100 (Quarterlys) 29 MAR 18 2725/2775/2725/2645 CALL/PUT @46.35

- ADJUSTED SPX Broken Wing Butterfly Jan 31 BOT +2 VERTICAL SPX 100 (Weeklys) 31 JAN 18 2710/2720 CALL @4.85

- ADJUSTED SPX Broken Wing Butterfly Jan 31 BOT +2 VERTICAL SPX 100 (Weeklys) 31 JAN 18 2705/2720 CALL @10.20

- ADJUSTED SPX Broken Wing Butterfly Feb 16 BOT +2 VERTICAL SPX 100 (Weeklys) 16 FEB 18 2715/2725 CALL @4.80

- ADJUSTED SPX Broken Wing Butterfly Feb 16 BOT +2 VERTICAL SPX 100 (Weeklys) 16 FEB 18 2715/2725 CALL @6.15

Milking

- No trades-a-milking