Week in Review

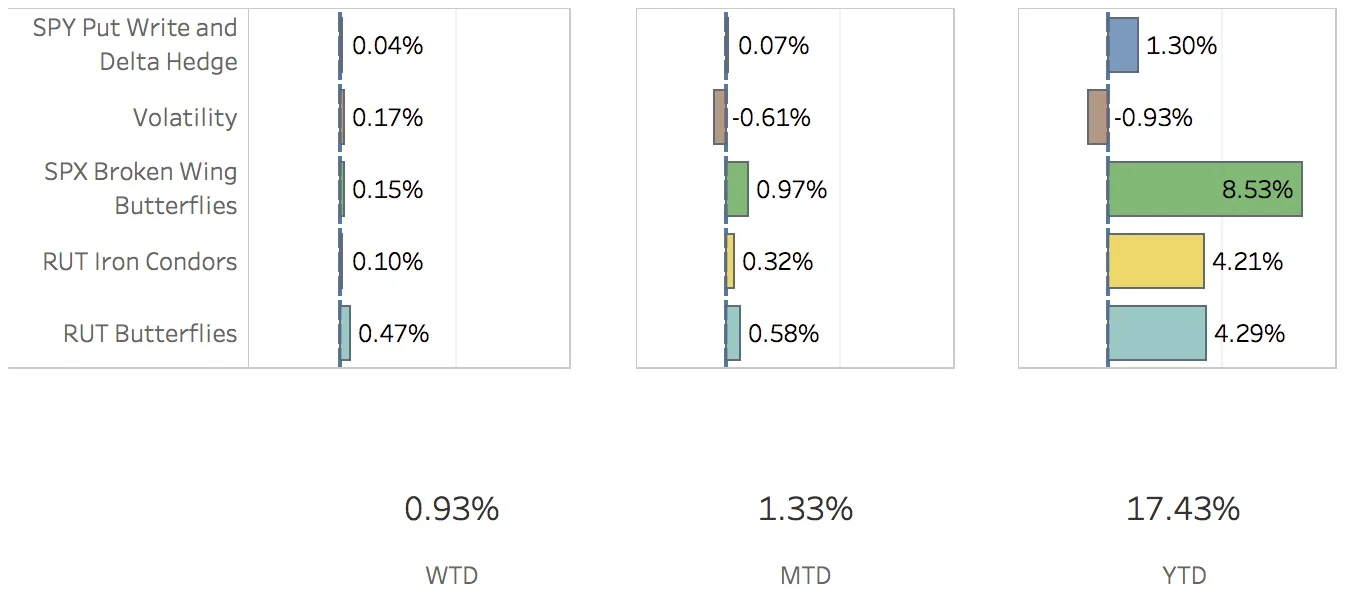

So this week I was reminded of an 80s song by Naked Eyes called Promises, Promises. It goes a little like this, "You made me promises, promises, knowing I'd believe, promises promises, you knew you'd never keep." And with that the president laid out the best tax plan ever. We'll see if it actually gets into law. I'm not holding my breath but the RUT just took it at face value and ran with it. The SPX (S&P 500) ended the week at 2519.36, +0.68%, and the RUT (Russell 2000) ended the week at 1490.86, up a scorching +2.76%. The portfolio was up a more modest but quite strong +0.93% for the week.

The SPY Put Write and Delta Hedge strategy did well with the rising markets. I didn't have a delta hedge on last week nor did I put one on this week simply because the portfolio is sitting pretty flat delta right now. The put write from last Friday was closed out for a max gain and a new one was opened this Friday. The strategy added 4 bps to the overall portfolio.

The Volatility strategy benefitted from gains in both the VIX calendar position as well as the VXX long put positions. For the week, the strategy added 17 bps to the portfolio.

The SPX Broken Wing Butterfly strategy was a little weaker this week compared to others but still put in some respectable gains. The Sep 29 position was closed for a small gain and I adjusted the Oct 20 and Oct 31 positions by purchasing some call debit spreads. All in all, the strategy added 15 bps to the portfolio this week.

The RUT Iron Condors strategy was pretty quiet. I closed out a Sep 29 trade for a small loss and the other position expiring on Oct 31 is holding on to a small gain. It isn't expected to move much unless the market moves sharply lower. I'll likely add the Nov position next week. For this week, the strategy added 10 bps to the portfolio.

The RUT Butterflies strategy was the star of the show this week. Last week, the market was sitting right in the middle of the sea of death of the Oct trade. The strong RUT blew right through that sea and straight up the shore of the long calls. With that I was able to close out that trade early for 9.79% gain. For the week, the strategy added 47 bps to the portfolio.

Contribution to Return

Trade Activity

- CLOSED SPY Put Write Sep 29 +1.68%

- CLOSED VXX Put Sep 29 -8.70%

- CLOSED SPX Broken Wing Butterfly Sep 29 +0.25%

- CLOSED RUT Weirdor Sep 29 -1.55%

- CLOSED RUT Butterfly Oct 20 +9.79%

- OPENED SPY Put Write Oct 6

- OPENED VXX Put Oct 13

- ADJUSTED SPX Broken Wing Butterfly Oct 20

- ADJUSTED SPX Broken Wing Butterfly Oct 31

SPX Broken Wing Butterfly Activity

- CLOSED SPX Broken Wing Butterfly Sep 29 BOT +1 IRON CONDOR SPX 100 (Quarterly) 29 SEP 17 2425/2350/2425/2450 PUT/CALL @ 25.00

- ADJUSTED SPX Broken Wing Butterfly Oct 20 BOT +1 VERTICAL SPX 100 (Weeklys) 20 OCT 17 2485/2495 CALL @7.85

- ADJUSTED SPX Broken Wing Butterfly Oct 20 BOT +1 VERTICAL SPX 100 (Weeklys) 20 OCT 17 2475/2485 CALL @8.35

- ADJUSTED SPX Broken Wing Butterfly Oct 31 BOT +2 VERTICAL SPX 100 (Weeklys) 31 OCT 17 2455/2465 CALL @8.65

Milking

- No trades-a-milking