Week in Review

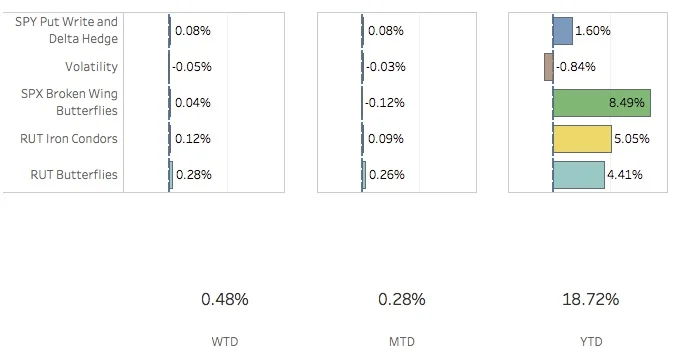

Ok. Not a bad week at all. Very busy and very solid returns as we head towards the holidays. I found the RUT to be a major pain in the butt this week as my RUT Butterfly trade (already twitchy with about 2 weeks left to expiration) got smacked around. We'll see how the Dec trade goes. The SPX (S&P 500) ended the week at 2587.84, up +0.26%, and the RUT (Russell 2000) ended the week at 1494.91, down, -0.89%. The portfolio was up for the week, +0.48%.

The SPY Put Write and Delta Hedge strategy was fine. With the SPX up, I was able to close out both the put write and delta hedge for small gains. I opened another put write on Friday but I didn't add another delta hedge. Things were pretty flat in the morning but by the afternoon I was second guessing that decision. For the week, the strategy added 8 bps to the portfolio.

The Volatility strategy was fairly quiet. No huge market moves or shifts in volatility. I opened a long VXX put on Monday which I plan on holding for another week. For this week, the strategy subtracted 5 bps.

The SPX Broken Wing Butterflies strategy was also fine this week. The Oct 31 trade expired this week for a gain of +2.74%. I adjusted the Dec 15 trade by bringing in remaining 2525 calls to 2520. That raises the potential profit on the right side of the butterfly to close to 5% if I don't make any further adjustments. Also, I opened the Jan 31 trade this week. So there was some activity but not a lot of profits or losses. For the week, the strategy added 4 bps to the portfolio.

The RUT Iron Condors trade was the busiest strategy. I closed out the Oct 31, Nov 17 and Nov 30 weirdors. The Nov 17 and Nov 30 trades were the first ones in a long time where I did not have to make any adjustments. The RUT has been trading in a range recently and the weirdors have handled it fairly well. This week I opened the Dec 15 and Dec 29 weirdors. I have a feeling these ones will be more challenging but we'll see. For the week, the strategy added 12 bps to the portfolio.

The RUT Butterflies strategy was the big winner of the week. I clawed back some of my losses in the Nov 17 trade but I eventually gave up on it on Friday morning and closed it for a loss. Even though the RUT has been trading in a bit of a range, the Nov 17 trade was a little twitchy being so close to expiration. Rather than obsess over it, I closed it out and decided to move on. Much of the gains this week came from the Dec 15 trade. Since it has just over 40 days until expiration it is much better able to stand a bit of movement up and down in the RUT. For the week, the strategy added 28 bps to the portfolio.

Contribution to Return

Trade Activity

- CLOSED SPY Put Write Nov 3 +1.45%

- CLOSED SPY Delta Hedge Nov 8 +0.90%

- CLOSED SPX Broken Wing Butterfly Oct 31 +2.74%

- CLOSED RUT Weirdor Oct 31 +1.33%

- CLOSED RUT Weirdor Nov 17 +4.58%

- CLOSED RUT Weirdor Nov 30 +3.54%

- CLOSED RUT Butterfly Nov 17 -2.18%

- OPENED SPY Put Write Nov 10

- OPENED VXX Put Nov 17

- OPENED RUT Weirdor Dec 15

- OPENED RUT Weirdor Dec 29

- OPENED SPX Broken Wing Butterfly Jan 31

- ADJUSTED SPX Broken Wing Butterfly Oct 31

- ADJUSTED SPX Broken Wing Butterfly Dec 15

SPX Broken Wing Butterfly Details

- ADJUSTED SPX Broken Wing Butterfly Oct 31 BOT +2 VERTICAL SPX 100 (Weeklys) 31 OCT 17 2425/2455 CALL @30.05

- CLOSED SPX Broken Wing Butterfly Oct 31 BOT +2 VERTICAL SPX 100 (Weeklys) 31 OCT 17 2425/2350 PUT @0.00

- ADJUSTED SPX Broken Wing Butterfly Dec 15 BOT +2 VERTICAL SPX 100 (Weeklys) 15 DEC 17 2520/2525 CALL @4.20

- OPENED SPX Broken Wing Butterfly Jan 31 SOLD -4 IRON CONDOR SPX 100 (Weeklys) 31 JAN 18 2560/2610/2560/2475 CALL/PUT @48.00

Milking

- No trades-a-milking