Week in Review

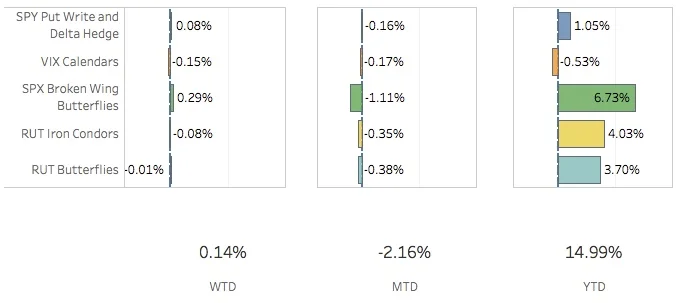

So this week wasn't terrible but it wasn't great either. The move up earlier this week had me thinking I might actually recoup most of my losses from last week. Instead, the market taught me again that I know nothing. I adjusted when the market moved up and then adjusted again when the market moved back down. Still, I was able to escape the week with a small gain which is more than I can say for the indices. The SPX (S&P 500) ended the week at 2425.55, down -0.65%, and the RUT (Russell 2000) ended the week at 1357.79, down -1.20%. That puts the RUT at almost the same level as the end of last year when it closed at 1357.13 on Dec 30, 2016. The portfolio finished the week up +0.14%.

The SPY Put Write and Delta Hedge strategy did reasonably well this week. Last week's put write was closed out for just about scratch and the naked calls were closed out for a nice gain. With the portfolio again sitting positive delta a new put write and a new set of naked calls were opened. The strategy added 8 bps to the portfolio this week.

The VIX Calendars strategy took a little more out of me this week by subtracting 15 bps. This strategy is in for some changes. I am planning to rename it simply Volatility. It will continue to contain the same trades it does now but I will be adding some SPX Calendars to help combat spikes in volatility. Now don't get me wrong here, calendars are evil. Everyone knows that. But I'm willing to sell my soul in exchange for a little protection. We'll see how this goes. I haven't figured out exactly what I will do but I will probably add a couple of trades with expirations similar to the SPX Broken Wing Butterflies.

The SPX Broken Wing Butterflies strategy actually did alright this week considering the market was down. Like I mentioned in the introduction, I got a wee bit greedy and adjusted when the market started going up early in the week and then got smacked and had to adjust again on Friday after the down move on Thursday. You can see all of the gory details in the Trade Activity section below. All of the trades are still losers with a couple of them close to me just giving up on them. For the week, the strategy added 29 bps to the portfolio.

The RUT Iron Condors strategy held on fairly well but I am close to another adjustment if the RUT keeps heading down. Both trades already have two more put debit spreads than they did when the trades were first opened. It's not looking promising but we shall see. The strategy subtracted 8 bps from the portfolio.

The RUT Butterflies strategy has been all over the place. By the middle of the week, I was thinking I might actually make some money on this trade. By Thursday I was close to closing the thing down. I'm still close and if we move another 10-20 points down in the RUT I will be taking what I have left of my marbles and going home on this one. This strategy subtracted 1 bp from the portfolio.

Contribution to Return

Trade Activity

- CLOSED SPY Put Write Aug 18 +0.02%

- CLOSED SPY Delta Hedge Aug 25 +1.41%

- CLOSED VXX Put Aug 25 -37.15%

- CLOSED RUT Weirdor Aug 18 +2.15%

- OPENED SPY Put Write Aug 25

- OPENED SPY Delta Hedge Sep 1

- OPENED VXX Put Sep 8

- ADJUSTED SPX Broken Wing Butterfly Sep 1

- ADJUSTED SPX Broken Wing Butterfly Sep 22

- ADJUSTED SPX Broken Wing Butterfly Sep 29

- ADJUSTED SPX Broken Wing Butterfly Oct 6

- ADJUSTED SPX Broken Wing Butterfly Oct 20

SPX Broken Wing Butterfly Details

- ADJUSTED SPX Broken Wing Butterfly Sep 1 BOT +1 VERTICAL SPX 100 (Weeklys) 1 SEP 17 2455/2460 CALL @3.65

- ADJUSTED SPX Broken Wing Butterfly Sep 1 SOLD -1 VERTICAL SPX 100 (Weeklys) 1 SEP 17 2455/2460 CALL @1.65

- ADJUSTED SPX Broken Wing Butterfly Sep 22 BOT +1 VERTICAL SPX 100 (Weeklys) 22 SEP 17 2495/2500 CALL @2.20

- ADJUSTED SPX Broken Wing Butterfly Sep 22 SOLD -1 VERTICAL SPX 100 (Weeklys) 22 SEP 17 2495/2500 CALL @.85

- ADJUSTED SPX Broken Wing Butterfly Sep 29 BOT +1 VERTICAL SPX 100 (Quarterlys) 29 SEP 17 2465/2470 CALL @3.30

- ADJUSTED SPX Broken Wing Butterfly Sep 29 SOLD -1 VERTICAL SPX 100 (Quarterlys) 29 SEP 17 2465/2470 CALL @2.15

- ADJUSTED SPX Broken Wing Butterfly Oct 6 BOT +1 VERTICAL SPX 100 (Weeklys) 6 OCT 17 2510/2515 CALL @1.90

- ADJUSTED SPX Broken Wing Butterfly Oct 6 SOLD -1 VERTICAL SPX 100 (Weeklys) 6 OCT 17 2510/2515 CALL @.75

- ADJUSTED SPX Broken Wing Butterfly Oct 20 BOT +1 VERTICAL SPX 100 (Weeklys) 20 OCT 17 2500/2505 CALL @2.50

- ADJUSTED SPX Broken Wing Butterfly Oct 20 SOLD -1 VERTICAL SPX 100 (Weeklys) 20 OCT 17 2500/2505 CALL @1.45

Milking

- No trades-a-milking