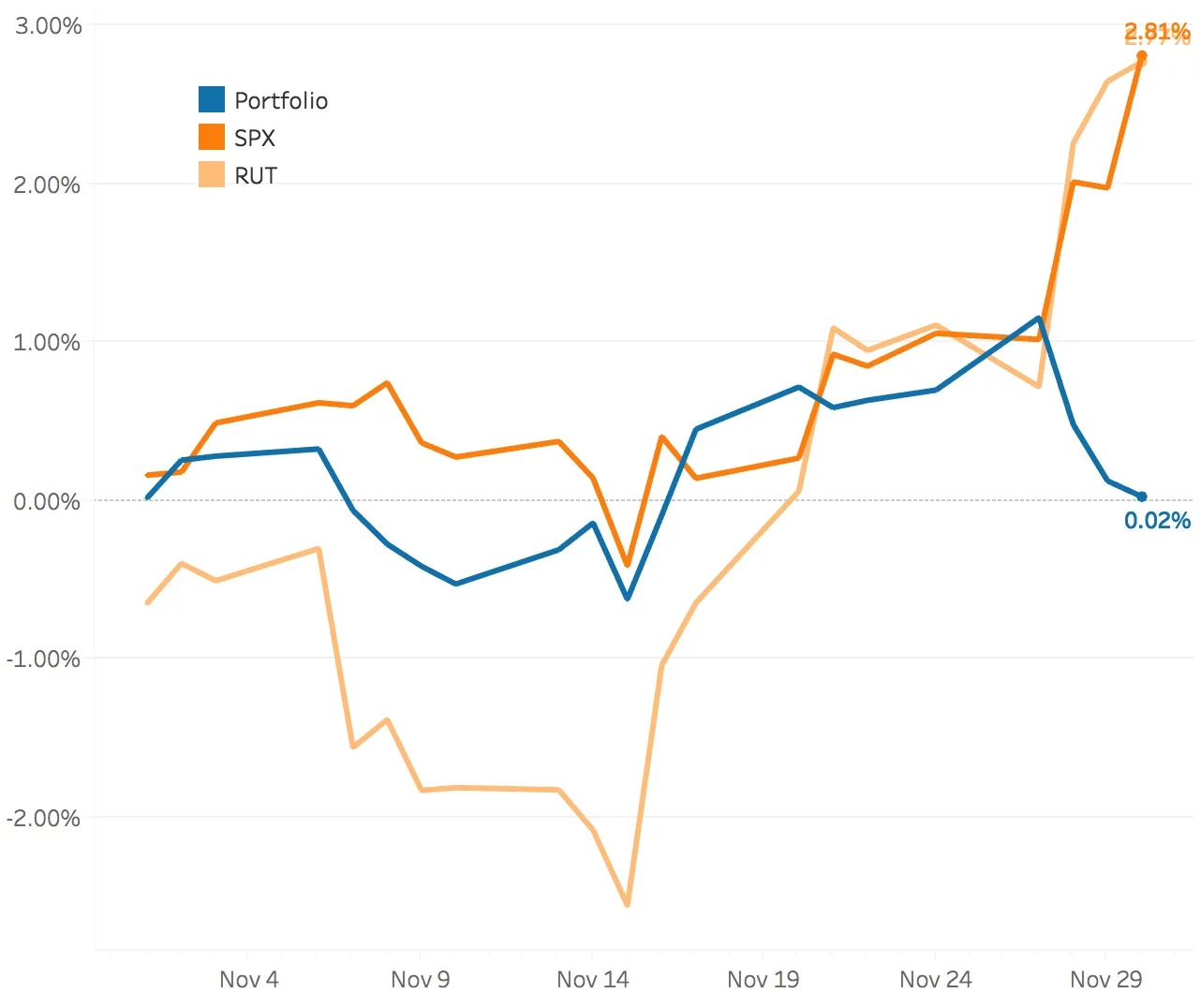

October 2017

This was another month that just drove me kind of crazy. The portfolio struggled a bit to get moving, made some headway in the third week of the month, and then gave it all back in the last week when the SPX and RUT surged higher. The SPX (S&P 500) ended the month at 2647.58, up +2.81%, and the RUT (Russell 2000) ended the month at 1544.14, up +2.77%. The portfolio was up +0.02%, about enough to buy me a cup of coffee.

The SPY Put Write and Delta Hedge strategy kind of saved my bacon this month adding 34 bps and the Volatility strategy took some of that away removing 16 bps. I had a really tough time in the last week of the month when the SPX surged higher. As a result, the SPX Broken Wing Butterflies strategy subtracted 54 bps. The two RUT strategies did okay with the RUT Iron Condors strategy adding 20 bps and the RUT Butterflies strategy adding 18 bps.

