Week in Review

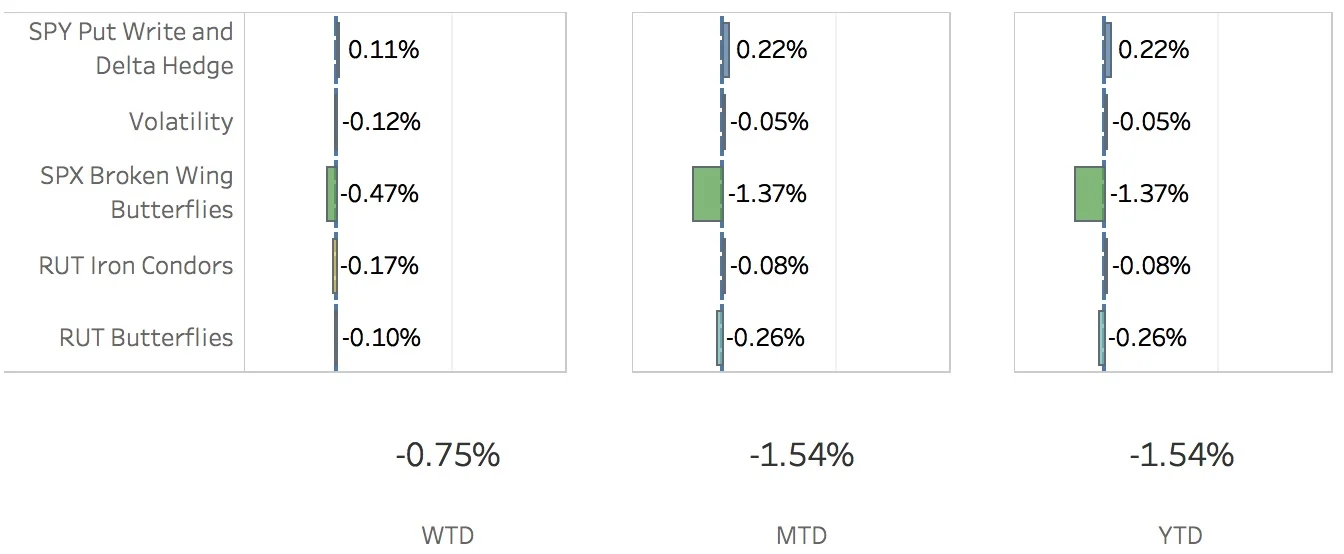

Life happens. Things get busy at work and in other parts of my life and posting my trading results take a bit of a back seat. Oh well, better late than never. In any case, the past week felt like a bit of a punch in the gut. This year hasn't started out all too well and the trade that was the star of 2017 has been a bit of a bugaboo this year. To say that I've found the sharp market rise a challenge would be a bit of an understatement. No one said this was going to be easy. The SPX (S&P 500) ended the week at 2786.24, up +1.57%, and the RUT (Russell 2000) ended the week at 1591.97, up +2.05%. The portfolio was down -0.75%.

The SPY Put Write and Delta Hedge strategy did well since all I put on last week were short puts. I did the same this week with a short put for the put write strategy and some short puts for the delta hedge. For the week the strategy added 11 bps to the portfolio.

The Volatility strategy had a wee bit of trouble. The VXX puts were fine but the VIX calendar got a little bit trounced and I'm not exactly sure why. It subtracted 12 bps from the portfolio this past week.

The SPX Broken Wing Butterflies decided to dump on me again this week. I've had some trouble keeping up with the rise in the market and I'm going to have some losers right out of the gate this year. The trades expiring further out will have a better chance of surviving but I really did myself a disservice by adding back some of the shorter term trades in the first week of the year. Oh well, lesson learned. For the week, the strategy subtracted 47 bps from the portfolio.

The RUT Iron Condors strategy did okay this week. The move up in the RUT did prompt me to remove the call spreads on the Jan 26 and Feb 9 trades and also narrow the put debit spreads from 20 points to 10 points. If the market stays where it is, I'll have one small winner and one small loser. The Feb 16 trade is doing okay so far but we'll see how it goes in the coming weeks. For the week, the strategy subtracted 17 bps.

The RUT Butterflies strategy had a meh week. It fell a little as the market pushed into the sea of death section of the trade. I'm not sure what I am going to do with this. I'll leave it for a few days but at some point I'll have to figure out if I am going to move the whole trade or just try adding some call credit spreads to try and bring up the theta. For the week, the strategy subtracted 10 bps from the portfolio.

Contribution to Return

Trade Activity

- CLOSED SPY Put Write Jan 12 +1.37%

- CLOSED SPY Delta Hedge Jan 19 +1.16%

- CLOSED VXX Put Jan 12 +25.09%

- OPENED SPY Put Write Jan 19

- OPENED SPY Delta Hedge Jan 26

- OPENED VXX Put Jan 26

- OPENED RUT Weirdor Feb 23

- ADJUSTED SPX Broken Wing Butterfly Jan 31

- ADJUSTED SPX Broken Wing Butterfly Feb 16

- ADJUSTED SPX Broken Wing Butterfly Feb 28

- ADJUSTED SPX Broken Wing Butterfly Mar 16

SPX Broken Wing Butterfly Details

- ADJUSTED SPX Broken Wing Butterfly Jan 31 BOT +2 VERTICAL SPX 100 (Weeklys) 31 JAN 18 2700/2710 CALL @9.40

- ADJUSTED SPX Broken Wing Butterfly Feb 16 BOT +4 VERTICAL SPX 100 (Weeklys) 16 FEB 18 2710/2715 CALL @4.25

- ADJUSTED SPX Broken Wing Butterfly Feb 28 BOT +3 VERTICAL SPX 100 (Weeklys) 28 FEB 18 2745/2750 CALL @3.30

- ADJUSTED SPX Broken Wing Butterfly Feb 28 BOT +3 BUTTERFLY SPX 100 (Weeklys) 28 FEB 18 2740/2745/2750 CALL @.20

- ADJUSTED SPX Broken Wing Butterfly Feb 28 BOT +3 VERTICAL SPX 100 (Weeklys) 28 FEB 18 2745/2750 CALL @3.55

- ADJUSTED SPX Broken Wing Butterfly Mar 16 BOT +4 VERTICAL SPX 100 (Weeklys) 16 MAR 18 2710/2715 CALL @3.65

Milking

- No trades-a-milking