Week in Review

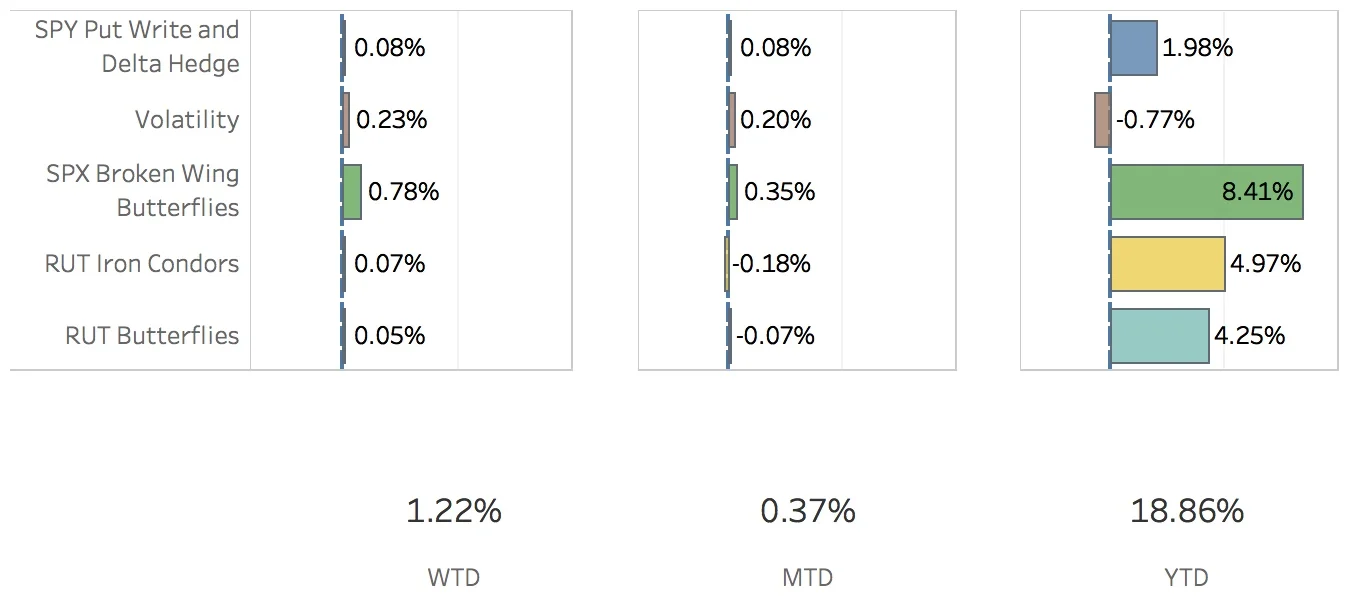

This was a nice week with gains in all five of the strategies. The indices were mixed and volatility was down across the board. This made for a good environment in which to simply let the trades sit and soak in much of the theta they lost the week before. There was some activity in the portfolio, with the normal weekly trades closed and reopened along with a pair of new weirdors and a new broken wing butterfly. The SPX (S&P 500) ended the week at 2651.50, up +0.35%, and the RUT (Russell 2000) ended the week at 1521.72, down -1.00%. The portfolio was strong, up +1.22%.

The SPY Put Write and Delta Hedge strategy went well with the market up slightly. This week's put write trade was closed and a new one expiring next Friday was opened. The strategy added 8 bps to the portfolio.

The Volatility strategy also went well this week and benefitted greatly from the drop in volatility. The short term weekly long VXX put was closed out and a new long VXX put was opened to expire two weeks from now. Also, the VIX calendar position made back some of its losses as the VIX started pushing up the left side of trade. Overall, the strategy added 23 bps to the portfolio.

The SPX Broken Wing Butterfly strategy came back with a vengeance this week. The strategy benefitted greatly from the drop in volatility along with little price movement in SPX. I adjusted the Feb 16 trade by pulling in some of the calls and opened a Feb 28 trade. For the week, the strategy added 78 bps to the portfolio.

The RUT Iron Condors strategy was fine. A Jan 12 and a Jan 26 trade were opened this week. I tried to position them so that one expires the week before the RUT butterfly expires and one expires the week after. I'm hoping that helps limit the damage from a wildly swinging market and doesn't take out all three trades at once. We shall see. For this week, the strategy added 7 bps to the portfolio.

The RUT Butterfly strategy was also fine. The RUT came down a bit but it didn't hurt this trade. Because this trade is currently negative theta and positive vega, I'd rather have the market move a bit, either up or down. That's exactly opposite of what I need for the iron condors. We shall see what next week brings. For the week, the strategy added 5 bps.

Contribution to Return

Trade Activity

- CLOSED SPY Put Write Dec 8 +2.06%

- CLOSED VXX Put Dec 8 +41.97%

- OPENED SPY Put Write Dec 15

- OPENED VXX Put Dec 22

- OPENED SPX Broken Wing Butterfly Feb 28

- OPENED RUT Weirdor Jan 12

- OPENED RUT Weirdor Jan 26

- ADJUSTED SPX Broken Wing Butterfly Feb 16

SPX Broken Wing Butterfly details

- OPENED SPX Broken Wing Butterfly Feb 28 SOLD -4 IRON CONDOR SPX 100 (Weeklys) 28 FEB 18 2620/2670/2620/2540 CALL/PUT @47.70

- ADJUSTED SPX Broken Wing Butterfly Feb 16 BOT +4 VERTICAL SPX 100 (Weeklys) 16 FEB 18 2635/2640 CALL @3.45

Milking

- No trades-a-milking