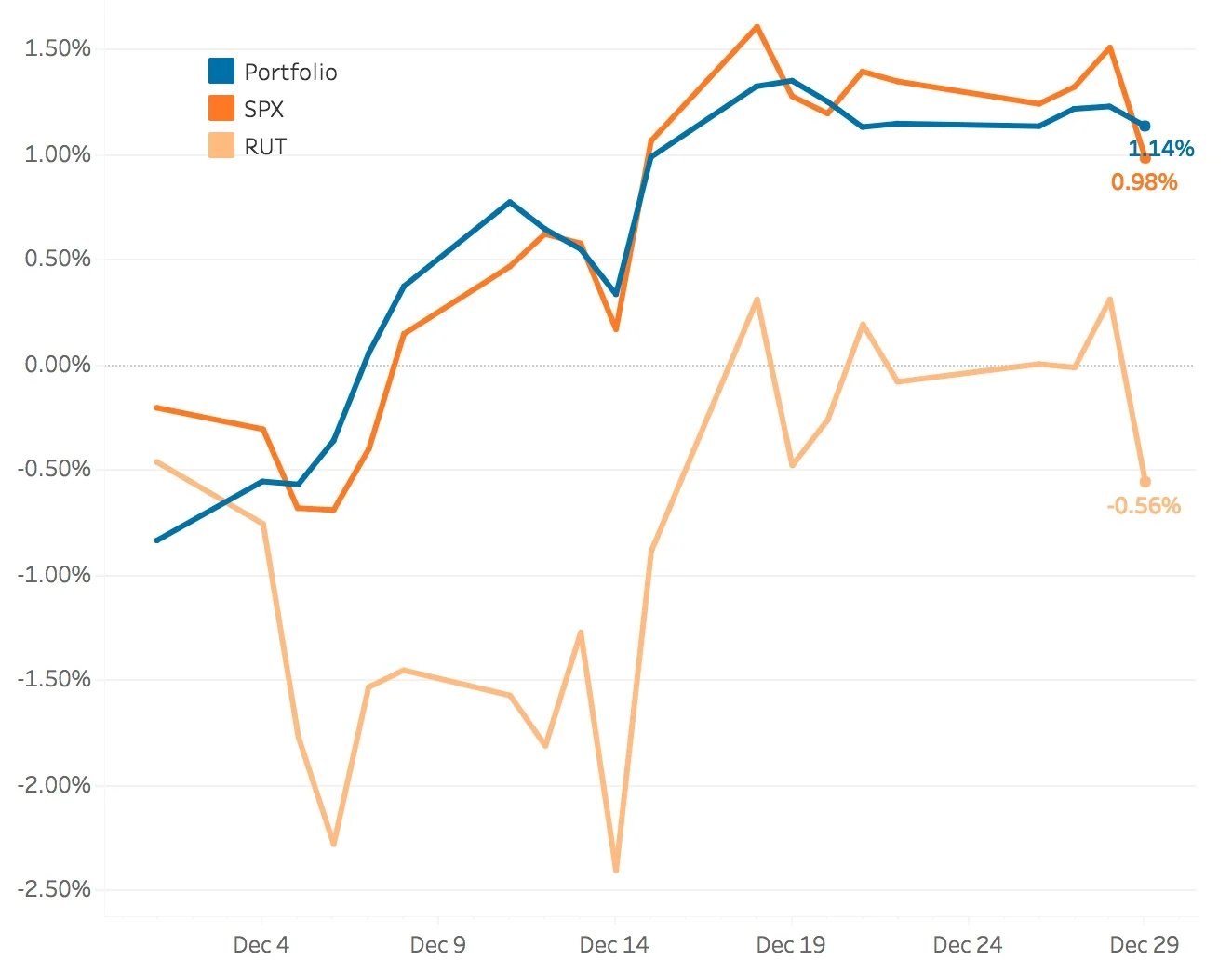

December 2017

This turned out to be a pretty solid and also fairly boring month. The strategies just kind of plodded along with some doing well and some not really living up to expectations. I started out in the hole but made that up fairly quickly by the middle of the month. Then things just kind of stalled out and the performance curve flattened out for the last two weeks of the year. The SPX (S&P 500) ended the month at 2673.61, up +0.98%, and the RUT (Russell 2000) ended the month at 1535.51, down -0.56%. The portfolio was up +1.14%.

It was a bit of a surprise to see almost half of the month's gains coming from the SPY Put Write and Delta Hedge and the Volatility strategy. They contributed 18 bps and 35 bps respectively. The SPX Broken Wing Butterflies strategy contributed 78 bps. The RUT Iron Condors was okay by contributing 9 bps and the RUT Butterflies was the disappointing strategy of the bunch subtracting 27 bps for the month.

