Week in Review

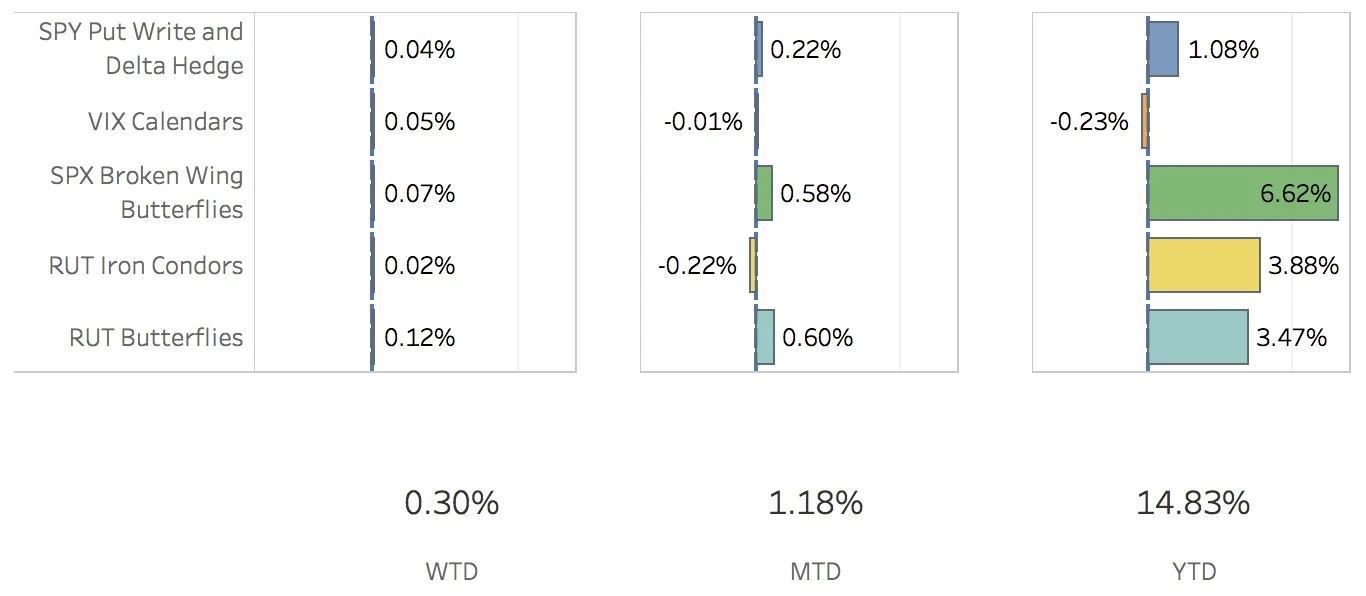

Whew! So this was a busy week! Lots of trading compared to the last one with a good number of the SPX Broken Wing Butterflies opened, closed or adjusted. The SPX (S&P 500) ended the week at 2438.30, up +0.21%, and the RUT (Russell 2000) ended the week at 1414.78, up +0.57%. The portfolio ended the week up +0.30%.

The SPY Put Write and Delta Hedge strategy did reasonably well. With the market drop on Tuesday and Wednesday the portfolio shifting big time into the positive deltas, I decided to remove the delta hedge early. In hindsight, it was a mistake but I just wasn't comfortable with that much positive delta and just made a decision to remove it. I removed the put write on Friday and added a new put write and a new delta hedge. For the week, the strategy added 4 bps to the overall portfolio.

The VIX Calendars strategy was pretty uneventful. The strategy added 5 bps to the portfolio this week.

The SPX Broken Wing Butterfly strategy was quite the handful this week. I had neglected to put on properly planned contingent orders and as a result a bunch of them got executed when the market moved up on Monday. This left me long a lot more delta than I would normally like and I had to back track on a couple of them. That being said, I was able to close out the Jul 28 and Aug 31 trades for a +4.04% and a +5.58% return respectively. To replace that inventory, I opened up Aug 11, Aug 25 and Sep 15 trades. I adjusted the Jul 14 and Aug 18 trades on Monday and then quickly reversed those adjustments on Tuesday or Wednesday because I had taken on too much positive delta. The Jul 31 trade was adjusted and Aug 4 was adjusted too. I am currently milking the Aug 4 trade with a plan to close it out if the SPX hits either 2425 or 2475. All in all, the strategy added 7 bps to the portfolio this week.