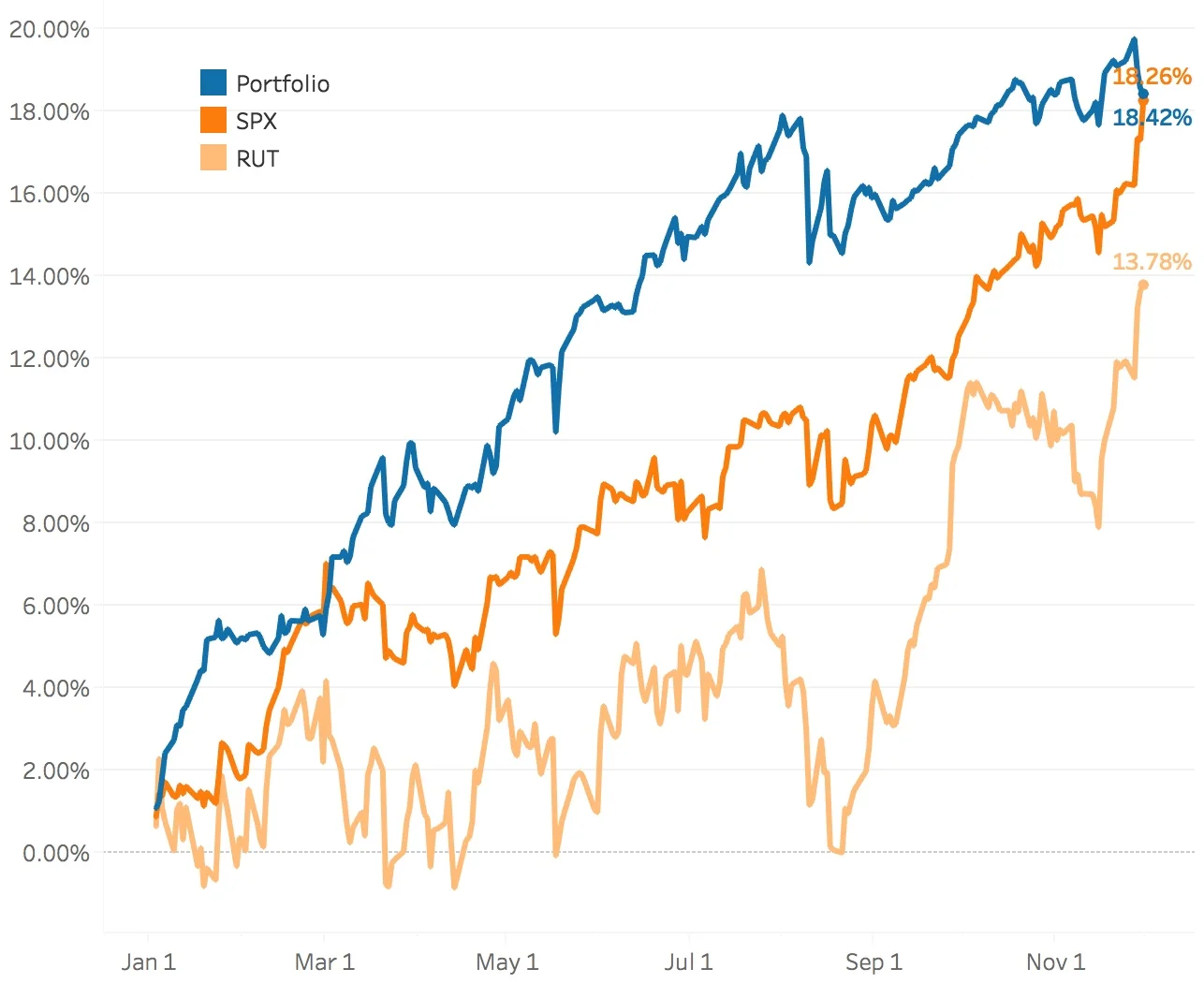

Year-to-Date

The portfolio has been struggling since the summer whereas the indices have really come back strong. The SPX is up +18.26% for the year and the RUT is up +13.78%. The portfolio is still slightly ahead, up +18.42%.

The SPY Put Write and Delta Hedge Strategy has added 188bps to the portfolio so far this year and the Volatility strategy has subtracted 98 bps. The SPX Broken Wing butterflies had some trouble this month but still is the biggest contributor to the portfolio's gains adding 802 bps. The RUT Iron Condors strategy added 516 bps and the RUT Butterflies strategy added 432 bps.