The Week in Review

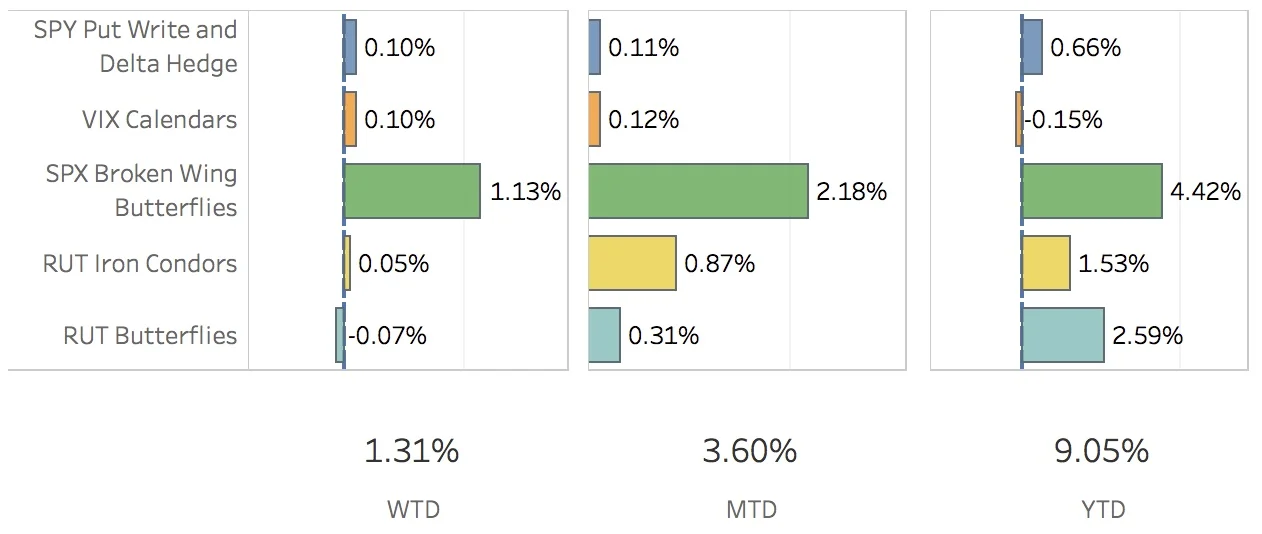

Whew! This was a really strong week. And it was busy too! The SPX Broken Wing Butterflies I started opening in late Jan / early Feb have started ripening. Some have been closed, many adjusted, and a few are being milked for more theta. The SPX, S&P 500, ended the week at 2378.25 or up +0.24% and the RUT, Russell 2000, ended the week at 1391.52 or up +1.92%, nearly recovering from all of last week's minor meltdown. The portfolio ended the week up +1.31%.

The SPY Put Write and Delta Hedge strategy did really well this week. With the SPX barely moving, I was able to collect a decent amount of theta. Both of last week's trades were closed out this Friday and two new ones were put on in their place. With the portfolio leaning slightly negative delta, I switched back to naked puts to try and hedge some of that away. For the week, the strategy added 10 bps.

The VIX Calendars had a decent week. I converted the short term calendars to straight long puts on the VXX. The longer term VIX calendar trades are still in place. I may need to change the name of this strategy as it has morphed a bit over the past few months and VIX Calendars is a bit misleading since it will also include some long VXX puts. In any case, the strategy added 10 bps to the portfolio this week.

The SPX Broken Wing Butterflies strategy was the big winner this week with the SPX inching upwards only slightly. This allowed me to close out the May 19 trade, adjust the Apr 28 and May 12 trades, and open a Jun 16 trade. Currently, there are three trades a-milking: Apr 13, Apr 28 and May 12. Details on their exits are in the SPX Broken Wing Butterflies Details section below. These milking trades are like lottery tickets. I've already made my 100% target profit in the trade and now I've reduced my exposure and I'm going to let them sit until they hit those target prices. Those target prices are where each of my target profits would hit 75% if they reached that price today. However, if the market stays in a range, then theta will decay and I will hopefully end up with much more than my current 100% target profit. For the week, the strategy added 113 bps to the portfolio.

The RUT Iron Condors strategy was pretty quiet this week. The nested iron condor trade did reasonably well even though the RUT rocketed higher this week. I added two weirdor trades, one for Apr 28 and one for May 19. For the week, the strategy added 5 bps to the portfolio.

The RUT Butterflies had a so-so week. The big move in the RUT was hard to manage but I'm pretty happy with escaping it with only a small loss in this strategy. It may require a bit more adjusting next week. Also next week, I'll probably be adding the May trade. The strategy subtracted 7 bps from the portfolio.

Hey! Don't forget to check out my charts and graphs on the Performance page. You can see my performance, trade statistics and contribution to return for any period of time!

Contribution to Return

Trade Activity

- CLOSED SPY Put Write Mar 17 +3.40%

- CLOSED SPY Delta Hedge Mar 24 +0.49%

- CLOSED SPX Broken Wing Butterfly May 19 +5.22%

- OPENED SPY Put Write Mar 24

- OPENED SPY Delta Hedge Mar 31

- OPENED VXX Calendar Apr 7 / Mar 24

- OPENED RUT Weirdor Iron Condor Apr 28

- OPENED RUT Weirdor Iron Condor May 19

- OPENED SPX Broken Wing Butterfly Jun 16

SPX Broken Wing Butterflies Details

- CLOSED SPX Broken Wing Butterfly May 19 BOT +2 IRON CONDOR SPX 100 19 MAY 17 2340/2390/2340/2260 CALL/PUT @47.30

- OPENED SPX Broken Wing Butterfly Jun 16 SOLD -2 IRON CONDOR SPX 100 16 JUN 17 2375/2425/2375/2300 CALL/PUT @47.65

- ADJUSTED SPX Broken Wing Butterfly Apr 28 BOT +1 IRON CONDOR SPX 100 (Weeklys) 28 APR 17 2300/2340/2275/2150 CALL/PUT @39.65

- ADJUSTED SPX Broken Wing Butterfly Apr 28 SOLD -2 IRON CONDOR SPX 100 (Weeklys) 28 APR 17 2375/2425/2375/2300 CALL/PUT @41.85

- ADJUSTED SPX Broken Wing Butterfly Apr 28 BOT +1 IRON CONDOR SPX 100 (Weeklys) 28 APR 17 2375/2425/2375/2300 CALL/PUT @39.45

- ADJUSTED SPX Broken Wing Butterfly May 12BOT +2 IRON CONDOR SPX 100 (Weeklys) 12 MAY 17 2335/2385/2335/2260 CALL/PUT @46.45

- ADJUSTED SPX Broken Wing Butterfly May 12SOLD -1 IRON CONDOR SPX 100 (Weeklys) 12 MAY 17 2360/2410/2360/2285 CALL/PUT @45.75

- MILKING SPX Broken Wing Butterfly Apr 13 where 2330 < SPX < 2395

- MILKING SPX Broken Wing Butterfly Apr 28 where 2350 < SPX < 2395

- MILKING SPX Broken Wing Butterfly May 12 where 2335 < SPX < 2410