The RUT Iron Condors strategy was pretty quiet. I removed the calls from the nested iron condor and that was it. For the week, the strategy added 2 bps to the portfolio.

The RUT Butterfly strategy was also pretty quiet. The trade is sitting right at my target gain but I was not able to get a fill and close it out. I'm hoping to close it out next week if the market stays still. I'll also be opening up the Aug trade next week. This strategy added 12 bps to the portfolio.

Contribution to Return

Trade Activity

- CLOSED SPY Put Write Jun 23 +2.11%

- CLOSED SPY Delta Hedge Jun 30 +1.00%

- CLOSED VXX Put Jun 30 +1.30%

- CLOSED SPX Broken Wing Butterfly Jul 28 +4.04%

- CLOSED SPX Broken Wing Butterfly Aug 31 +5.58%

- OPENED SPY Put Write Jun 30

- OPENED SPY Delta Hedge Jul 7

- OPENED VXX Put Jul 14

- OPENED SPX Broken Wing Butterfly Aug 11

- OPENED SPX Broken Wing Butterfly Aug 25

- OPENED SPX Broken Wing Butterfly Sep 15

- ADJUSTED SPX Broken Wing Butterfly Jul 14

- ADJUSTED SPX Broken Wing Butterfly Jul 31

- ADJUSTED SPX Broken Wing Butterfly Aug 4

- ADJUSTED SPX Broken Wing Butterfly Aug 18

SPX Broken Wing Butterfly Details

- CLOSED SPX Broken Wing Butterfly Jul 28 BOT +1 IRON CONDOR SPX 100 (Weeklys) 28 JUL 17 2425/2470/2425/2350 CALL/PUT @38.60

- CLOSED SPX Broken Wing Butterfly Aug 31 BOT +2 IRON CONDOR SPX 100 (Weeklys) 31 AUG 17 2425/2475/2425/2350 CALL/PUT @44.30

- OPENED SPX Broken Wing Butterfly Aug 11 SOLD -2 IRON CONDOR SPX 100 (Weeklys) 11 AUG 17 2425/2465/2425/2350 CALL/PUT @37.95

- OPENED SPX Broken Wing Butterfly Aug 25 SOLD -2 IRON CONDOR SPX 100 (Weeklys) 25 AUG 17 2425/2470/2425/2350 CALL/PUT @41.60

- OPENED SPX Broken Wing Butterfly Sep 15 SOLD -2 IRON CONDOR SPX 100 15 SEP 17 2425/2470/2425/2350 CALL/PUT @43.95

- ADJUSTED SPX Broken Wing Butterfly Jul 14 BOT +2 VERTICAL SPX 100 (Weeklys) 14 JUL 17 2395/2405 CALL @8.60

- ADJUSTED SPX Broken Wing Butterfly Jul 14 SOLD -2 VERTICAL SPX 100 (Weeklys) 14 JUL 17 2395/2405 CALL @8.20

- ADJUSTED SPX Broken Wing Butterfly Jul 31 BOT +1 VERTICAL SPX 100 (Weeklys) 31 JUL 17 2400/2425 CALL @20.10

- ADJUSTED SPX Broken Wing Butterfly Jul 31 BOT +1 VERTICAL SPX 100 (Weeklys) 31 JUL 17 2400/2425 CALL @19.75

- ADJUSTED SPX Broken Wing Butterfly Aug 4 BOT +2 IRON CONDOR SPX 100 (Weeklys) 4 AUG 17 2415/2455/2415/2340 CALL/PUT @37.20

- ADJUSTED SPX Broken Wing Butterfly Aug 4 SOLD -1 IRON CONDOR SPX 100 (Weeklys) 4 AUG 17 2450/2490/2450/2375 CALL/PUT @35.70

- ADJUSTED SPX Broken Wing Butterfly Aug 18 BOT +2 VERTICAL SPX 100 18 AUG 17 2410/2425 CALL @11.10

- ADJUSTED SPX Broken Wing Butterfly Aug 18 SOLD -2 VERTICAL SPX 100 18 AUG 17 2410/2425 CALL @10.40

Milking

- SPX Broken Wing Butterfly Aug 4 2450/2490/2450/2375 where 2425 < SPX < 2475