Week in Review

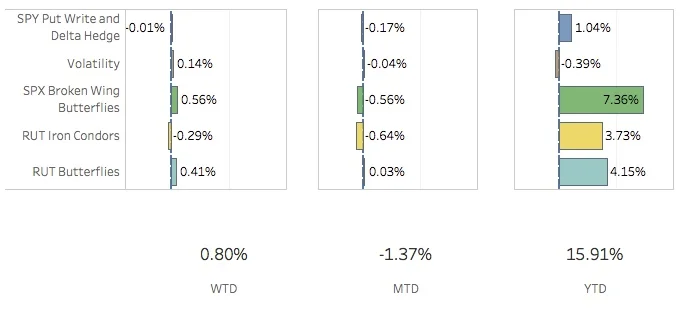

Things aren't looking so horrible this week. The month isn't going to turn out great and the portfolio was due for a down month. The SPX (S&P 500) ended the week at 2443.05, up +0.72%, and the RUT (Russell 2000) ended the week at 1377.45, up +1.45%. The portfolio was up +0.80% this week.

The SPY Put Write and Delta Hedge had limited impact on the portfolio. The long put and short calls effectively cancelled each other out. I added another short put for the put write and a couple of short puts for the delta hedge because the portfolio is currently leaning short delta. For the week, the strategy subtracted 1 bp from the portfolio.

The Volatility strategy (previously known as VIX Calendars) did reasonably well this week. I added a couple of SPX Calendars to remove some of the vega risk from the SPX Broken Wing Butterflies strategy. For the week, this strategy added 14 bps to the portfolio.

The SPX Broken Wing Butterflies strategy had a strong week. Even though I had to close out the Sep 22 and Oct 6 trades for a loss, this was for less of a loss than I had last week and the week before. I closed out the Sep 1 trade for a small gain and opened an Oct 31 and Nov 17 trade. For the week, the strategy added 56 bps to the portfolio.

The RUT Iron Condors strategy was weak. After repositioning the trades, the RUT has comeback somewhat forcing me to remove the short call spreads. The two trades are currently in the red and it doesn't look like I will be able to turn a profit on them. I'll let them sit for a while longer and let theta decay to lessen the loss but it likely won't be enough to bring them above the 0 line. For the week, this strategy subtracted 29 bps from the portfolio.

The RUT Butterflies strategy did reasonably well this week. Last week, I was close to shutting down the trade near max loss. This week with the RUT coming back, I was able to make back a lot of that loss. There is even a possibility of making some money on this trade. For the week, the strategy added 41 bps to the portfolio.

Contribution to Return

Trade Activity

- CLOSED SPY Put Write Aug 25 +3.23%

- CLOSED SPY Delta Hedge Sep 1 -0.71%

- CLOSED VXX Put Sep 1 -65.90%

- CLOSED SPX Broken Wing Butterfly Sep 1 +1.65%

- CLOSED SPX Broken Wing Butterfly Sep 22 -5.35%

- CLOSED SPX Broken Wing Butterfly Oct 6 -5.79%

- OPENED SPY Put Write Sep 1

- OPENED SPY Delta Hedge Sep 8

- OPENED VXX Put Sep 15

- OPENED SPX Calendar Sep 15 / Oct 20

- OPENED SPX Calendar Oct 20 / Nov 17

- OPENED SPX Broken Wing Butterfly Oct 31

- OPENED SPX Broken Wing Butterfly Nov 17

- ADJUSTED SPX Broken Wing Butterfly Sep 1

SPX Broken Wing Butterfly Details

- CLOSED SPX Broken Wing Butterfly Sep 1 BOT +1 IRON CONDOR SPX 100 (Weeklys) 1 SEP 17 2425/2450/2425/2350 CALL/PUT @22.55

- CLOSED SPX Broken Wing Butterfly Sep 22 BOT +1 IRON CONDOR SPX 100 (Weeklys) 22 SEP 17 2455/2500/2455/2380 CALL/PUT @40.00

- CLOSED SPX Broken Wing Butterfly Oct 6 BOT +1 IRON CONDOR SPX 100 (Weeklys) 6 OCT 17 2460/2515/2460/2370 CALL/PUT @47.85

- OPENED SPX Broken Wing Butterfly Oct 31 SOLD -2 IRON CONDOR SPX 100 (Weeklys) 31 OCT 17 2425/2475/2425/2350 CALL/PUT @47.65

- OPENED SPX Broken Wing Butterfly Nov 17 SOLD -4 IRON CONDOR SPX 100 (Weeklys) 17 NOV 17 2425/2475/2425/2350 CALL/PUT @48.90

- ADJUSTED SPX Broken Wing Butterfly Sep 1 BOT +1 VERTICAL SPX 100 (Weeklys) 1 SEP 17 2450/2460 CALL @4.05

Milking

- No trades-a-milking