Week in Review

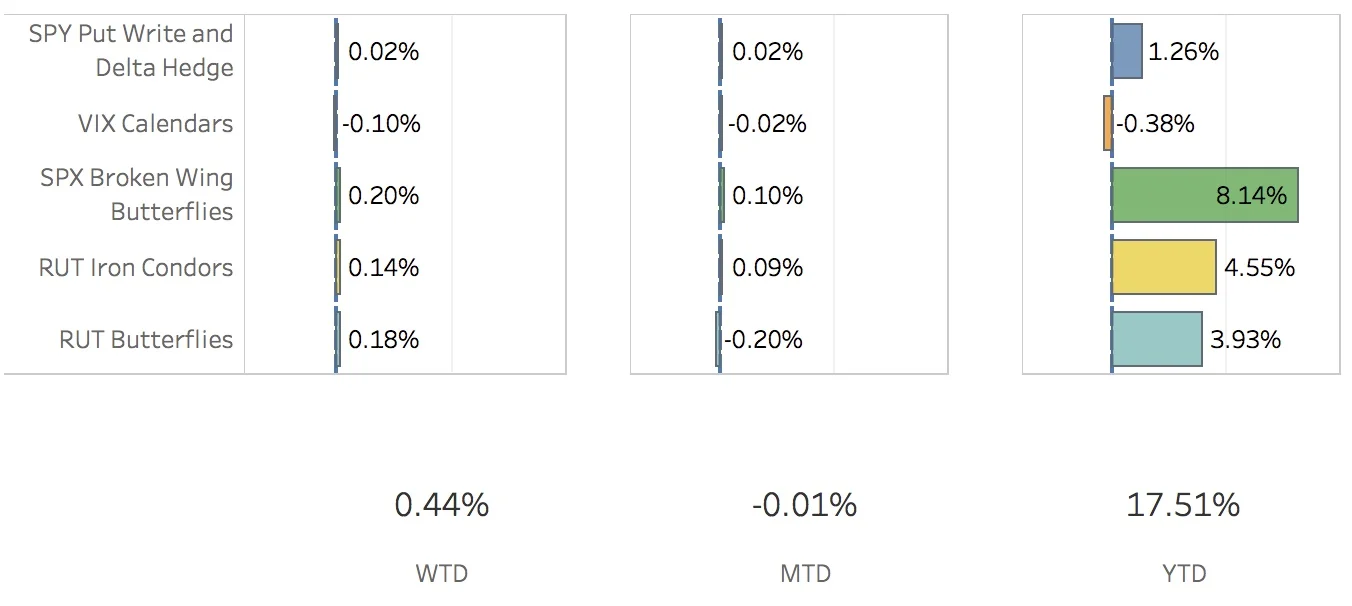

Earnings season seems to be winding down, a reasonably good jobs report came out on Friday, and the markets were relatively quiet. The SPX (S&P 500) ended the week at 2476.83, up +0.19%, and the RUT (Russell 2000) ended the week at 1412.32, down -1.19%. The portfolio gained +0.44%.

The SPY Put Write and Delta Hedge strategy did fine this week. I only had a put write on this week and that came off on Friday for a nice profit. I added a new put write and a delta hedge. For the week, the strategy added 2 bps to the portfolio.

The VIX Calendars strategy was a little busier than usual. I closed out the Aug/Sep calendar for a loss and opened an Oct/Nov calendar. The Aug 11 VXX put was closed for a gain and an Aug 25 VXX put was opened. For the week, the strategy subtracted 10 bps from the portfolio.

The SPX Broken Wing Butterflies strategy was fairly busy this week. The Jul 31 trade was closed for a +1.13% gain. I opened three other trades: Sep 22, Oct 6 and Oct 20. The Sep 8 was adjusted and is now being milked. It will stay open until the SPX hits 2450 or 2490. Exact details are below. For the week, the strategy added 20 bps to the portfolio.

The RUT Iron Condors strategy was pretty quiet. The Aug 18 and Aug 31 trades are still open. If the market sits here or moves down slightly, I'll be able to pick up some more gains. If the market moves up, then I've made all I can expect to make on these trades. I'll be opening up the Sep trades next week. For the week, this strategy added 14 bps to the portfolio.

The RUT Butterflies strategy has been a pain in the butt. I was able to close out the Aug trade for a +6.98% gain. The Sep trade was doing well but the RUT pushed down later in the week and I had to adjust it. It's now under water but there is still lots of time until expiration. We shall see. For the week, this strategy added 18 bps to the portfolio.

Contribution to Return

Trade Activity

- CLOSED SPY Put Write Aug 4 +2.01%

- CLOSED VXX Put Aug 11 +11.07%

- CLOSED VIX Calendar Aug/Sep -6.44%

- CLOSED RUT Butterfly Aug 18 +6.98%

- CLOSED SPX Broken Wing Butterfly Jul 31 +1.13%

- OPENED SPY Put Write Aug 11

- OPENED SPY Delta Hedge Aug 18

- OPENED VXX Put Aug 25

- OPENED VIX Calendar Oct/Nov

- OPENED SPX Broken Wing Butterfly Sep 22

- OPENED SPX Broken Wing Butterfly Oct 6

- OPENED SPX Broken Wing Butterfly Oct 20

- ADJUSTED SPX Broken Wing Butterfly Sep 8

SPX Broken Wing Butterfly Details

- CLOSED SPX Broken Wing Butterfly Jul 31 BOT +2 IRON CONDOR SPX 100 (Weeklys) 31 JUL 17 2375/2395/2375/2300 CALL/PUT @20.05

- OPENED SPX Broken Wing Butterfly Sep 22 SOLD -2 IRON CONDOR SPX 100 (Weeklys) 22 SEP 17 2455/2495/2455/2380 CALL/PUT @37.75

- OPENED SPX Broken Wing Butterfly Oct 6 SOLD -2 IRON CONDOR SPX 100 (Weeklys) 6 OCT 17 2460/2505/2460/2370 CALL/PUT @43.50

- OPENED SPX Broken Wing Butterfly Oct 20 SOLD -2 IRON CONDOR SPX 100 (Weeklys) 20 OCT 17 2450/2500/2450/2360 CALL/PUT @48.40

- ADJUSTED SPX Broken Wing Butterfly Sep 8 BOT +2 IRON CONDOR SPX 100 (Weeklys) 8 SEP 17 2450/2490/2450/2375 CALL/PUT @35.10

- ADJUSTED SPX Broken Wing Butterfly Sep 8 SOLD -1 IRON CONDOR SPX 100 (Weeklys) 8 SEP 17 2475/2515/2475/2400 CALL/PUT @31.95

Milking

- SPX Broken Wing Butterfly Sep 8 SPX 2475/2515/2475/2400 where 2450 < SPX < 2490