The Week in Review

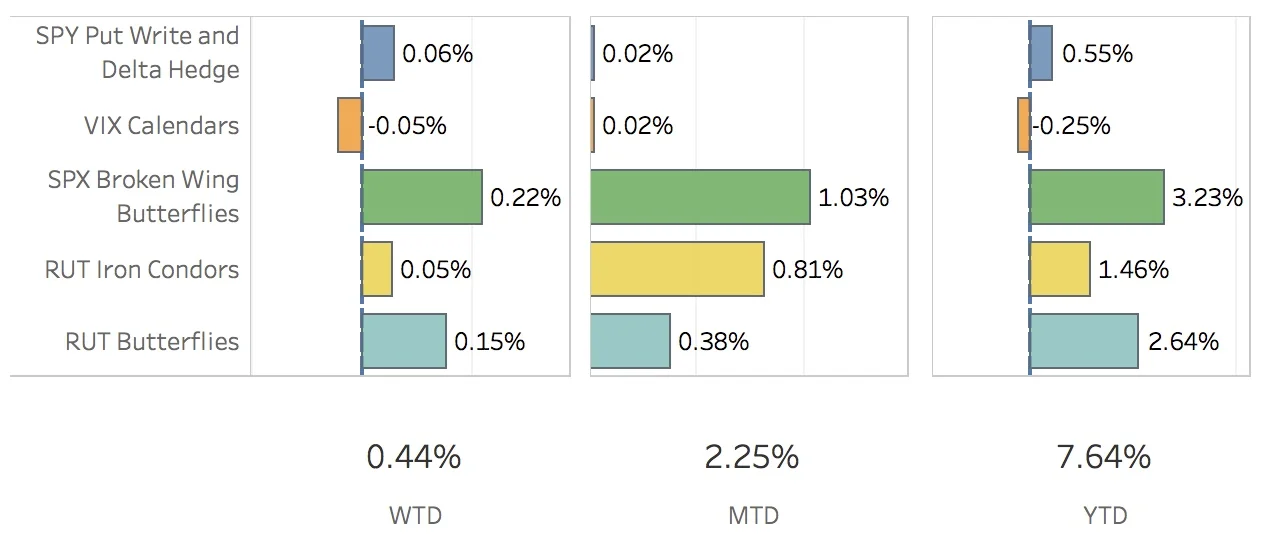

This was a pretty boring week. The only thing of real consequence was a fairly strong jobs report and unemployment number on Friday which pretty much ensured the Fed will raise interest rates later this month. Although, I'm pretty sure I remember the current president saying the numbers are all fake anyways and the real unemployment rate is north of 40%. Whatever. I don't really care, I just want my portfolio to continue moving up. The SPX, S&P 500, headed lower this week ending at 2372.60, down -0.44%. The RUT, Russell 2000, had a minor meltdown finishing the week at 1365.26, down -2.07%. The portfolio was up +0.44%.

The SPY Put Write and Delta Hedge did alright this week. The put write was closed out for a very small gain and the delta hedge did fairly well thanks to the market moving down. With the portfolio leaning positive delta again this week, the hedge for next week again consists of naked calls. For the week, this strategy added 6 bps to the portfolio.

The VIX Calendars strategy again proved troublesome. I need to spend some more time on this. I've got a longer term position that is supposed to profit from a move up in the VIX and a shorter term position that profits from a move down. It's not working quite the way I want it to and I will have to make some changes next week. For this week, it ended up costing the portfolio 5 bps.

The SPX Broken Wing Butterflies strategy did fairly well this week. I was thinking I was going to have to make some more adjustments to the strategies this week if the market moved up. Thankfully, it moved down slowly which helped my positions. I've got an Apr 13 position that I am milking and will hold while the market stays between 2330 and 2395. Once the SPX hits one of those numbers, I will exit the trade. The longer we stay in that range, the better the trade will do. We shall see. For the week, the strategy added 22 bps.

The RUT Iron Condors had a reasonable week considering the RUT seems to have fallen off of a small cliff for the past 6 or 7 trading sessions. I closed out the Mar 17 and Mar 31 weirdors and the Apr 21 nested iron condor. I opened the May 19 nested iron condor. The Apr weirdors will be opened next week. For this week, the strategy added 5 bps to the portfolio.

The RUT Butterflies strategy had a nice week. Not a lot of gains but I am happy with the how the Apr trade did after a much needed adjustment on Tuesday. It seems to do a really good job of handling a volatile RUT. For the week, this strategy added 15 bps to the portfolio.

Hey! Don't forget to check out my charts and graphs on the Performance page. You can see my performance, trade statistics and contribution to return for any period of time!

Contribution to Return

Trade Activity

- CLOSED VXX Calendar Mar 10 / Mar 24 +15.59%

- CLOSED SPY Put Write Mar 10 +0.17%

- CLOSED SPY Delta Hedge Mar 17 +1.11%

- CLOSED RUT Weirdor Iron Condor Mar 17 +1.74%

- CLOSED RUT Weirdor Iron Condor Mar 31 +2.60%

- CLOSED RUT Nested Iron Condor Apr 21 +5.57%

- OPENED VXX Calendar Mar 17 / Mar 31

- OPENED SPY Put Write Mar 17

- OPENED SPY Delta Hedge Mar 24

- OPENED RUT Nested Iron Condor May 19

- OPENED SPX Broken Wing Butterfly May 31

SPX Broken Wing Butterflies Details

- ADJUSTED SPX Broken Wing Butterfly Apr 13 SOLD -1 IRON CONDOR SPX 100 (Weeklys) 13 APR 17 2360/2405/2360/2285 CALL/PUT @38.25

- MILKING SPX Broken Wing Butterfly Apr 13 where 2330 < SPX < 2395