The Week in Review

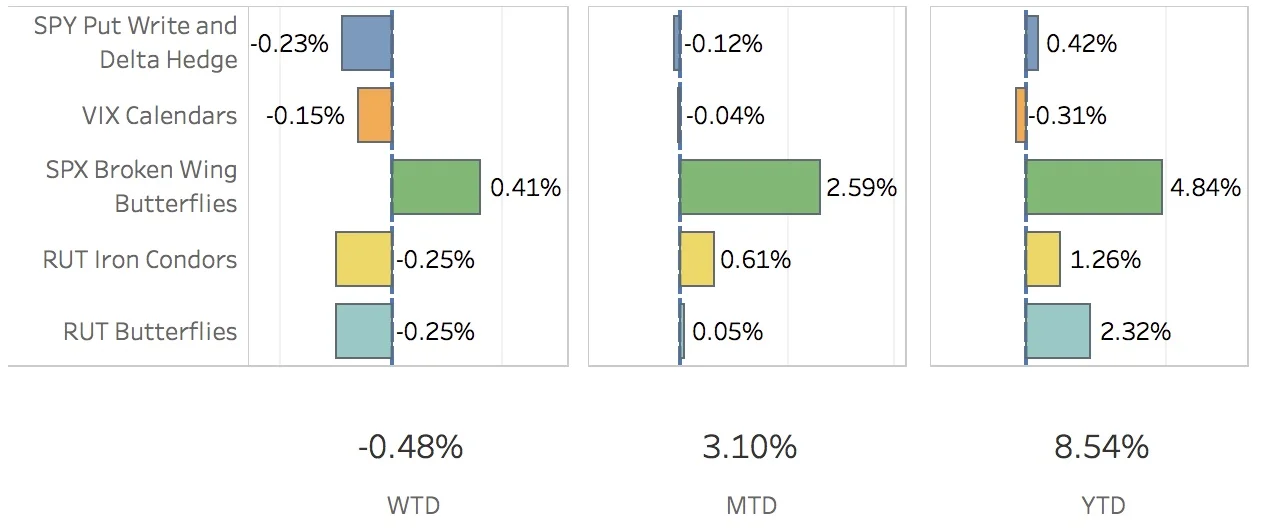

So that was an interesting week. The first cracks are appearing are in the new administration and the market hates it, or maybe not. The threat of failure to pass the new health care act seemed to send markets into a tailspin on Tuesday. By late Friday afternoon, markets which were down all day headed upwards as news of the pulled bill made the rounds. What gives? I don't know. Maybe the markets are happy we're done with doing something unpopular with most of the nation. Instead we will move on to the good stuff that is getting support from both sides, infrastructure spending and tax cuts! Or not. Again, I don't know. What I do know is that the SPX (S&P 500) ended the week at 2343.98, down -1.44%, and the RUT (Russell 2000) ended the week at 1354.64, down -2.65%. The portfolio was down -0.48%.

The SPY Put Write and Delta Hedge strategy got pounded this week. I lost on both trades opened last Friday. This Friday, I opened only the put write. The strategy was pretty much delta neutral and didn't need a hedge one way or the other. For the week, the strategy subtracted 23 bps from the portfolio.

The VIX Calendars strategy was a little bit puzzling to me this week. I thought with VIX heading higher I would make money on my long VIX and lose on the short VXX. Instead, I lost money on both. Ha! I don't know why I do this to myself. Some day, I will get this right. For this week however, I got it wrong again as it subtracted 15 bps from the portfolio.

The SPX Broken Wing Butterflies was the big winner this week (yawn...) but there was some funky pricing at the close on my Jun 16 trade which added 30 bps too much and it will get taken out next week. That being said, there was a lot of activity in this strategy as the market bounced around. Five trades were closed, two of which I was milking: Apr 13 for a 6.21% gain and Apr 28 for a 3.41% gain. That definitely wasn't ideal but the market moved, it hit my numbers, and I got out. I wasn't about to turn winning trades into losers. At this point in time, only the May 12 trade is still being milked. For the week, this strategy added 41 bps to the portfolio.

The RUT Iron Condors had some difficulty this week. The big drop on Tuesday necessitated two adjustments to each of the weirdors and they are both losers right now. We'll see what the future brings. For the week, this strategy subtracted 25 bps from the portfolio.

The RUT Butterflies strategy also had a tough time. I had close to half my targeted gain in the Apr trade before the Tuesday drop. Now it's close to nothing. I opened up the May trade on Wednesday hoping to take advantage of some higher volatility. For the week, this strategy subtracted 25 bps from the portfolio.

Hey! Don't forget to check out my charts and graphs on the Performance page. You can see my performance, trade statistics and contribution to return for any period of time!

Contribution to Return

Trade Activity

- CLOSED VXX Calendar Mar 31 +39.13%

- CLOSED SPY Put Write Mar 24 -4.65%

- CLOSED SPY Delta Hedge Mar 31 -2.29%

- CLOSED SPX Broken Wing Butterfly Mar 24 +3.02%

- CLOSED SPX Broken Wing Butterfly Apr 7 +3.62%

- CLOSED SPX Broken Wing Butterfly Apr 13 +6.21%

- CLOSED SPX Broken Wing Butterfly Apr 28 +3.41%

- CLOSED SPX Broken Wing Butterfly May 31 +5.97%

- OPENED VXX Put Apr 13

- OPENED RUT Butterfly May 19

- OPENED SPY Put Write Mar 31

- OPENED SPX Broken Wing Butterfly Apr 26

SPX Broken Wing Butterflies Details

- ADJUSTED SPX Broken Wing Butterfly Apr 13 BOT +2 IRON CONDOR SPX 100 (Weeklys) 13 APR 17 2275/2310/2275/2200 CALL/PUT @34.45

- ADJUSTED SPX Broken Wing Butterfly May 5 SOLD -2 VERTICAL SPX 100 (Weeklys) 5 MAY 17 2365/2375 CALL @4.90

- CLOSED SPX Broken Wing Butterfly Mar 24 BOT +2 IRON CONDOR SPX 100 (Weeklys) 24 MAR 17 2300/2320/2300/2225 CALL/PUT @20.10

- CLOSED SPX Broken Wing Butterfly Apr 7 BOT +2 IRON CONDOR SPX 100 (Weeklys) 7 APR 17 2275/2305/2275/2200 CALL/PUT @29.70

- CLOSED SPX Broken Wing Butterfly Apr 13 BOT +1 IRON CONDOR SPX 100 (Weeklys) 13 APR 17 2360/2405/2360/2285 CALL/PUT @34.15

- CLOSED SPX Broken Wing Butterfly Apr 28 BOT +1 IRON CONDOR SPX 100 (Weeklys) 28 APR 17 2375/2425/2375/2300 CALL/PUT @39.50

- CLOSED SPX Broken Wing Butterfly May 31 BOT +2 IRON CONDOR SPX 100 (Weeklys) 31 MAY 17 2350/2400/2350/2275 CALL/PUT @46.20

- MILKING SPX Broken Wing Butterfly May 12 where 2335 < SPX < 2410