August 2017

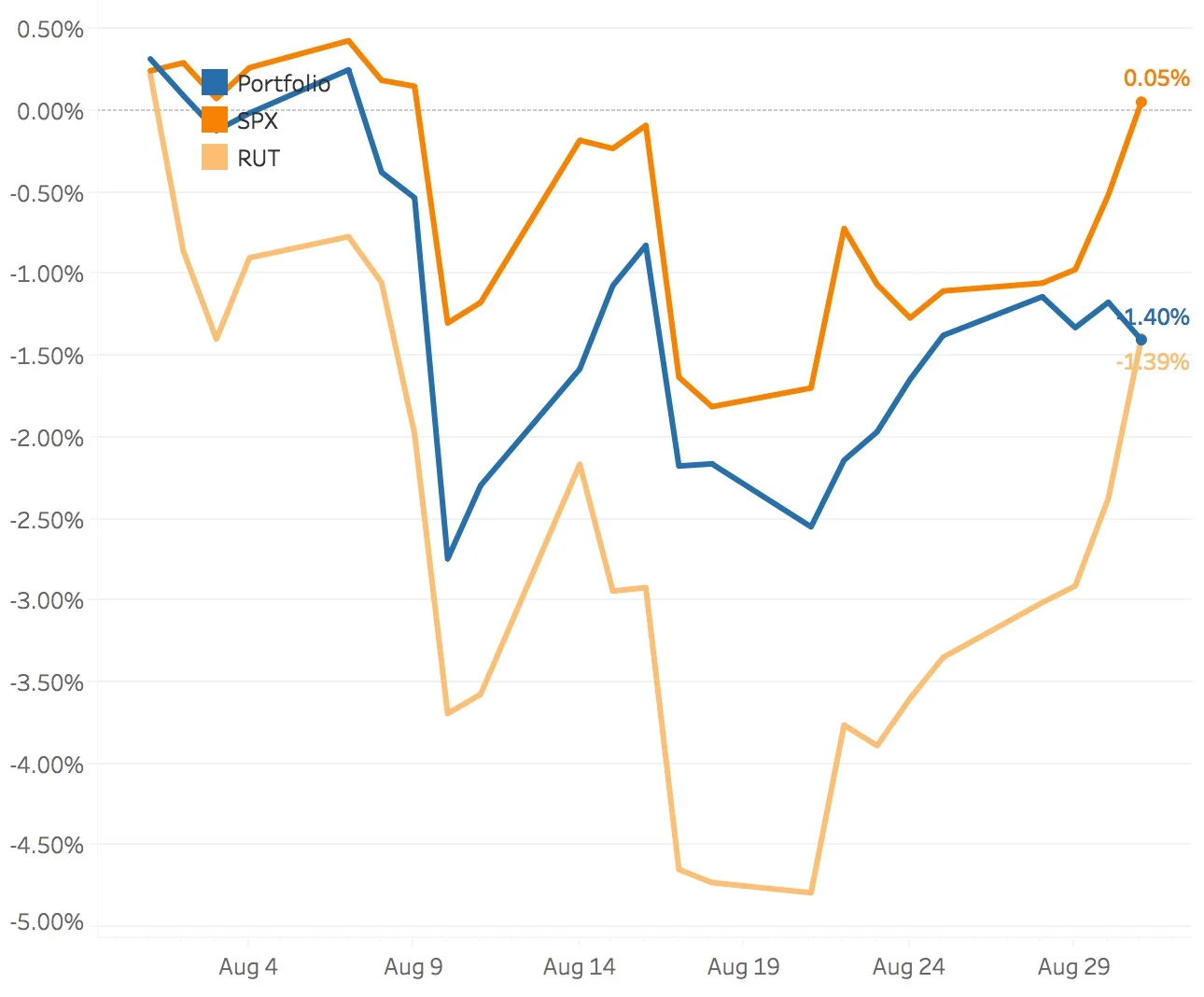

This turned out to be a pretty disappointing month for me. This was the first month the portfolio was tested and, as far as I am concerned, it failed miserably. The SPX Broken Wing Butterfly positions got hammered and the long VIX volatility position didn't help at all. Luckily, the downturn was a mild one and it has prompted me to make some long overdue changes to the composition of the portfolio. I am reducing the number of SPX Broken Wing Butterfly positions, but increasing the size (overall exposure will remain the same), to make it easier to manage them when things get hairy. Also, I am adding some SPX calendar positions to the Volatility strategy to dial back some of the short vega. Hopefully this downturn just serves as a learning experience, the cost of tuition, so that I make smarter decisions in the future. The SPX (S&P 500) ended the month up +0.05% and the RUT (Russell 2000) ended the month down -1.39%. The portfolio finished down -1.40%.

