Week in Review

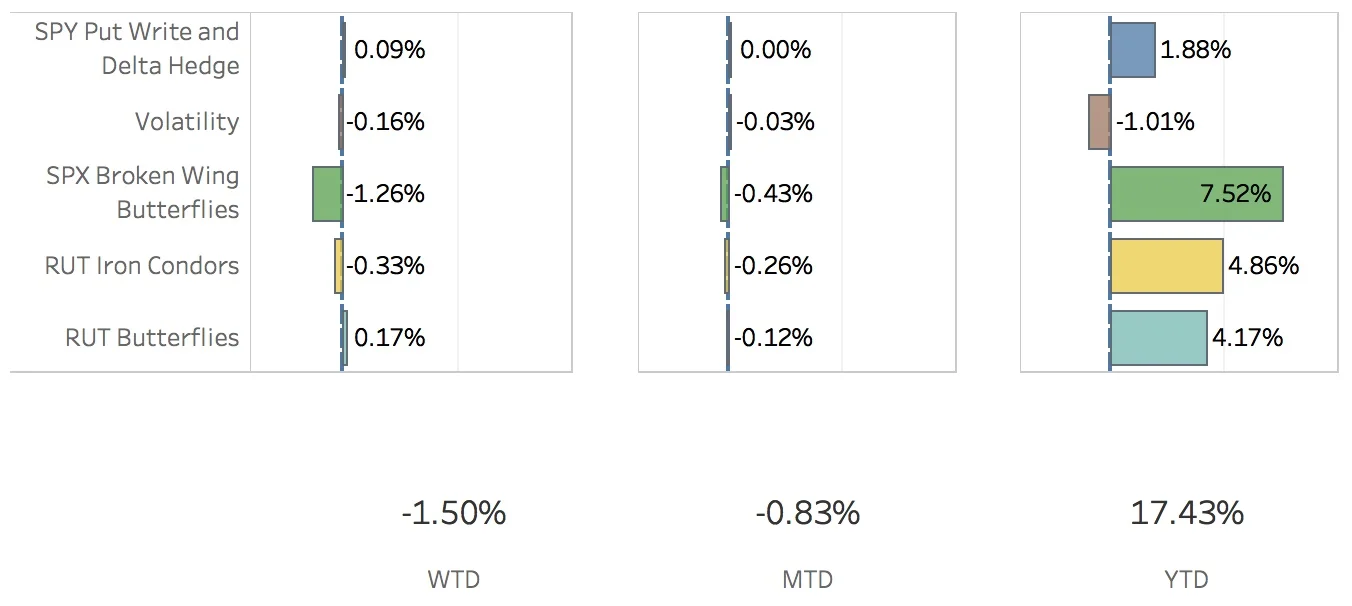

This was supposed to be a quiet week. I had planned on closing the two RUT weirdors and the RUT butterfly and I was counting on quiet in the markets. Instead, I got surge for the first four days of the week, a complete breakdown Friday morning and then nearly a full recovery by Friday's close. So much for a nice easy week. The SPX (S&P 500) ended the week at 2642.22, up +1.53%, and the RUT (Russell 2000) ended the week at 1537.02, up +1.18%. The portfolio got its head handed to it with all this activity and ended down for the week, -1.50%.

The SPY Put Write and Delta Hedge strategy did fine. With the market up, the strategy notched 9 bps of gains. I closed out the put write and delta hedge on Friday and opened up another put write. No delta hedge this week since I am leaning pretty positive delta right now. I had thought about putting on some naked calls but it looked pretty clear the new tax plan was going to pass and I didn't feel like it was worth the risk.

The Volatility strategy had some trouble this week. The long VXX puts were getting pounded. I closed out the Dec/Jan VIX calendar and opened a Jan/Feb trade. All in all, the strategy subtracted 16 bps from the portfolio.

The SPX Broken Wing Butterflies, my bread and butter trade, took it on the chin this week. After making some adjustments early in the week to deal with the move up, the strategy really got taken to the woodshed when the market moved down and volatility ticked up. Ouch ouch ouch. The open trades aren't looking particularly great right now. We'll see what happens next week if the volatility comes out of the market and if we see a strong move upwards. Fingers crossed. For the week, the strategy subtracted 126 bps from the portfolio.

The RUT Iron Condors had some trouble this week. I was planning to close them out on Friday and the market move down just made that whole process painful. I was looking forward to some small gains in both of the weirdors and instead got an extra small gain in the Dec 15 trade and a small loss in the Dec 29 trade. I decided to wait until next week before I put on the new Jan trades. For the week, the strategy subtracted 33 bps from the portfolio.

The RUT Butterflies did fairly well this week. I really struggled with the Dec trade and closed it out for a small loss on Friday. One of my weaknesses is my tendency to over trade and that's exactly what I did here. Oh well. I opened the new Jan trade this week and it really handled the ups and downs quite well. We'll see how this one goes. For the week, the strategy added 17 bps to the portfolio.

Contribution to Return

Trade Activity

- CLOSED SPY Put Write Dec 1 +1.85%

- CLOSED SPY Delta Hedge Dec 8 +0.96%

- CLOSED VXX Put Dec 1 +49.21%

- CLOSED VIX Calendar Dec/Jan -9.70%

- CLOSED RUT Butterfly Dec 15 -0.75%

- CLOSED RUT Weirdor Dec 15 +0.14%

- CLOSED RUT Weirdor Dec 29 -1.63%

- OPENED SPY Put Write Dec 8

- OPENED VXX Put Dec 15

- OPENED VIX Calendar Jan/Feb

- OPENED RUT Butterfly Jan 19

- ADJUSTED SPX Broken Wing Butterfly Jan 19

- ADJUSTED SPX Broken Wing Butterfly Jan 31

- ADJUSTED SPX Broken Wing Butterfly Feb 16

SPX Broken Wing Butterfly details

- ADJUSTED SPX Broken Wing Butterfly Jan 19 BOT +4 VERTICAL SPX 100 (Weeklys) 19 JAN 18 2600/2610 CALL @7.05

- ADJUSTED SPX Broken Wing Butterfly Jan 31 BOT +4 VERTICAL SPX 100 (Weeklys) 31 JAN 18 2600/2610 CALL @7.00

- ADJUSTED SPX Broken Wing Butterfly Feb 16 BOT +4 IRON CONDOR SPX 100 (Weeklys) 16 FEB 18 2590/2640/2590/2510 CALL/PUT @46.75

- ADJUSTED SPX Broken Wing Butterfly Feb 16 SOLD -4 IRON CONDOR SPX 100 (Weeklys) 16 FEB 18 2590/2640/2590/2510 CALL/PUT @46.65

Milking

- No trades-a-milking