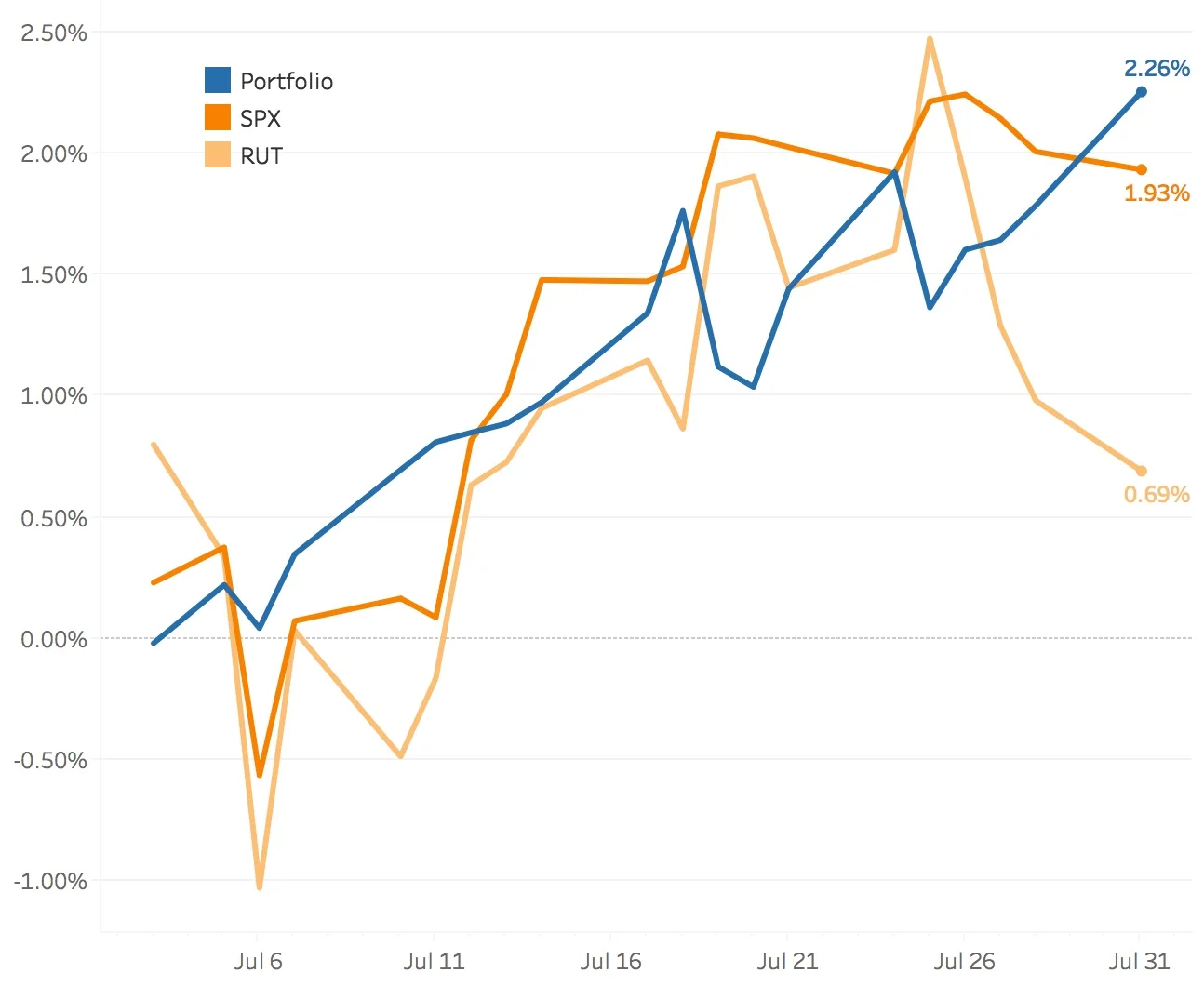

July 2017

This was a pretty solid month for the portfolio with gains in every week. The RUT (Russell 2000) stumbled at first, had a strong middle of the month and then weakened at the end finishing with a gain of +0.69%. The SPX (S&P 500) was a more stable and stronger finishing the month up +1.93%. The portfolio finished strongly, up +2.26%.

With the market moving up, the SPY Put Write and Delta Hedge also did well adding 28 bps. The VIX Calendars strategy was mostly quiet this month adding only 1 bp to the portfolio. It was another strong month for the SPX Broken Wing Butterfly strategy, this time adding 90 bps for the month. The two RUT strategies, the Iron Condor and Butterfly, added 46 bps and 59 bps respectively.

