Week in Review

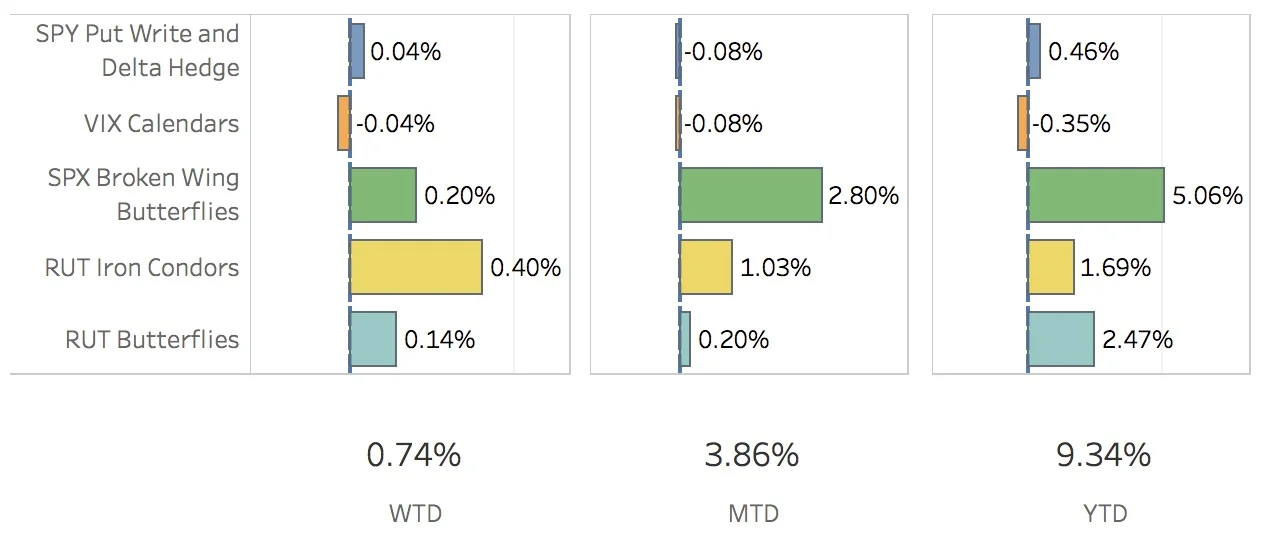

So that was a boring week. The SPX (S&P 500) ended the week at 2362.77, up +0.80%, and the RUT (Russell 2000) ended the week at 1385.92, up +2.31% (darn you Russell 2000!). The portfolio was up +0.74% for the week.

With the move up in the SPX, the SPY Put Write and Delta Hedge strategy did alright. I just had a single put write on last week and did the same this week. The portfolio was flat enough that I decided not to put a delta hedge on. For the week, the strategy added 4 bps to the portfolio.

The VIX Calendars strategy was okay this week. I lost again on it but it wasn't terrible. I closed one VXX put and opened another. For the week, the strategy subtracted 4 bps from the portfolio.

The SPX Broken Wing Butterflies strategy did okay this week. Nothing to write home about. I closed two trades and opened two more. One of the trades I was milking, the May 12 expiration, I ended up closing when the market went down through 2335. That along with the original profit on the main trade garnered a gain of 7.92%. This week, I started milking another trade, this one expiring Jun 16. I'll close that one when the market hits 2345 or 2410. For the week, the strategy added 20 bps to the portfolio.

The RUT Iron Condors strategy did better than I thought they would this week. Last week I had to defend them from a big drop in the RUT. This week I peeled off some of that protection when the RUT bounced right back up again. This is going to be a painful trade to deal with over the next month and I don't expect much from it. For this week though, it added 40 bps to the portfolio.

The RUT Butterflies strategy just killed me this week. The April expiration is right in the prime theta decay period and I wasted this past week defending this trade from the strong move up in the RUT after wasting last week defending this trade from the strong down move down in the RUT. I ended up losing on the April expiration but making it up on the May expiration. I'll be holding on to the April expiration until the end of the week and the movement of the RUT next week is going to make or break that trade. For the week, this strategy added 14 bps to the portfolio.

Contribution to Return

Trade Activity

- CLOSED SPY Put Write Mar 31 +2.91%

- CLOSED VXX Calendar Mar24/Apr7 -13.09%

- CLOSED SPX Broken Wing Butterfly May 5 +4.16%

- CLOSED SPX Broken Wing Butterfly May 12 +7.92%

- CLOSED RUT Nested Iron Condor May 19 +6.32%

- OPENED SPY Put Write Apr 7

- OPENED VXX Put Apr 21

- OPENED SPX Broken Wing Butterfly Jun 2

- OPENED SPX Broken Wing Butterfly Jun 30

SPX Broken Wing Butterflies Details

- CLOSED SPX Broken Wing Butterfly May 5 BOT +2 IRON CONDOR SPX 100 (Weeklys) 5 MAY 17 2325/2375/2325/2250 CALL/PUT @42.75

- CLOSED SPX Broken Wing Butterfly May 12 BOT +1 IRON CONDOR SPX 100 (Weeklys) 12 MAY 17 2360/2410/2360/2285 CALL/PUT @44.65

- OPENED SPX Broken Wing Butterfly Jun 2 SOLD -2 IRON CONDOR SPX 100 (Weeklys) 2 JUN 17 2355/2400/2355/2280 CALL/PUT @42.25

- OPENED SPX Broken Wing Butterfly Jun 30 SOLD -2 IRON CONDOR SPX 100 (Quarterlys) 30 JUN 17 2355/2405/2355/2280 CALL/PUT @47.55

- ADJUSTED SPX Broken Wing Butterfly Jun 16 BOT +2 IRON CONDOR SPX 100 16 JUN 17 2375/2425/2375/2300 CALL/PUT @45.95

- ADJUSTED SPX Broken Wing Butterfly Jun 16 SOLD -1 IRON CONDOR SPX 100 16 JUN 17 2375/2425/2375/2300 CALL/PUT @45.85

Milking

- SPX Broken Wing Butterfly Jun 16 where 2345 < SPX < 2410