Week in Review

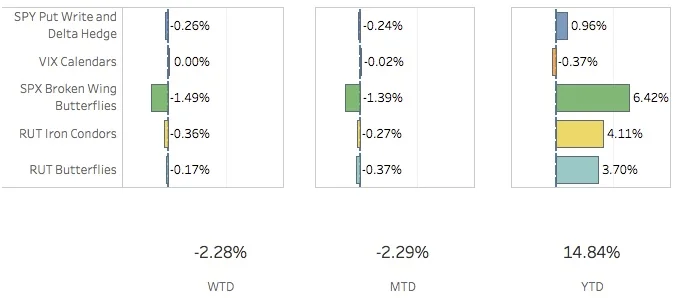

Disappointed. I knew this day was coming. The portfolio was tested and as far as I am concerned it failed miserably. And it was barely a test! More like a multiple choice quiz! On the bright side, at least we're not in the middle of a nuclear winter. Nuclear winter...hmmm....a cure for global warming? In any case, the SPX (S&P 500) ended the week at 2441.32, down -1.43% and the RUT (Russell 2000) ended the week at 1374.23, down -2.70%. In the middle of the two indices, the portfolio ended the week down -2.28%.

The SPY Put Write and Delta Hedge strategy took a big hit this week. With the portfolio negative delta at the end of last week I had short puts for the put write as well as the delta hedge. That did not go well this week. Both ended up as big losers. This Friday, I still put on the short put for the put write part but I put on a couple of short calls for the delta hedge. We'll see how that goes. For the week, the strategy subtracted 26 bps.

The VIX calendars did nothing this week. This was supposed to save my bacon but ended up being a big waste of time. I'm going to have to rethink what I do with this strategy. Is it worth it or should I expend my energy elsewhere? For the week, it added zilch bps.

The SPX Broken Wing Butterflies strategy was the big loser. Live by the sword, die by the sword. Throughout the year I reaped the rewards of this strategy luckily avoiding doom until now. I can't keep doing this and I won't. I may look at adding some long puts to this strategy to protect it from jumps in volatility. Also, I have way too many positions on and it's difficult to manage when things get hairy. I think I am okay with the total size of the position so I will probably double the size of trades and reduce by half the number of positions. That along with some long puts should make it easier to manage. I closed out the Aug 18 and Sep 8 trade and adjusted all of the others. Everything that is open right now is currently a loser. I've reduced the size of each trade to take off some of the risk for now. I'm going to stew over strategy changes this weekend and will hopefully have some ideas next week. For this week, the strategy yanked 149 bps from the portfolio. Ouch.

The RUT Iron Condors strategy did admirably. I closed the Aug 31 trade and opened a Sep 15 and Sep 29 trade. Both of the open trades had to be adjusted with the downturn but haven't suffered too much because of the long put protecting that downside. For the week, the strategy subtracted 36 bps from the portfolio.

The RUT Butterflies strategy also held up fairly well this week. I peeled off some of the long IWM calls to flatten out the deltas after the big moves down. I'm not crazy about how the trade looks right now but it will have to do for now. It subtracted 17 bps from the portfolio this week.

Contribution to Return

Trade Activity

- CLOSED SPY Put Write Aug 11 -6.21%

- CLOSED SPY Delta Hedge Aug 18 -2.23%

- CLOSED VXX Put Aug 18 -3.52%

- CLOSED SPX Broken Wing Butterfly Aug 18 +1.34%

- CLOSED SPX Broken Wing Butterfly Sep 8 +3.48%

- CLOSED RUT Weirdor Iron Condor Aug 31 +1.23%

- OPENED SPY Put Write Aug 18

- OPENED SPY Delta Hedge Aug 25

- OPENED VXX Put Sep 1

- OPENED RUT Weirdor Sep 15

- OPENED RUT Weirdor Sep 29

- ADJUSTED SPX Broken Wing Butterfly Sep 1

- ADJUSTED SPX Broken Wing Butterfly Sep 22

- ADJUSTED SPX Broken Wing Butterfly Sep 29

- ADJUSTED SPX Broken Wing Butterfly Oct 6

- ADJUSTED SPX Broken Wing Butterfly Oct 20

SPX Broken Wing Butterfly Details

- CLOSED SPX Broken Wing Butterfly Aug 18 BOT +2 IRON CONDOR SPX 100 18 AUG 17 2375/2395/2375/2300 CALL/PUT @20.70

- CLOSED SPX Broken Wing Butterfly Sep 8 BOT +1 IRON CONDOR SPX 100 (Weeklys) 8 SEP 17 2475/2515/2475/2400 CALL/PUT @32.45

- ADJUSTED SPX Broken Wing Butterfly Sep 1 BOT +2 VERTICAL SPX 100 (Weeklys) 1 SEP 17 2450/2460 CALL @8.35

- ADJUSTED SPX Broken Wing Butterfly Sep 1 SOLD -2 VERTICAL SPX 100 (Weeklys) 1 SEP 17 2450/2460 CALL @6.35

- ADJUSTED SPX Broken Wing Butterfly Sep 1 BOT +1 IRON CONDOR SPX 100 (Weeklys) 1 SEP 17 2425/2460/2425/2350 CALL/PUT @34.55

- ADJUSTED SPX Broken Wing Butterfly Sep 22 SOLD -2 VERTICAL SPX 100 (Weeklys) 22 SEP 17 2495/2500 CALL @1.65

- ADJUSTED SPX Broken Wing Butterfly Sep 22 BOT +1 IRON CONDOR SPX 100 (Weeklys) 22 SEP 17 2455/2500/2455/2380 CALL/PUT @41.20

- ADJUSTED SPX Broken Wing Butterfly Sep 29 BOT +1 IRON CONDOR SPX 100 (Quarterlys) 29 SEP 17 2425/2470/2425/2350 CALL/PUT @44.15

- ADJUSTED SPX Broken Wing Butterfly Sep 29 BOT +2 VERTICAL SPX 100 (Quarterlys) 29 SEP 17 2465/2470 CALL @3.70

- ADJUSTED SPX Broken Wing Butterfly Sep 29 SOLD -2 VERTICAL SPX 100 (Quarterly’s) 29 SEP 17 2465/2470 CALL @2.65

- ADJUSTED SPX Broken Wing Butterfly Oct 6 SOLD -2 VERTICAL SPX 100 (Weeklys) 6 OCT 17 2505/2515 CALL @3.30

- ADJUSTED SPX Broken Wing Butterfly Oct 6 BOT +1 IRON CONDOR SPX 100 (Weeklys) 6 OCT 17 2460/2515/2460/2370 CALL/PUT @49.75

- ADJUSTED SPX Broken Wing Butterfly Oct 20 SOLD -2 VERTICAL SPX 100 (Weeklys) 20 OCT 17 2500/2505 CALL @2.05

- ADJUSTED SPX Broken Wing Butterfly Oct 20 BOT +1 IRON CONDOR SPX 100 (Weeklys) 20 OCT 17 2450/2505/2450/2360 CALL/PUT @52.60

Milking

- No trades-a-milking