Week in Review

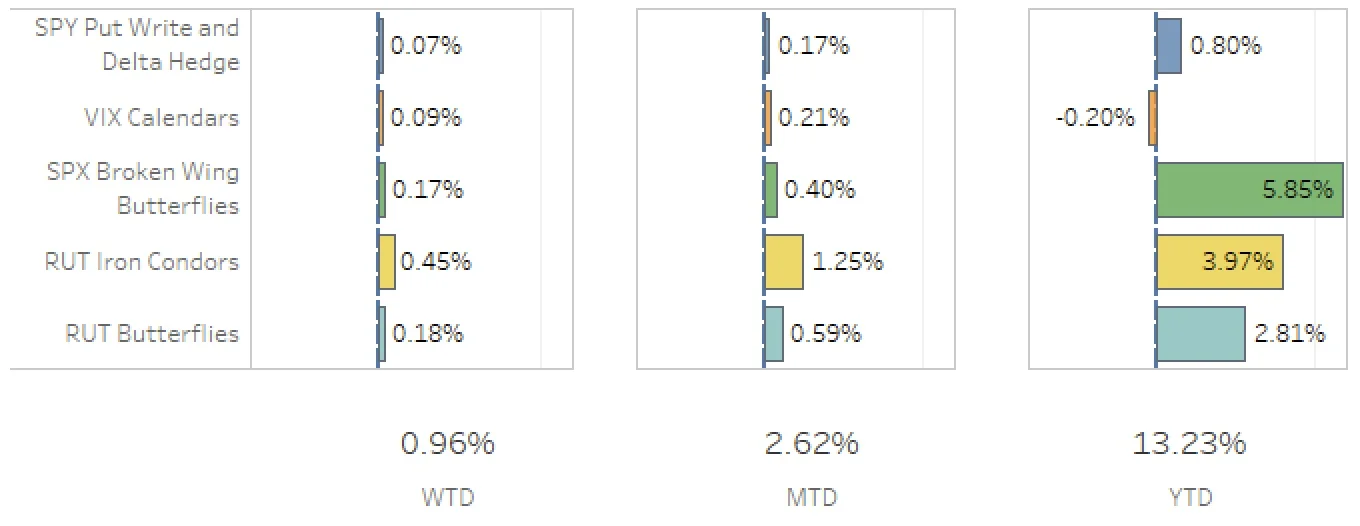

Hello all! Sorry for the delay but I was at the Ottawa marathon trying not to die this past weekend and decided I was only going to put so much effort into this post. At some point, my computer wasn't cooperating and I decided to leave it until I got home. So I'm back now and here's what happened....the SPX (S&P 500) finished the week at 2415.82, +1.43%, and the RUT (Russell 2000) ended up at 1382.24, up +1.09%. The portfolio was up +0.96% for the week.

The SPY Put Write and Delta Hedge strategy did nicely this week. I chose not to put on a delta hedge the previous week but I did have a put write on which I closed at the end of the week. On Friday, I added both a put write and a naked put as a delta hedge since I was leaning fairly negative delta. For the week, this strategy added 7 bps to the portfolio.

The VIX Calendars strategy made money again this week. The VIX part that is supposed to profit from a rise in VIX is pretty flat. The VXX part that pays for the hedge has been doing well. For the week, this strategy added 9 bps to the portfolio.

The SPX Broken Wing Butterflies strategy had some activity last week. I was able to take off the Jun 23 expiration for a +4.73% gain. I also opened trades in the Jul 14 and Aug 18 expiration cycles. Details on strikes and prices are below in the Trade Activity section of the post. No trades are being milked at this point. This strategy added 17 bps to the portfolio this week.

The RUT Iron Condors strategy had a pretty nice week. Volatility in the RUT came down last week helping bring in some unrealized gains on both the Jun 30 and Jul 21 weirdors and the Jul 21 nested iron condor. For the week, the strategy added 45 bps to the overall portfolio.

The RUT Butterflies strategy had a nice week as well. I held on to the Jun 16 trade until Friday afternoon and closed it out for a nice +15.19% gain. It hit my profit target and I was lucky to get away with only two adjustments for this cycle. The RUT has been trading in a fairly nice range without too many upside or downside breakouts. I'll be putting on the Jul trade either this week or next week. For this past week, this strategy added 18 bps to the portfolio.

Contribution to Return

Trade Activity

- CLOSED SPY Put Write May 26 +2.37%

- CLOSED RUT Butterfly Jun 16 +15.19%

- CLOSED VXX Put Jun 2 -3.76%

- CLOSED SPX BWB Jun 23 +4.73%

- OPENED VXX Put Jun 16

- OPENED SPX BWB Jul 14

- OPENED SPX BWB Aug 18

- OPENED SPY Put Write Jun 2

- OPENED SPY Delta Hedge Jun 9

SPX Broken Wing Butterflies Details

- CLOSED SPX BWB Jun 23 BOT +2 IRON CONDOR SPX 100 (Weeklys) 23 JUN 17 2335/2370/2335/2265 CALL/PUT @34.50

- OPENED SPX BWB Jul 14 SOLD -2 IRON CONDOR SPX 100 (Weeklys) 14 JUL 17 2375/2420/2375/2300 CALL/PUT @41.40

- OPENED SPX BWB Aug 18 SOLD -2 IRON CONDOR SPX 100 18 AUG 17 2375/2425/2375/2300 CALL/PUT @47.35

Milking

- No trades-a-milking