Week in Review

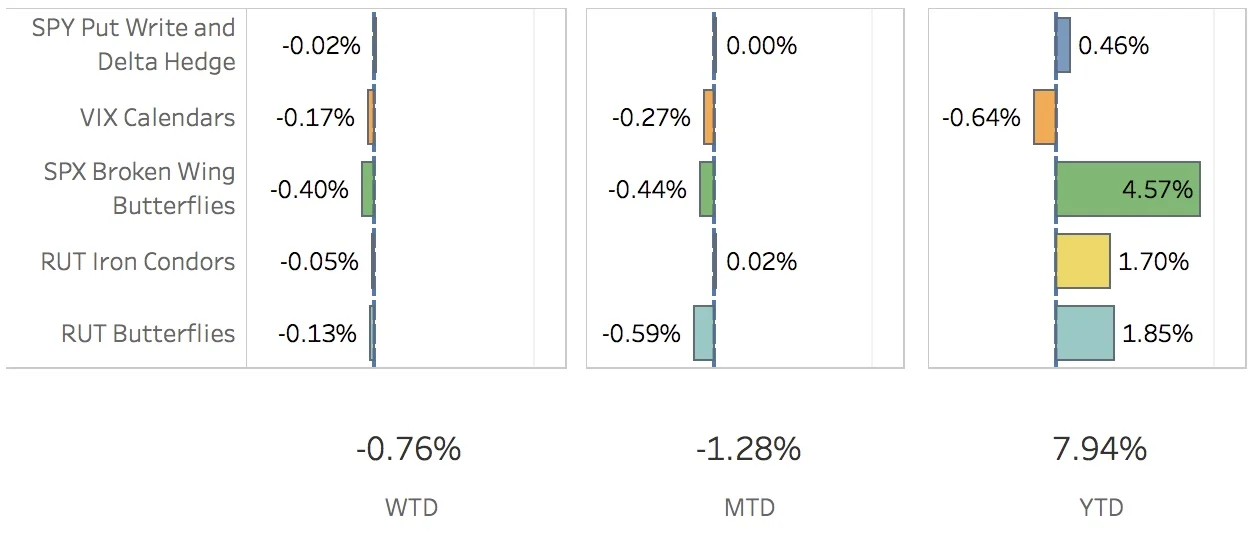

It was a short week but it was also another down one for the markets and the portfolio. Volatility started ticking up again this week but it's not outrageous...yet. I had hoped that my VIX Calendars strategy would protect me from some of this but no, I still don't seem to have that figured out yet. And so it goes. The SPX (S&P 500) ended the week at 2328.95, down -1.13%, and the RUT (Russell 2000) ended the week at 1345.24, down -1.42%. The portfolio was also down this week with a loss of -0.76%.

The SPY Put Write and Delta Hedge strategy had a respectable performance this week. Last Friday, because the portfolio delta was pretty flat, I only put on the put write. Even though the market was down, I closed that out this week for a tiny gain. I added another put write this week. Also, because the portfolio is leaning positive delta, I added a couple of naked calls to take some of that edge off. For the week, the strategy subtracted 2 bps from the portfolio.

I closed out some of my VIX positions. I am again thinking that I should rework this strategy and try and limit my losses (and gains) by closing them out earlier rather than letting them ride a bit. We'll see how that goes. As mentioned previously, this position didn't protect me at all from the uptick in volatility over the past two weeks. I may need to find something else that will reduce my vega but not decrease my theta. Calendars in the other products may be the answer but I've never been fond of them. We shall see. For this week though, the strategy subtracted 17 bps from the portfolio.

My precious Broken Wing Butterflies strategy was the big loser this week. I ended up closing two trades this week. I ended up closing my May 26 position for a small gain. The milking part of it was a loss but the overall trade still squeaked out a gain. I also closed my Jun 2 position. That position was only on for two weeks but came close to hitting the put side of the tent. I decided to close it out for a loss. I may open it up again next week if volatility stays higher. This was the first loss of the year for what has turned out to be a really solid strategy. So long as I stick to my rules and exit early (unlike last year), I'm hoping this strategy will form the core of my portfolio and I will consider upping its size relative to other strategies within the portfolio. Right now, I only have open three SPX Broken Wing Butterflies: Apr 21, Jun 9 and Jun 30. That's not a heck of a lot of theta. This strategy will likely remain pretty quiet over the next month as I add some inventory. For the week, the strategy subtracted 40 bps from the portfolio.

I feel like the RUT Iron Condors strategy is sitting on a cliff's edge this week. More momentum downwards next week in the markets could push this strategy over the edge. I have three positions on with one of them, maybe two, to be closed out next week. Dangers signs are flashing. For this week though, the strategy subtracted 5 bps.

Finally, the RUT Butterflies strategy did minimal damage to me this week. I didn't end up adjusting the strategy but the move down in the RUT did hurt. For the week, this strategy subtracted 13 bps from the portfolio.

Contribution to Return

Trade Activity

- CLOSED SPY Put Write Apr 13 +0.11%

- CLOSED VIX Calendar Apr19/May17 -6.86%

- CLOSED VIX Calendar May17/Jun21 -14.79%

- CLOSED VXX Put Apr 21 +2.55%

- CLOSED SPX Broken Wing Butterfly May 26 +2.50%

- CLOSED SPX Broken Wing Butterfly Jun 2 -4.36%

- OPENED SPY Put Write Apr 21

- OPENED SPY Delta Hedge Apr 28

- OPENED VXX Put May 5

- OPENED VIX Calendar Jun21/Jul19

SPX Broken Wing Butterfly Details

- CLOSED SPX Broken Wing Butterfly May 26 BOT +1 IRON CONDOR SPX 100 (Weeklys) 26 MAY 17 2360/2410/2360/2285 CALL/PUT @43.80

- CLOSED SPX Broken Wing Butterfly Jun 2 BOT +2 IRON CONDOR SPX 100 (Weeklys) 2 JUN 17 2355/2400/2355/2280 CALL/PUT @43.60

Milking

- Nothing open