Week in Review

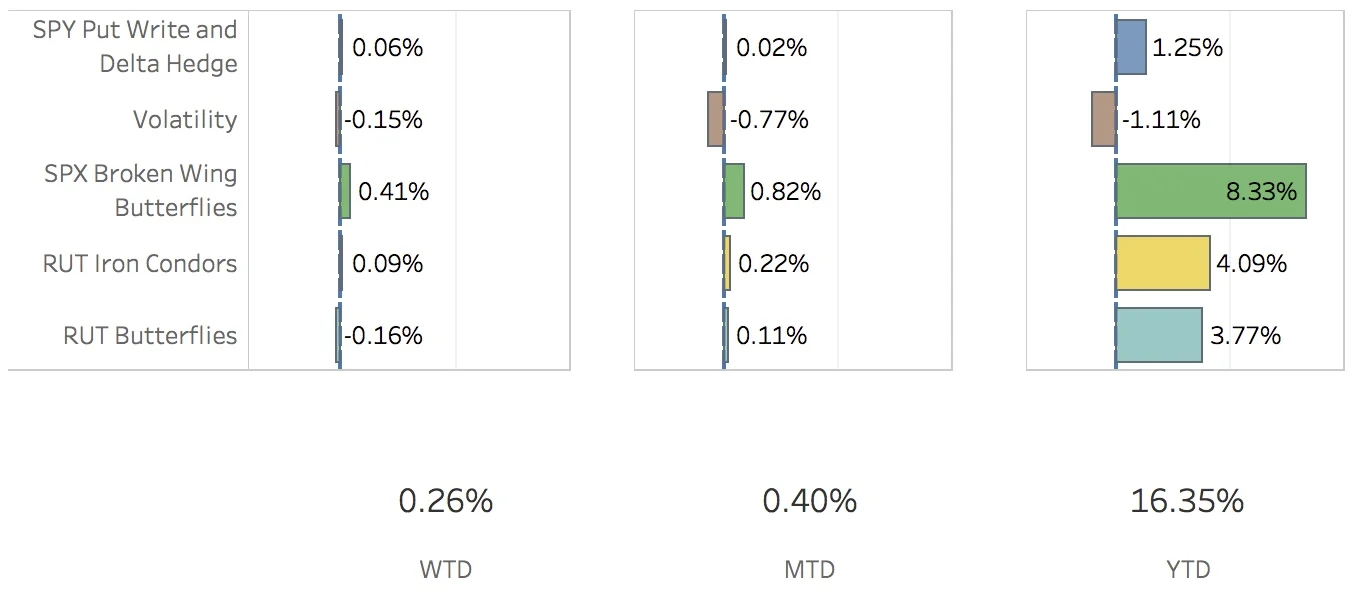

This was another week where I felt like a kid standing outside in the winter evening cold watching everyone enjoy themselves indoors. Weird analogy, I know...but that freakin' RUT. Arg. The SPX (S&P 500) ended the week at 2502.22, up +0.08%, and the RUT (Russell 2000) ended the week at 1450.78, up +1.33%. The portfolio was up +0.26% for the week.

The SPY Put Write and Delta Hedge did fine this week. Both the put write and delta hedge put on last Friday were closed out for gains this week. I added a new put write this Friday but left the delta hedge off since the portfolio is pretty flat right now. For the week, the strategy added 6 bps to the portfolio.

The Volatility strategy, the strategy that keeps on taking, was a pain in the butt again. I closed out the two failed calendars, frustrated with their loses due to the sinking volatility. I'm really not sure what to do here. I added a couple of VXX puts again, but I am just so lost with this one. For the week, the strategy subtracted 15 bps from the portfolio.

The SPX Broken Wing Butterfly strategy was my savior this week. It's contribution to the total return is almost back up to where it was near the beginning of August. I was able to close out the Nov 30 trade for the target gain and opened up the Dec 15 trade. Currently, I have the following expirations open: Sep 29, Oct 20, Oct 31, Nov 17 and Dec 15. For the week, the strategy added 41 bps to the total portfolio.

The RUT Iron Condors strategy didn't do a whole lot this week. There are three trades open right now and all of them have only the put side open. The call sides were closed out earlier this month and last as the RUT pushed relentlessly upwards. For the week, the strategy added 9 bps.

The RUT Butterflies strategy has been a bit of a pain in the butt. The Oct trade has the current RUT market price sitting in the sea of death. I'm going to probably move that as we are getting into prime theta decay time. I opened up the Nov trade and it's been pretty quiet so far. For the week, the strategy subtracted 16 bps from the portfolio.

Contribution to Return

Trade Activity

- CLOSED SPY Put Write Sep 22 +1.35%

- CLOSED SPY Delta Hedge Sep 29 +0.51%

- CLOSED SPX Calendar Oct 20 / Nov 17 -9.50%

- CLOSED SPX Calendar Oct 27 / Nov 17-13.28%

- CLOSED SPX Broken Wing Iron Condor Nov 30 +6.15%

- OPENED SPY Put Write Sep 29

- OPENED VXX Put Sep 29

- OPENED VXX Put Oct 6

- OPENED SPX Broken Wing Butterfly Dec 15

- OPENED RUT Butterfly Nov 17

SPX Broken Wing Butterfly Details

- CLOSED SPX Broken Wing Iron Condor Nov 30 BOT +4 IRON CONDOR SPX 100 (Weeklys) 30 NOV 17 2450/2500/2450/2375 CALL/PUT @47.00

- OPENED SPX Broken Wing Butterfly Dec 15 SOLD -4 IRON CONDOR SPX 100 (Weeklys) 15 DEC 17 2485/2530/2485/2410 CALL/PUT @44.60

Milking

- No trades-a-milking