Week in Review

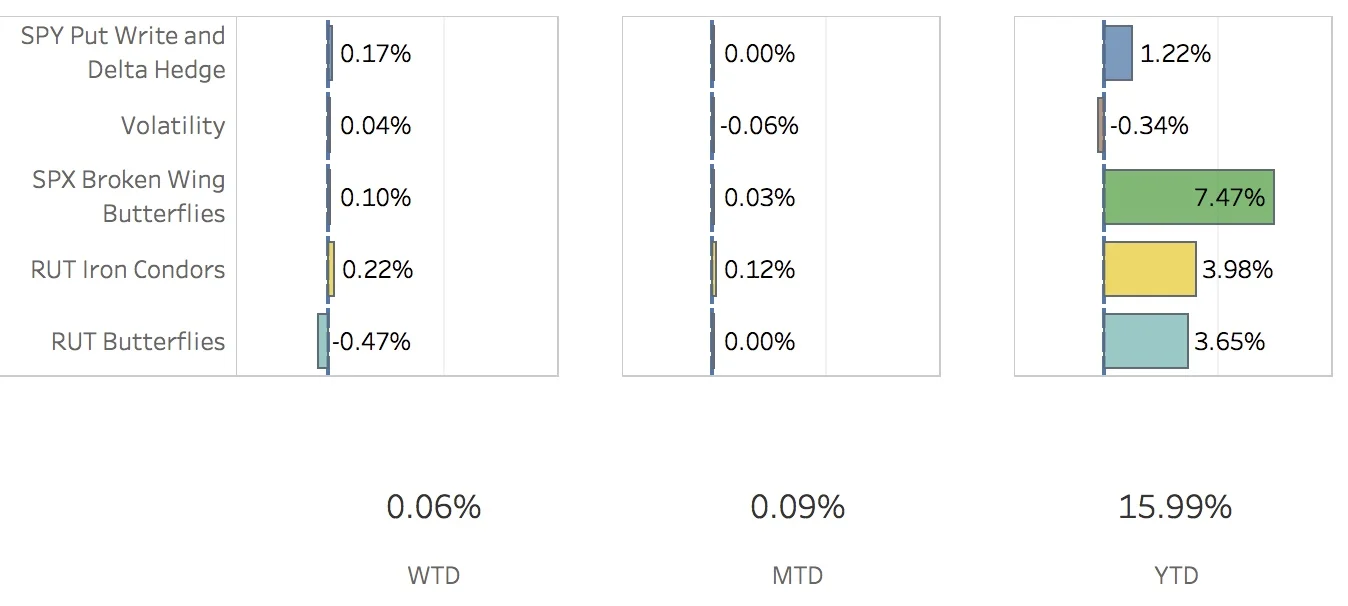

I kept things pretty quiet this past week because I was on vacation. Most of my trading was done using contingent trades which is fine since that's how I handle most of my trading anyways while working a full time job. Frankly, I'm happy to escape this week flat considering the markets were on a tear. The SPX (S&P 500) ended the week at 2476.55, up +1.37%, and the RUT (Russell 2000) ended the week at 1413.57, up +2.62%. The portfolio ended the week up +0.06%.

With a short put for the put write and a couple more short puts as part of a delta hedge, this strategy did very well adding 17 bps to the portfolio for the week. The same positions were rolled forward another week on Friday.

The Volatility strategy has been benefitting from some gains in the new SPX calendars. Gains in the SPX calendars have offset losses in the VIX calendars and long VXX puts. For the week, the strategy added 4 bps to the portfolio.

The SPX Broken Wing Butterflies strategies required some adjusting as the market moved up. Three of the four open positions were adjusted by purchasing vertical call spreads. I'll probably be adding a Nov 30 position next week. For this week, the strategy added 10 bps to the portfolio.

The RUT Iron Condors strategy did reasonably well this week. Both weirdor positions are sitting with small losses. I don't think it is reasonable to expect a gain out of either of them at this point with the way the RUT has thrashed around the past few weeks. I will probably hold them a little bit longer to squeeze out a little bit more theta. In the mean time, I will be adding the Oct trades next week or the week after. The strategy added 22 bps to the portfolio this week.

The RUT Butterflies strategy was the big disappointment. At the end of last week, I was looking at potentially making money off of this trade. The strong move up in the RUT this week and the high gamma due to being so late in the trade made making a profit very difficult indeed. I struggled and attempted to adjust but decided to give up on it and take the loss. I'll be adding the Oct trade next week. For this week, the strategy subtracted 47 bps from the portfolio.

Contribution to Return

Trade Activity

- CLOSED SPY Put Write Sep 1 +2.19%

- CLOSED SPY Delta Hedge Sep 8 -0.71%

- CLOSED VXX Put Sep 8 -1.10%

- CLOSED VXX Put Sep 15 +26.56%

- CLOSED SPX Calendar Sep 15 / Oct 20 +6.49%

- CLOSED RUT Butterfly Sep 15 -4.37%

- OPENED SPY Put Write Sep 8

- OPENED SPY Delta Hedge Sep 15

- OPENED VXX Put Sep 22

- ADJUSTED SPX Broken Wing Butterfly Sep 29

- ADJUSTED SPX Broken Wing Butterfly Oct 20

- ADJUSTED SPX Broken Wing Butterfly Oct 31

SPX Broken Wing Butterfly trade activity

- ADJUSTED SPX Broken Wing Butterfly Sep 29 BOT +1 VERTICAL 2460/2470 CALL 29 SEP 17 @ 6.45

- ADJUSTED SPX Broken Wing Butterfly Oct 20 BOT +1 VERTICAL 2495/2505 CALL 20 OCT 17 @ 4.95

- ADJUSTED SPX Broken Wing Butterfly Oct 31 BOT +1 VERTICAL 2465/2475 CALL 31 OCT 17 @ 6.85

Milking

- No trades-a-milking