Week in Review

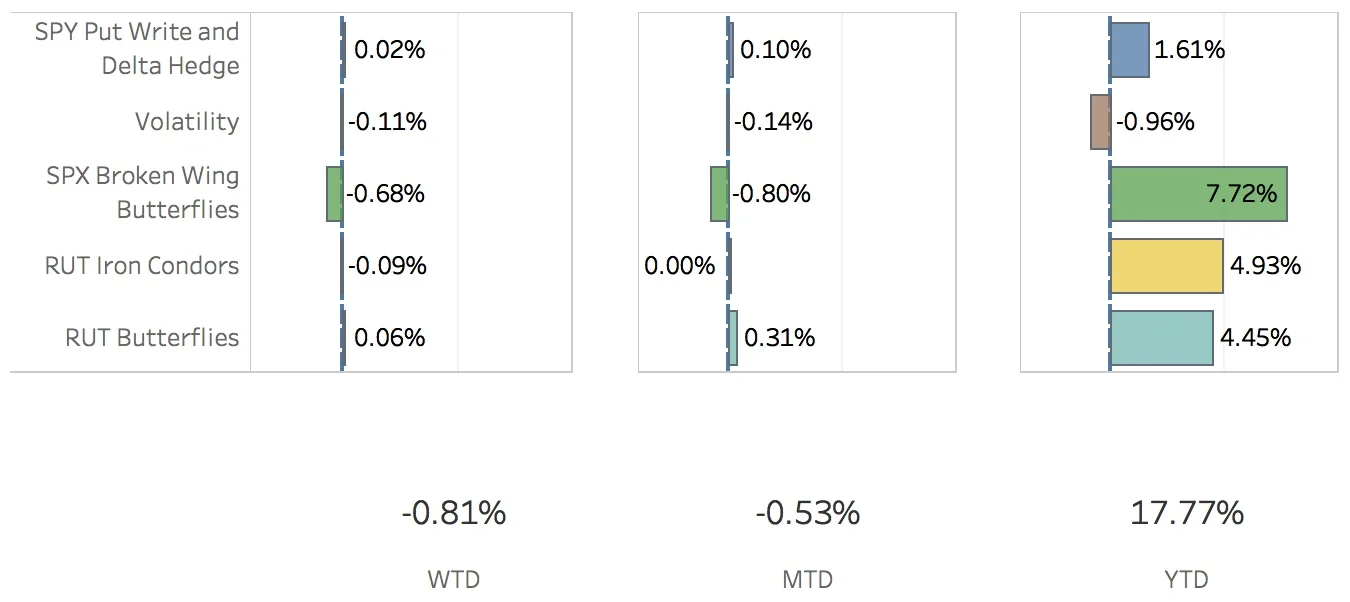

Super quiet week. The markets bounced around a bit with the Russell 2000 taking most of the heat. The S&P 500 didn't fall that much but volatility ticked up a couple of percentage points. The volatility is what hurt me the most this week. The SPX (S&P 500) ended the week at 2582.30, down -0.21%, and the RUT (Russell 2000) finished off the week at 1475.27, down -1.31%. The portfolio was down -0.81%.

The SPY Put Write and Delta Hedge strategy did reasonably well. Even though the SPX was down, I was still able to capture some gains due to theta decay. I closed out last week's trade and added another. I decided again not put a delta hedge on. The portfolio is sitting a bit negative delta but with volatility up, the markets are a bit twitchy and I didn't feel it was worth the risk of adding some naked puts. For the week, the strategy added 2 bps to the portfolio.

The Volatility strategy didn't do too badly. I added another long VXX put at the beginning of the week and both VXX trades are currently under water. The VIX calendar is down a bit but that's to be expected at this point. For the week, the strategy subtracted 11 bps from the portfolio.

The SPX Broken Wing Butterflies strategy really took it on the chin this week. It helped that the market didn't move all that much but the rising volatility is what pushed down the value of those trades. I got a little skittish and adjusted both the Dec 15 and Jan 31 trades so that they were both slightly negative delta. That should help a bit if the market moves down but it will make making money on the upside more difficult. For the week, the strategy subtracted 68 bps from the portfolio.

The RUT Iron Condors were okay this week. I ended up making some adjustments to both of the weirdors on Tuesday when the RUT was down over 1%. Both of them are pretty flat right now but we'll see how things go as we get closer to expiration. For the week, the strategy subtracted 9 bps from the portfolio.

The RUT Butterflies strategy was fine. It was able to handle the downturn fairly well. I did buy a put spread to help flatten the trade out and that's helped for now but it does make the trade susceptible to a strong move up. For the week, the strategy added 6 bps to the portfolio.

Contribution to Return

Trade Activity

- CLOSED SPY Put Write Nov 10 +1.07%

- OPENED SPY Put Write Nov 17

- OPENED VXX Put Nov 24

SPX Broken Wing Butterfly Details

- ADJUSTED SPX Broken Wing Butterfly Dec 15 SOLD -4 VERTICAL SPX 100 (Weeklys) 15 DEC 17 2520/2525 CALL @4.10

- ADJUSTED SPX Broken Wing Butterfly Jan 31 SOLD -1 VERTICAL SPX 100 (Weeklys) 31 JAN 18 2610/2625 CALL @7.25

Milking

- No trades-a-milkin'