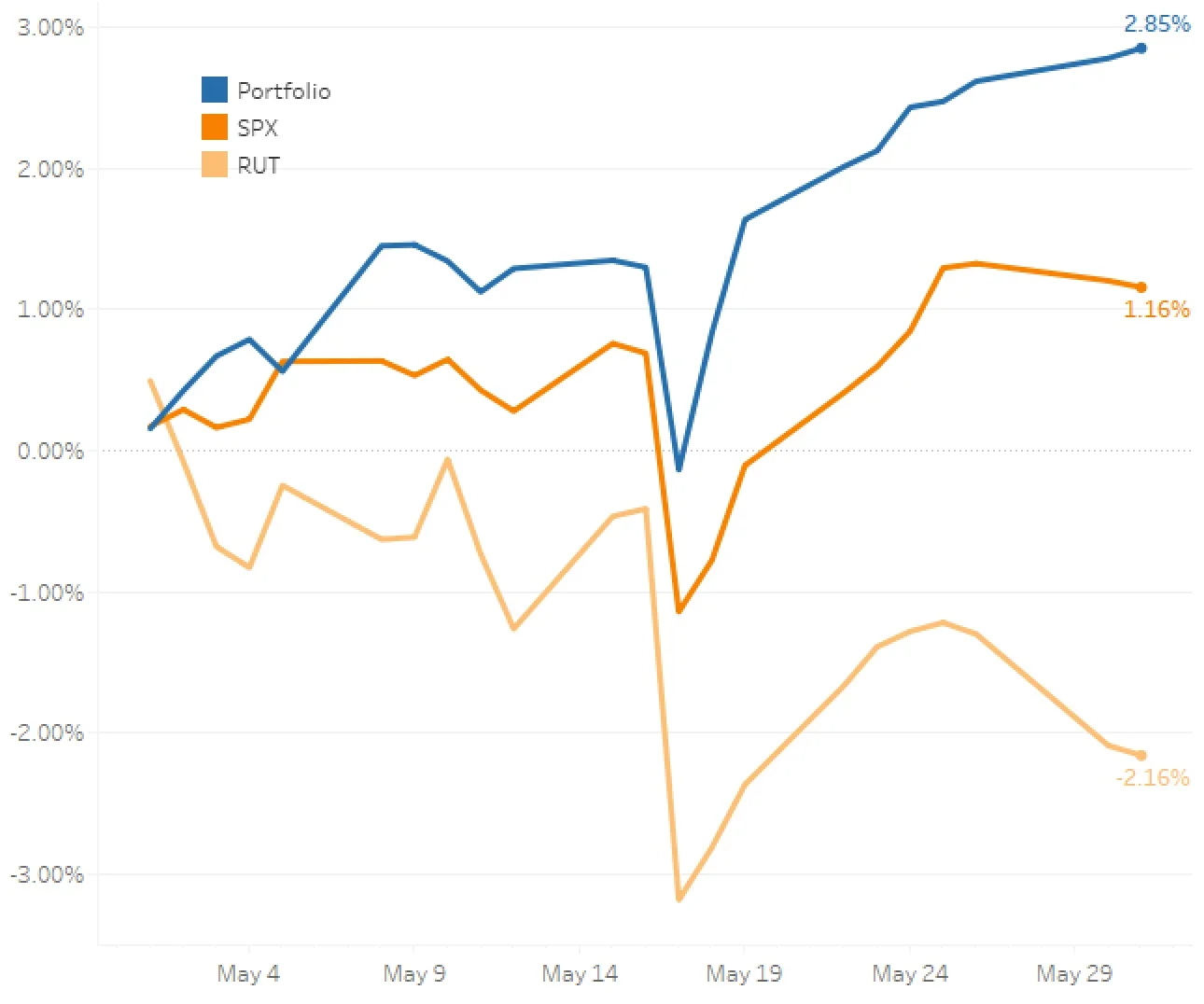

May 2017

Contrary to last month, this month saw quite the divergence in performance when comparing the portfolio, the SPX (S&P 500) and the RUT (Russell 2000). The portfolio was the least volatile and had the best performance finishing the month with a +2.85% return. The SPX (S&P 500) also ended up in positive territory up +1.16% but the RUT (Russell 2000) turned weaker down -2.16% for the month.

The SPY Put Write and Delta Hedge strategy added 20 bps to the portfolio return this month and the VIX Calendars strategy added another 21 bps. The SPX Broken Wing Butterflies strategy wasn't quite as successful as in past but it still added 50 bps to the overall portfolio return. The RUT Iron Condors strategy was the big winner this month bringing in 135 bps. And last but not least, the RUT Butterflies strategy added 59 bps to the portfolio return.

