Week in Review

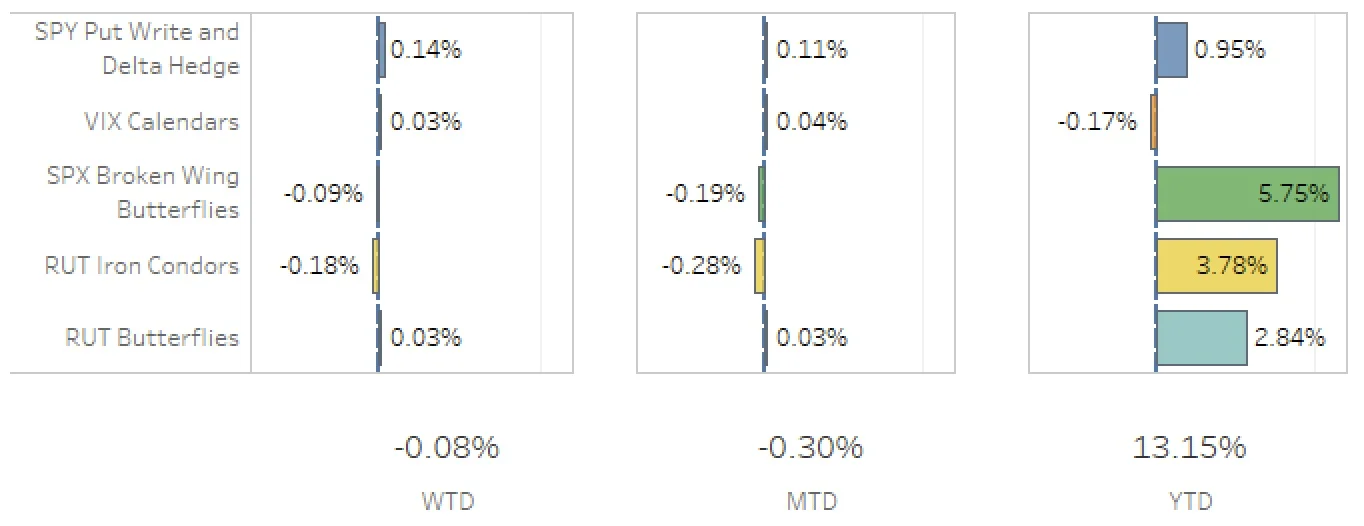

Run Ottawa marathon? Check. Close out May with a nice return? Check. Start off the shortened Memorial Day week strong? Ehh...not so fast. Two out of three ain't bad. The SPX (S&P 500) ended the week at 2439.07, up +0.96%, and the RUT (Russell 2000) ended the week at 1405.39, up +1.67%. The portfolio had a tougher time this week, down -0.08%.

The SPY Put Write and Delta Hedge strategy had a nice solid week. With both a put write and a put delta hedge on as of the end of last week, it did a nice job picking up premium as the market moved up. Both were closed out at the end of this week and replaced with duplicate trades one week further out. For the week, the strategy added 14 bps to the portfolio.

The VIX Calendars strategy did reasonably well this week. Nothing really to report here. For the week, the strategy added 3 bps to the portfolio.

The SPX Broken Wing Butterflies strategy didn't really do a ton this week. The market continues to push higher and push past those upper strikes on the butterflies. I was able to close the Jul 7 trade for a +4.35% return on Wednesday when the market dipped down 8 or 9 points at the beginning of the day. I adjusted the Jul 21 trade on Thursday by bringing in the long calls a bit when the market pushed higher. On Friday, I opened three trades: Jul 28, Aug 4 and Aug 31. For the week, the strategy subtracted 9 bps from the portfolio.

The RUT Iron Condors strategy had the most trouble of all of the strategies this week. With the dip down on Wednesday, I was able to close out the calls on the nested iron condor and with the strong move up later in the week, I was able to close out the puts. All together, the Jul 21 nested iron condor was closed for a +5.69% gain. The weirdors were the ones that had trouble. The really strong move on Friday forced me to roll out the calls on both the Jun 30 and Jul 21 weirdor trades. For the week, the strategy subtracted 18 bps from the portfolio.

The RUT Butterflies strategy was pretty quiet this week. With the Jun trade closed out last week, there was nothing on until Friday of this week when I opened the Jul trade. For the week, this strategy added 3 bps to the portfolio.

Contribution to Return

Trade Activity

- CLOSED VXX Put Jun 9 +7.82%

- CLOSED SPX Broken Wing Butterflies Jul 7 +4.35%

- CLOSED SPY Put Write Jun 2 +1.94%

- CLOSED SPY Delta Hedge Jun 9 +1.14%

- CLOSED RUT Nested Iron Condor Jul 21 +5.69%

- OPENED VXX Put Jun 23

- OPENED SPY Put Write Jun 9

- OPENED SPY Delta Hedge Jun 16

- OPENED RUT Butterfly Jul 21

- OPENED SPX Broken Wing Butterfly Jul 28

- OPENED SPX Broken Wing Butterfly Aug 4

- OPENED SPX Broken Wing Butterfly Aug 31

SPX Broken Wing Butterflies Activity

- CLOSED SPX Broken Wing Butterflies Jul 7 BOT +2 IRON CONDOR SPX 100 (Weeklys) 7 JUL 17 2365/2410/2365/2285 CALL/PUT @41.10

- ADJUSTED SPX Broken Wing Butterflies Jul 21 BOT +1 VERTICAL SPX 100 21 JUL 17 2360/2375 CALL @12.35

- OPENED SPX Broken Wing Butterfly Jul 28 SOLD -2 IRON CONDOR SPX 100 (Weeklys) 28 JUL 17 2425/2470/2425/2350 CALL/PUT @39.65

- OPENED SPX Broken Wing Butterfly Aug 4 SOLD -2 IRON CONDOR SPX 100 (Weeklys) 4 AUG 17 2415/2455/2415/2340 CALL/PUT @38.90

- OPENED SPX Broken Wing Butterfly Aug 31 SOLD -2 IRON CONDOR SPX 100 (Weeklys) 31 AUG 17 2425/2475/2425/2350 CALL/PUT @46.00

Milking

- No trades-a-milking