Week in Review

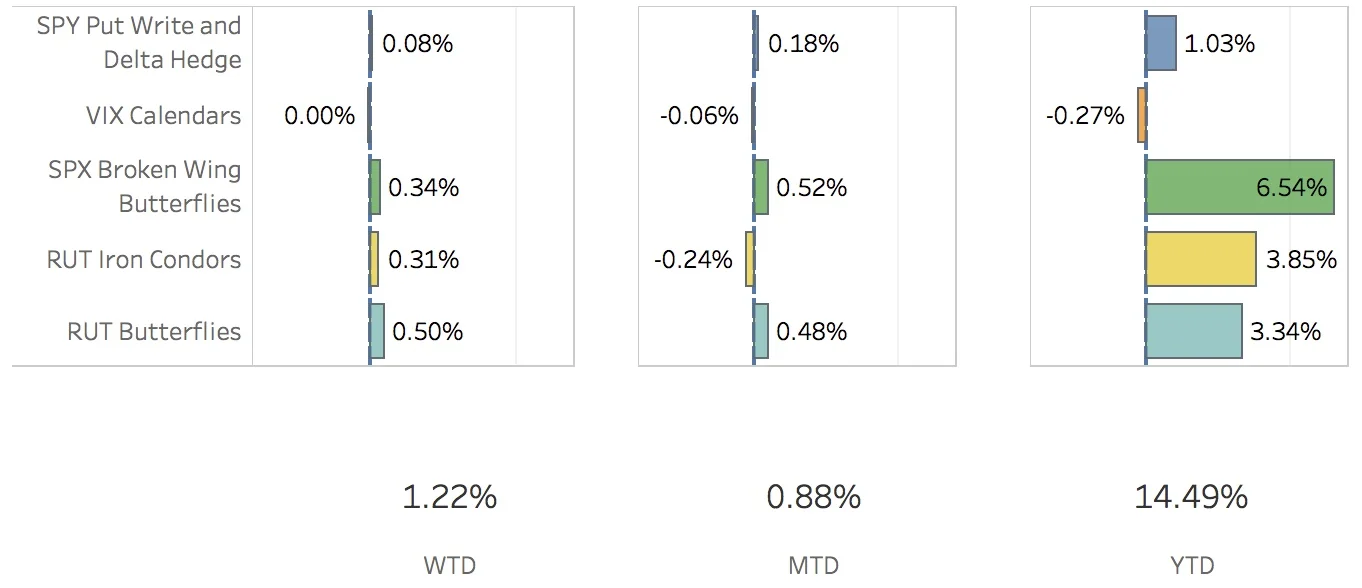

The markets settled down a bit this week allowing the portfolio to stop fighting and take a breather. It was sitting negative delta at the end of last week and was waiting for a slight pullback and let some theta come in to the trades. The SPX (S&P 500) ended the week at 2433.15, up +0.06%, and the RUT (Russell 2000) ended the week at 1406.73, down -1.05%. The portfolio did quite nicely in each of the three major strategies and ended the week with a really nice gain, up +1.22%.

The SPY Put Write and Delta Hedge strategy had a good week. The SPX hardly moved. With delta not playing a factor, all gains this week came from theta decay. Both the put write and naked put delta hedge from last week were closed out and rolled forward for another week. The portfolio is still sitting negative delta and may have some trouble next week if the market starts taking off again. For the week, the strategy added 8 bps to the portfolio.

The VIX Calendars strategy was fairly quiet this week. Volatility came down slightly but it didn't really impact the trades. The strategy did not add to or subtract from the portfolio this week.

The SPX Broken Wing Butterflies strategy had a good week. Volatility ticked down slightly and the SPX hardly moved. This was an ideal situation to take in some theta on a bunch of trades which were sitting fairly delta neutral at the end of last week. I adjusted the Jul 28 trade by reducing the exposure. I'm now milking that trade and will leave it on allowing it to collect theta until the SPX goes as low as 2400 or as high as 2450. If the market hits those levels, the trade will be closed out for good. For the week, the strategy added 34 bps to the overall portfolio.

The RUT Iron Condors strategy did nicely this week. The nested iron condor is fairing well but the weirdors are not. I had to take off the calls when the RUT moved up on Tuesday and now there is little to no theta left in either the Jun 30 or Jul 21 trade. If the market starts coming down slowly I can start pulling in some gains from the put debit spread. If the market doesn't move or goes up, then these trades will be closed out for just about scratch (a small gain or a small loss). The strategy added 31 bps to the portfolio.

The RUT Butterflies strategy also had a good week. It was sitting really short delta last week and I was pretty close to adjusting it. However, the market started coming down on Wednesday right into the meat of the butterfly. I was pretty close to my target gain on Friday but the market pushed up right at the end of the day. I've got a contingent order on to buy a call spread if the RUT hits 1410 anytime soon. For the week, the strategy added 50 bps to the overall portfolio.

Contribution to Return

Trade Activity

- CLOSED SPY Put Write Jun 16 -1.41%

- CLOSED SPY Delta Hedge Jun 23 -0.23%

- CLOSED VXX Put Jun 23 -7.05%

- OPENED SPY Put Write Jun 23

- OPENED SPY Delta Hedge Jun 30

- OPENED VXX Put Jul 7

- ADJUSTED SPX Broken Wing Butterfly Jul 28

SPX Broken Wing Butterfly Details

- ADJUSTED SPX Broken Wing Butterfly Jul 28 BOT +2 IRON CONDOR SPX 100 (Weeklys) 28 JUL 17 2425/2470/2425/2350 CALL/PUT @37.95

- ADJUSTED SPX Broken Wing Butterfly Jul 28 SOLD -1 IRON CONDOR SPX 100 (Weeklys) 28 JUL 17 2425/2470/2425/2350 CALL/PUT @38.30

Milking

- SPX Broken Wing Butterfly Jul 28 2425/2470/2425/2350 where 2400 < SPX < 2450