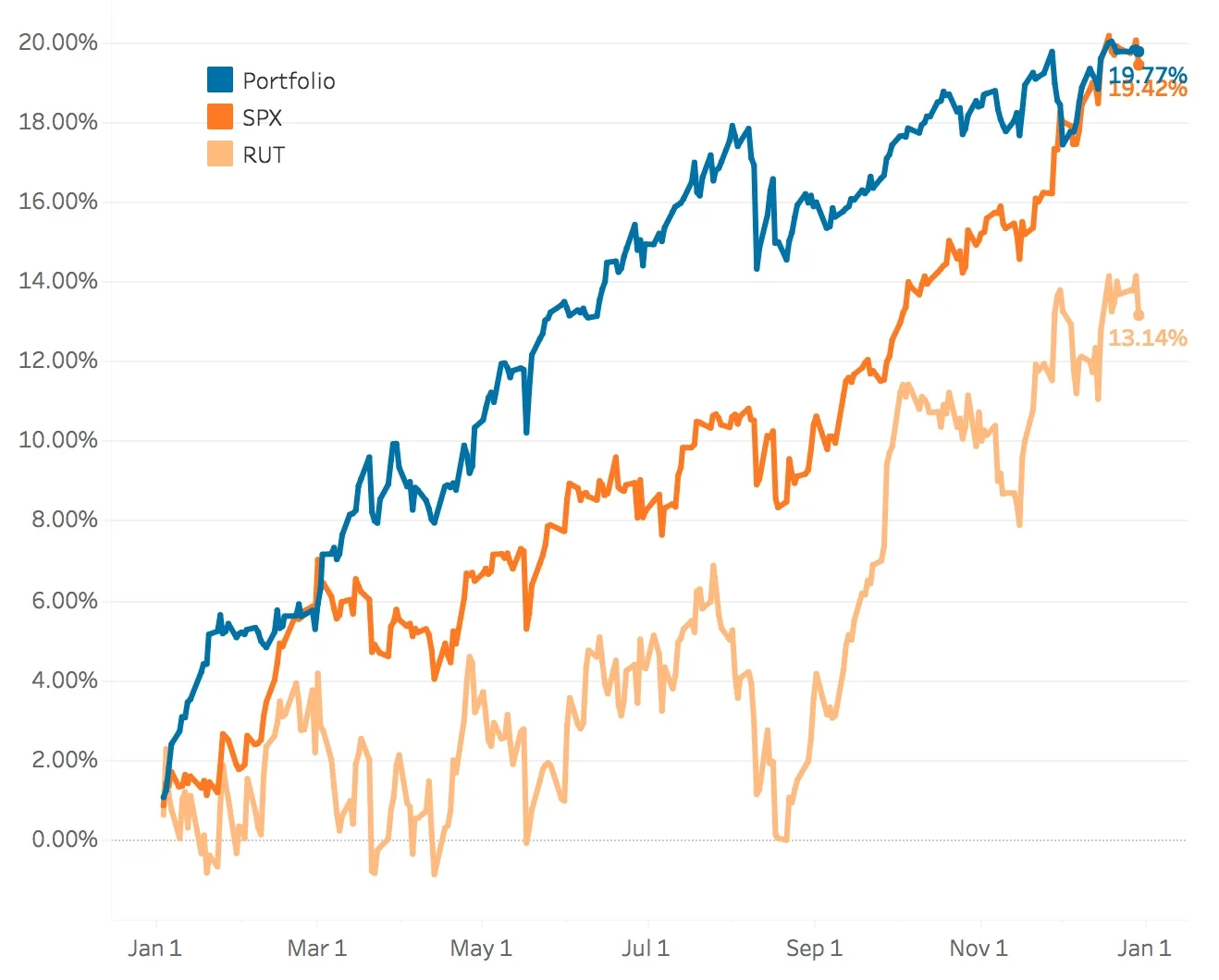

Year-to-Date

It was looking a little iffy these last few days of the year but the portfolio actually ended up on top. The SPX (S&P 500) was up +19.42% and the RUT (Russell 2000) was up +13.14%. The portfolio ended the year up +19.77%.

The SPY Put Write and Delta Hedge strategy added 209 bps. I changed up the Volatility strategy a bit by adding some VXX puts to it and that helped claw back some of the losses with it subtracting 60 bps for the year. The shining star this year was the SPX Broken Wing Butterflies strategy adding 892 bps. I made a slight change to that strategy too (I doubled the size of each trade but reduced the number of trades by half) and I may be making some more changes in 2018. The RUT Iron Condors strategy added a solid 529 bps to the portfolio which was pretty good. Finally, the RUT Butterflies strategy added 405 bps to the portfolio. I still have some work to do on that last strategy.

All in all, it turned out to be a pretty good year. By posting my results online, I kept myself honest and learned a lot about the markets and myself. Happy trading and I look forward to talking with all of you next year!