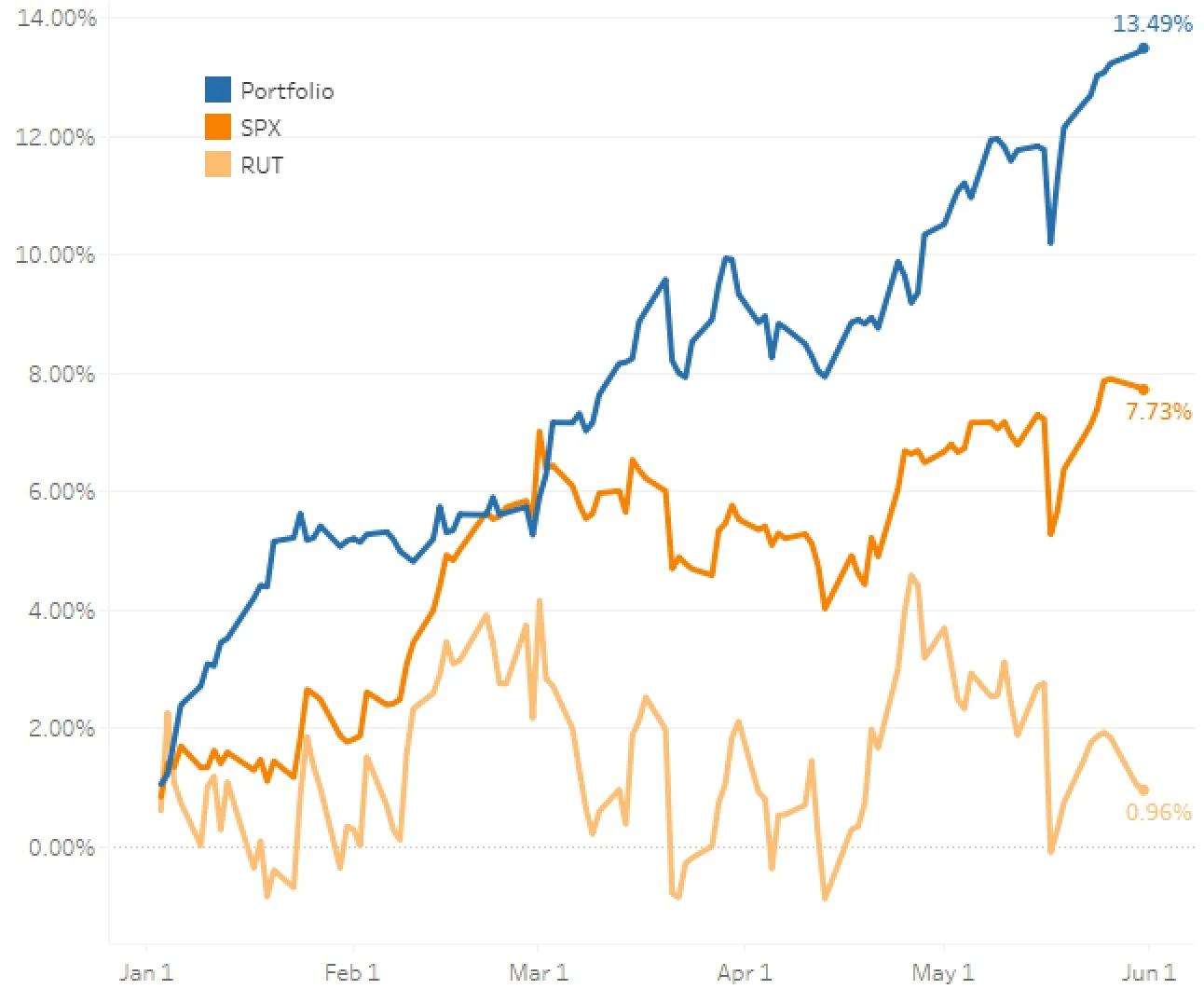

Year-to-Date

The portfolio's performance continues to give me warm fuzzies and so far is up +13.49%. This is well ahead of my general goal of earning 2% per month. The SPX (S&P 500) is up +7.73% and the RUT (Russell 2000) is the laggard of the group up only +0.96% for the year

The SPY Put Write and Delta Hedge strategy has done pretty much as expected so far this year adding 83 bps to the portfolio riding the general rise in the S&P 500. The VIX Calendars strategy subtracted 21 bps from the portfolio. I feel like I am slowly getting the hang of that strategy but I may only be one strong move down away from retracting that statement. The strongest strategy of the year is the SPX Broken Wing Butterflies strategy which added 596 bps to the overall portfolio. The RUT Iron Condors came in a strong second place adding 408 bps and the RUT Butterflies added a very respectable 281 bps.

All in all, I'm very happy with how the portfolio has performed so far. We'll see what the summer brings.

Hey! Check out the Performance page for interactive charts similar to the ones above where you can slice and dice the different time periods to see which strategies did well throughout the year!