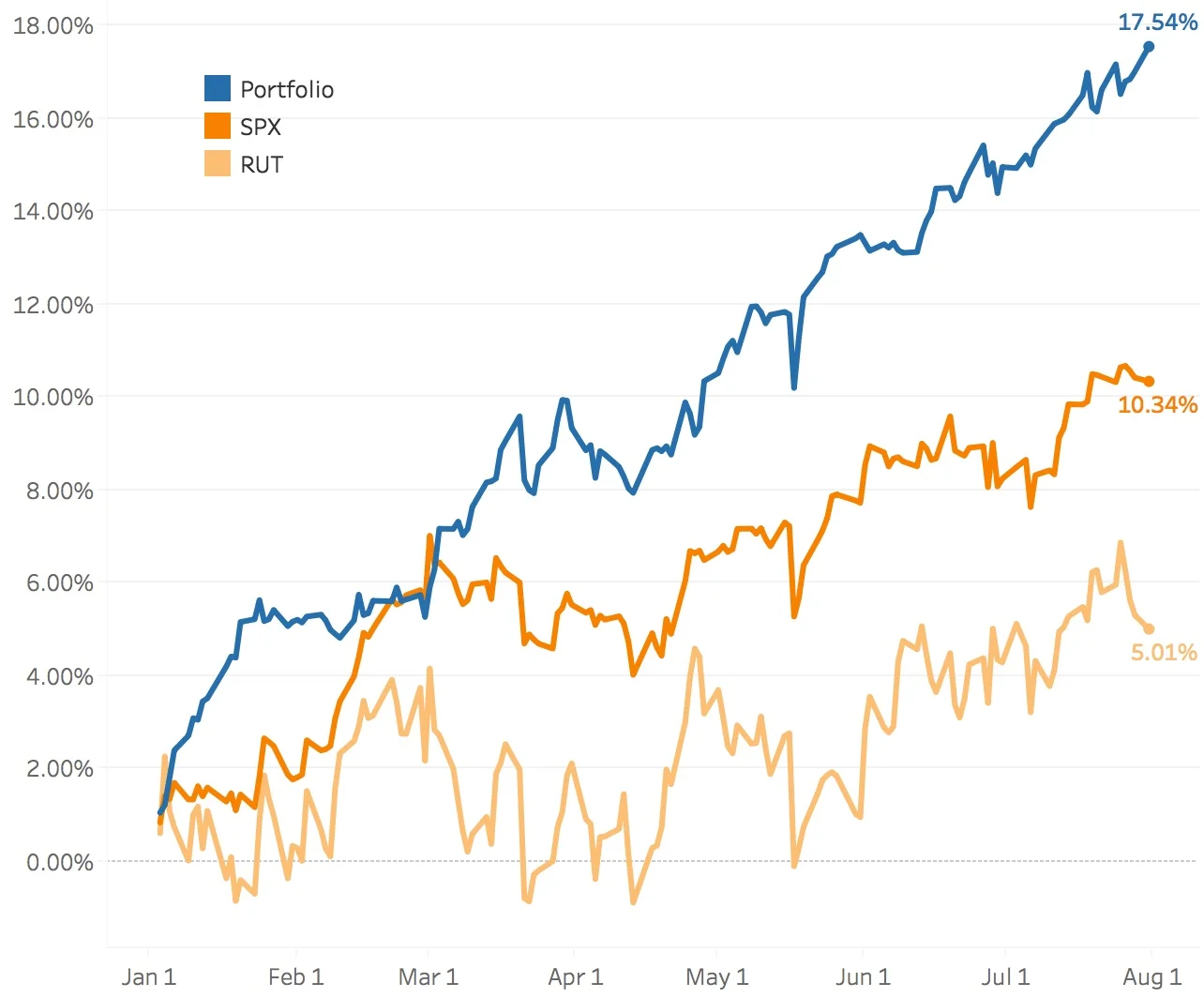

Year-to-Date

As mentioned last month, the portfolio really hasn't been tested at all. The markets in general have been stable without any major drops. The SPX (S&P 500) is up +10.34% for the year and the RUT (Russell 2000) has been weaker, up +5.01%. The portfolio is up a very nice +17.54%.

Because of the general uptrend in the markets, the SPY Put Write and Delta Hedge strategy has done well, adding +124 bps. The VIX Calendars strategy continues to be the bane of my existence, subtracting 35 bps. The SPX Broken Wing Butterfly strategy is again the big winner adding 802 bps for the year-to-date. The RUT Iron Condors added 446 bps and the RUT Butterflies added 415 bps.

Hey! Check out the Performance page, for interactive charts similar to the ones above, where you can slice and dice the different time periods to see which strategies did well throughout the year.