Week in Review

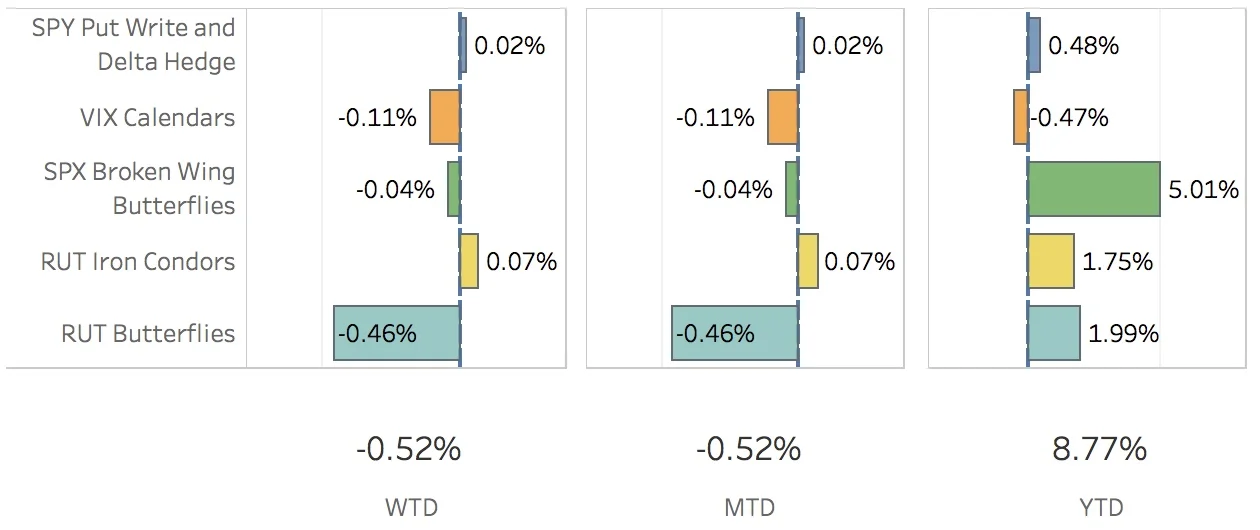

I don't have a lot to say this week. It kinda sucked and I really didn't like losing on my RUT Butterfly trade. Oh well, here we are. The SPX (S&P 500) ended the week at 2355.54, down -0.30%, and the RUT (Russell 2000) ended the week at 1364.56, down -1.54%. The portfolio finished with a loss this week, down -0.52%.

The SPY Put Write and Delta Hedge strategy added a respectable 2 bps even though the S&P 500 went down this week. I closed out the put from last week and added another short one this week. Again, no delta hedge with the portfolio sitting pretty flat delta.

The VIX Calendars again took its pound of flesh out of me this week. I feel like I am going to continue to bleed with this strategy unless some huge market shaking event occurs. For the week, this strategy subtracted 11 bps from the portfolio.

The SPX Broken Wing Butterflies strategy was pretty quiet. With the move down on Monday, my exit point of 2345 was hit for the Jun 16 trade which I was milking. I was able to cobble together a gain for the trade but the milking part of it proved to be unprofitable and took away from what would have been a larger profit. Also this week, I adjusted the May 26 trade, cut my exposure in half and started milking that one too. I have target exit points of 2330 and 2395 but I'm looking at it now and might move the 2395 one down a bit. For the week, this strategy subtracted 4 bps from the portfolio.

The RUT Iron Condors trades are puttering along fine. The Apr 28 trade will likely come off at the end of next week or maybe early into the following week. I'll likely hold on to the May 19 trade a week or two longer. I also added a nested iron condor with Jun 16 expiration. For the week, the strategy added 7 bps to the total portfolio.

And now we finally get to the RUT Butterflies Apr 21 trade. As I mentioned last week, the price action in the RUT was going to make or break this trade. For the past 5 weeks, the RUT has alternated between big down and big up: Mar 6-10 -2.07%, Mar 13-17 +1.92%, Mar 20-24 -2.65%, Mar 27-31 +2.31, Apr 3-7 -1.54%. This sort of activity is a killer for this trade and with the down move on Monday I decided to throw in the towel. I ended up with a modest loss of -3.19% on the trade. The May trade is doing fine right now but it would be nice if the RUT settled down a bit so I didn't have to keep adjusting. Arg! For the week, this strategy subtracted 46 bps from the portfolio.

Contribution to Return

Trade Activity

- CLOSED SPY Put Write Apr 7 +0.06%

- CLOSED VXX Put Apr 13 -31.86%

- CLOSED RUT Butterfly Apr 21 -3.19%

- CLOSED SPX Broken Wing Butterfly Jun 16 +3.58%

- OPENED SPY Put Write Apr 13

- OPENED VXX Put Apr 28

- OPENED SPX Broken Wing Butterfly Jun 9

- OPENED RUT Nested Iron Condor Jun 16

SPX Broken Wing Butterfly Details

- OPENED SPX Broken Wing Butterfly Jun 9 SOLD -2 IRON CONDOR SPX 100 (Weeklys) 9 JUN 17 2330/2375/2330/2255 CALL/PUT @43.15

- ADJUSTED SPX Broken Wing Butterfly May 26 BOT +2 IRON CONDOR SPX 100 (Weeklys) 26 MAY 17 2325/2375/2325/2240 CALL/PUT @46.10

- ADJUSTED SPX Broken Wing Butterfly May 26 SOLD -1 IRON CONDOR SPX 100 (Weeklys) 26 MAY 17 2360/2410/2360/2285 CALL/PUT @42.50

- CLOSED SPX Broken Wing Butterfly Jun 16 BOT +1 IRON CONDOR SPX 100 16 JUN 17 2375/2425/2375/2300 CALL/PUT @47.05

Milking

- SPX Broken Wing Butterfly May 26 where 2330 < SPX < 2395