Week in Review

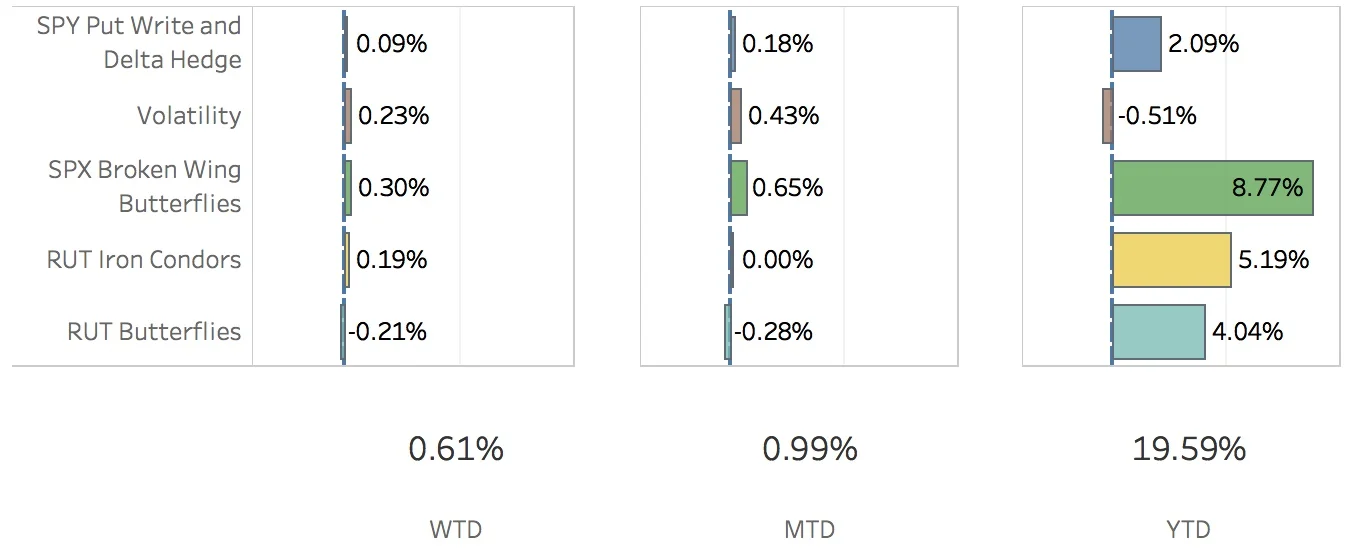

This was a another nice week with volatility ticking downwards a little in the SPX and quite a bit in the RUT. Also, it was the first week of trading for bitcoin futures on the CBOE and it looks like the tax reform bill will get signed into law soon. That hope has been nothing but good news for the markets. Fluttering around for most of the week and pushing lower on Thursday, the markets moved strongly up on Friday. The SPX (S&P 500) ended the week at 2675.81, up +0.92%, and the RUT (Russell 2000) ended the week at 1530.42, up +0.57%. The portfolio was up +0.61%.

The SPY Put Write and Delta Hedge strategy had a good week with the market pushing higher. I closed out last week's trade and opened a new put write on Friday. For the week, the strategy added 9 bps.

The Volatility strategy was strong this week with major gains in the VXX puts and the VIX calendar. It's a small position so the gains didn't add a ton to the overall portfolio but it was nice to see the losses this year in the strategy getting pared back. For the week, the strategy added 23 bps to the portfolio.

The SPX Broken Wing Butterfly strategy had another good week making back some more of the losses from two weeks ago. Gains came from a drop in volatility and a positive delta position. The Dec 15 trade was closed out for a good gain and a strong move in the SPX required adjustments in the Dec 29, Jan 19, Feb 16 and Feb 28 trades. The strategy added 30 bps to the portfolio this week.

The RUT Iron Condors strategy had a fairly good week. I adjusted both of the weirdors far too much. I really need to step away from my computer more often to save me from myself. Still, the strategy was able to contribute 19 bps to the portfolio.

The RUT Butterfly strategy had a so-so week. The RUT hasn't really moved as strongly as I would have hoped. That's good for the Iron Condors strategy but not so good for this one. I did adjust the trade slightly to try and take advantage of a market that was going to continue to sit still or move upwards but I'll probably need another adjustment soon. For the week, the strategy subtracted 21 bps from the portfolio.

Contribution to Return

Trade Activity

- CLOSED SPY Put Write Dec 15 +3.14%

- CLOSED VXX Put Dec 15 +36.82%

- CLOSED SPX Broken Wing Butterfly Dec 15 +1.90%

- OPENED SPY Put Write Dec 22

- OPENED VXX Put Dec 29

SPX Broken Wing Butterfly Details

- CLOSED SPX Broken Wing Butterfly Dec 15 BOT +4 SPX 100 (Weeklys) 15 DEC 17 2410/2485 PUT/PUT @ 0.00

- ADJUSTED SPX Broken Wing Butterfly Dec 15 BOT +2 2/-1/-1 CUSTOM SPX 100 (Weeklys) 15 DEC 17/15 DEC 17/15 DEC 17 2485/2515/2520 CALL/CALL/CALL @65.00

- ADJUSTED SPX Broken Wing Butterfly Dec 29 BOT +4 VERTICAL SPX 100 (Quarterlys) 29 DEC 17 2530/2540 CALL @9.90

- ADJUSTED SPX Broken Wing Butterfly Jan 19 BOT +4 VERTICAL SPX 100 (Weeklys) 19 JAN 18 2590/2600 CALL @9.00

- ADJUSTED SPX Broken Wing Butterfly Feb 16 BOT +4 VERTICAL SPX 100 (Weeklys) 16 FEB 18 2625/2635 CALL @7.40

- ADJUSTED SPX Broken Wing Butterfly Feb 28 BOT +2 VERTICAL SPX 100 (Weeklys) 28 FEB 18 2660/2670 CALL @6.85

Milking

- No trades-a-milking