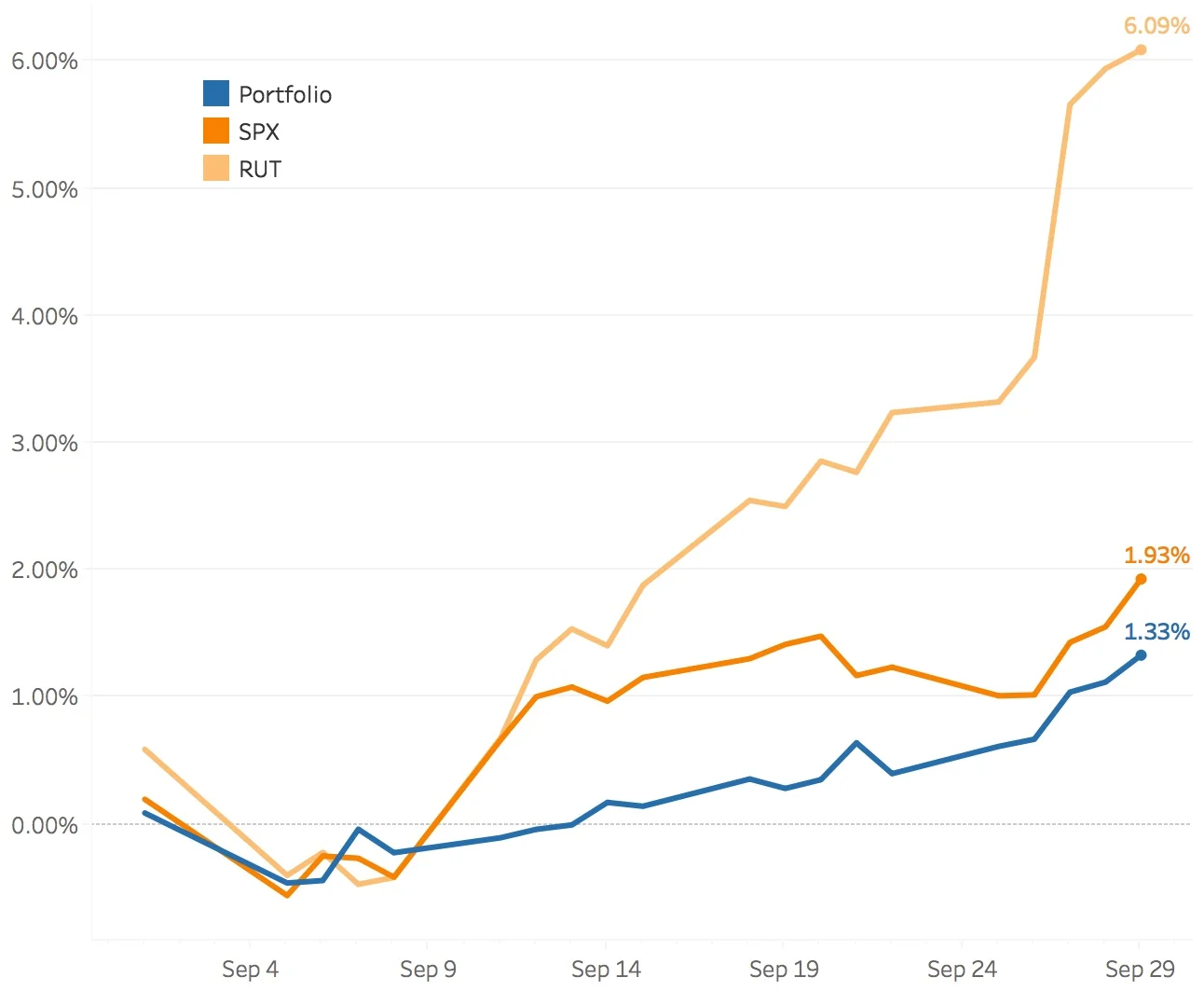

September 2017

This turned out to be a fairly solid month making back almost everything I lost in August. This was a month where I experimented with changes to the Volatility strategy by adding some SPX calendars and changes to the SPX Broken Wing Butterflies strategy by reducing the number of trades but increasing their size. Some of it seemed to work and some of it didn't. I'll just continue the journey, continue trying to figure out what works for me and what I am comfortable with. The SPX (S&P 500) ended the month up +1.93% and the RUT (Russell 2000) blasted off up +6.09%. The portfolio ended the month up +1.33%.

I took some heat the first week of the month when the market moved lower but the SPY Put Write and Delta Hedge strategy did reasonably well in a rising market adding 7 bps to the portfolio. I had the most trouble with the Volatility strategy this month. Adding the calendars didn't seem to work too well at all and by the end of the month this strategy subtracted 61 bps from the portfolio. The offset to that loss was the strong performance of the SPX Broken Wing Butterflies strategy adding 97 bps by month-end. The two RUT strategies, the Iron Condors and the Butterflies, added 32 bps and 58 bps respectively.