With the market moving down and then up again, the SPY Put Write and Delta Hedge strategy had a tough time the first half of the month but made it all up in the second half. It subtracted 1 bp from the portfolio. With the addition of the SPX Calendars, the Volatility strategy actually made some money this month adding 7 bps to the portfolio. The other strategies got pounded. First, with the uptick in volatility and then the move down they were hurt. When I adjusted the positions and reduced the size, they got hurt when the market recovered. The SPX Broken Wing Butterflies, RUT Iron Condors, and RUT Butterflies strategies subtracted 49 bps, 53 bps, and 44 bps respectively this month.

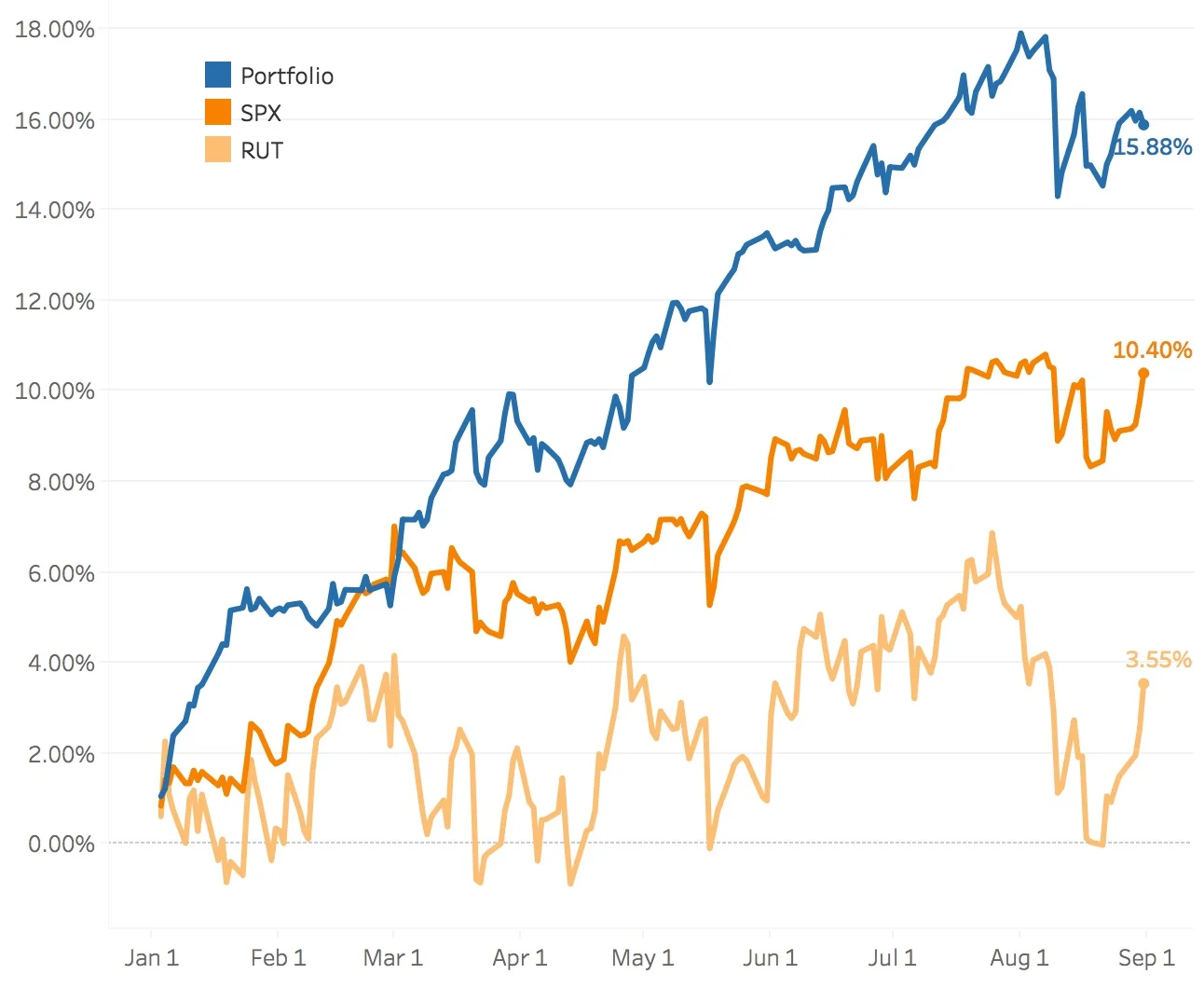

Year-to-Date

Year-to-Date, things look much better. It's good to get knocked down a few pegs every once in a while. The SPX (S&P 500) is up +10.40% and the RUT (Russell 2000) is up +3.55%. The portfolio, even with the recent downturn is up +15.88%. I am below my goal of 2% per month but I am close. Whether we will get there by the end of the year is anyone's guess.

The SPY Put Write and Delta Hedge strategy has added 122 bps to the portfolio this year. The Volatility strategy has subtracted 27 bps. The SPX Broken Wing Butterflies strategy has added 744 bps to the portfolio. The RUT strategies, RUT Iron Condors and RUT Butterflies, added 384 bps and 365 bps respectively.

Hey! Check out the Performance page for interactive charts similar to the ones above where you can slice and dice the different time periods to see which strategies did well throughout the year!