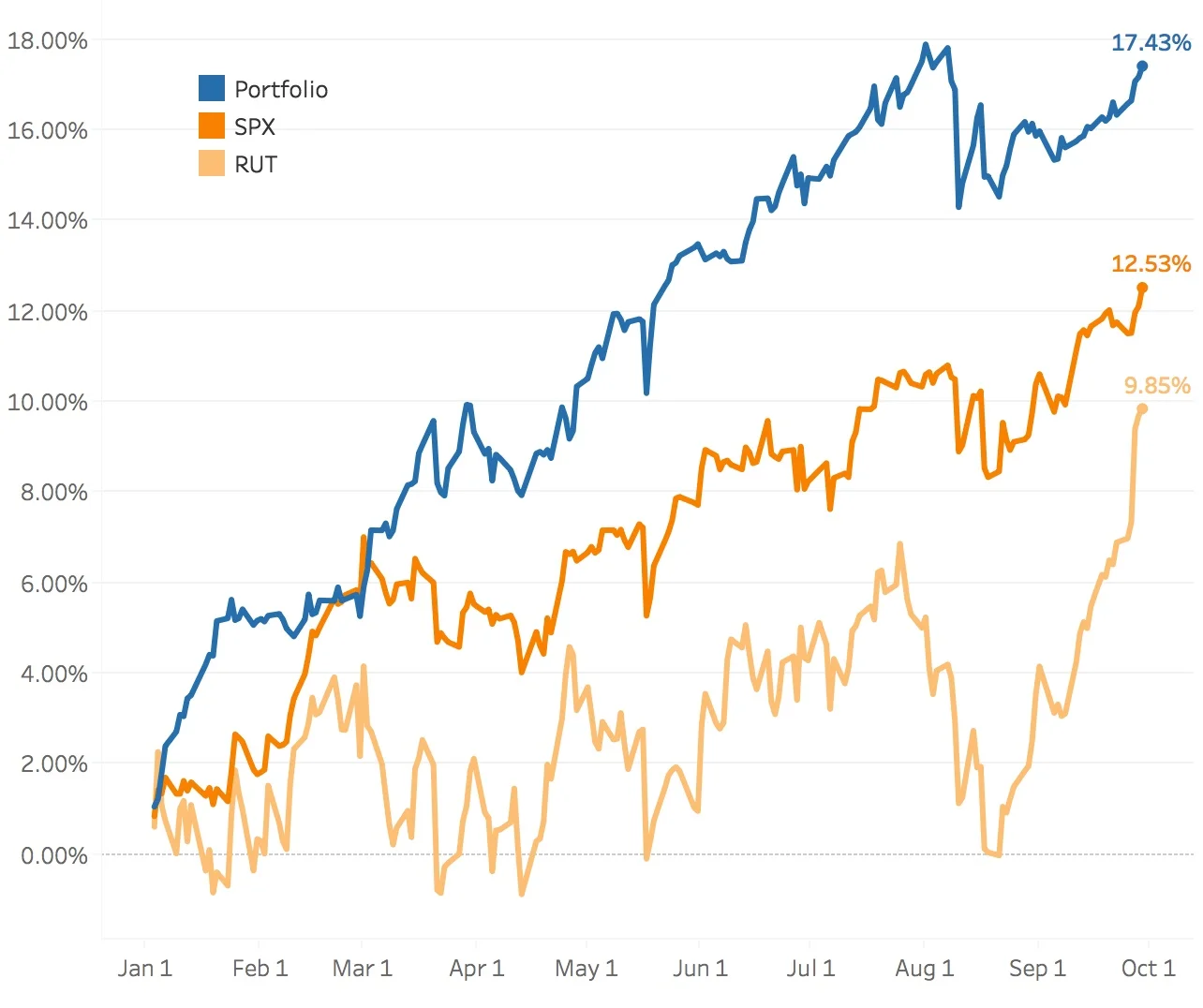

Year-to-Date

I like to complain week to week but I really shouldn't. Darn that RUT; it's up close to 10% in 6 weeks?! Pshaw. Based on a risk return measure like the Sharpe ratio, the portfolio continues to trounce the two indices. The portfolio is up +17.43% with a standard deviation of 5.64% and a Sharpe ratio of 3.09. The SPX is up 12.53% with a standard deviation of 6.07% and a Sharpe ratio of 2.06. The RUT is up 9.85% with a standard deviation of a zillion % (okay, maybe more like 10.88%) and a Sharpe ratio of 0.91. Pound for pound (or unit of risk for unit of risk), the portfolio continues to outperform the indices.

The SPY Put Write and Delta Hedge strategy contributed 130 bps to the portfolio and the Volatility strategy took a good chunk of that back subtracting 93 bps. The SPX Broken Wing Butterflies strategy has brought in 853 bps year-to-date. The RUT Iron Condors strategy has pulled in 421 bps and the RUT Butterflies strategy has added 429 bps.

Hey! Check out the Performance page for graphs that look like this and graphs that don't look like this!