Week in Review

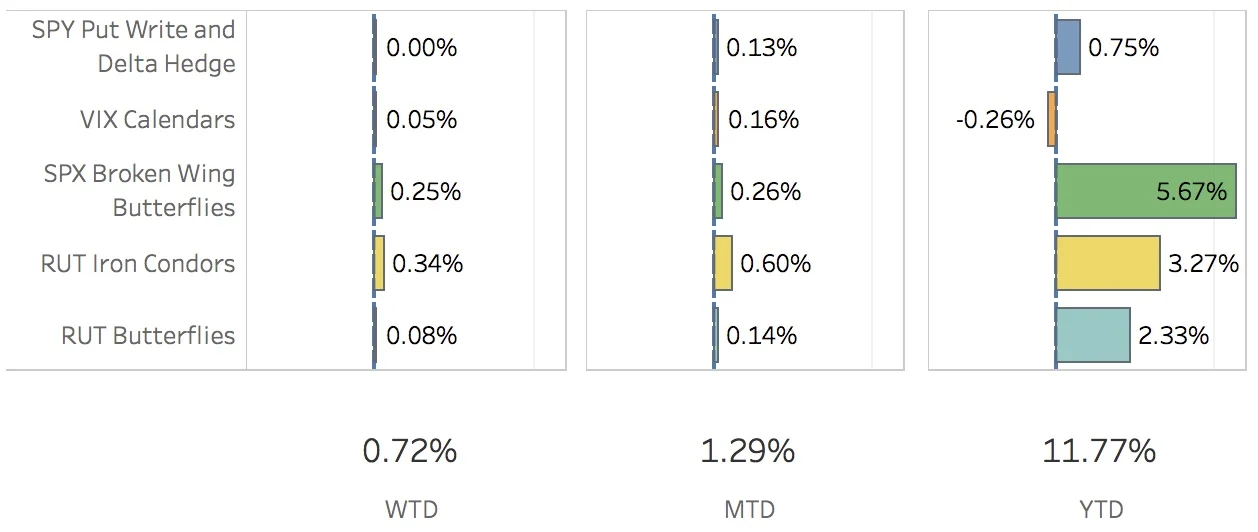

The portfolio had another solid week. There was a wonderful volatility crush on Monday which allowed me to close out some of my positions and make adjustments on others. Monday was the big winner whereas the rest of the week was so-so. The SPX (S&P 500) ended the week at 2390.90, down -0.35% and the RUT (Russell 2000) ended the week at 1382.77, down -1.02%. The portfolio finished the week up +0.72%.

The SPY Put Write and Delta Hedge struggled this week. On Thursday morning, with the market down, I took off the delta hedge as the portfolio swung from negative to positive delta. I took it off for a small gain. The put write also came off for a small gain on Friday and right away I put on another put write expiring next Friday. I also added a naked call to hedge some of the portfolio's positive delta. For the week, the strategy added/subtracted 0 bps to/from the portfolio.

The VIX Calendars had a breakout week. I closed the VIX Jun/Jul calendar for a gain and also managed to close the weekly VXX put for a gain. I added a VIX Jul/Aug calendar and a VXX put expiring expiring Jun 2. One thing I did want to bring up is that if you look at the Performance page, you might see something a little weird about this strategy. The strategy has positive net and gross average returns but it has negative contribution to return. This is because the average is a straight arithmetic average return of the trades and assumes each one was weighted equally. The contribution to return is negative because I do weight the trades differently. The VIX Calendars are bigger trades and are opened and closed once a month. The VXX trades are smaller and are opened and closed every week. Lately, I've had more luck with the VXX trades and because there are more occurrences of the VXX trade that pushes the average returns up but does not make a huge difference to the contribution to return. If I equal weighted each trade, then I would have positive contribution to return for the year. But, I really don't want to do that because the VIX Calendar is there to protect me from a spike in volatility and the VXX put trades are there to try and pay for that protection. For the week, the strategy added 5 bps to the portfolio.

The SPX Broken Wing Butterflies strategy was quiet this week. There was no reason to close any trades and no new expirations were available for me to open a new one. Instead, the portfolio just soaked up theta. For the week, the strategy added 25 bps to the portfolio.

The RUT Iron Condors strategy was the busiest strategy this week. I closed the Jun 2 and Jun 16 weirdor trades. I closed the Jun 16 nested iron condor and opened a Jul 21 nested iron condor. I also made some adjustments to the May 19 weirdor. For the week, this strategy added 34 bps to the portfolio.

Finally, the RUT Butterflies strategy had a reasonable week. I added an adjustment on Monday when the market moved up. This turned out to be the wrong move because Thursday's drop would have given me the opportunity to take off the trade at my target gain. Oh well. I did what I thought was right at the time and I still think it was the right decision given the information at the time. And now, we wait. For the week, this strategy added 8 bps to the portfolio.

Contribution to Return

Trade Activity

- CLOSED SPY Put Write May 12 +1.57%

- CLOSED SPY Delta Hedge May 19 +0.02%

- CLOSED VXX Put May 19 +52.55%

- CLOSED RUT Weirdor Iron Condor Jun 2 +2.57%

- CLOSED VIX Calendar Jun/Jul +8.12%

- CLOSED RUT Nested Iron Condor Jun 16 +1.33%

- CLOSED RUT Weirdor Iron Condor Jun 16 +2.75%

- OPENED SPY PUT Write May 19

- OPENED SPY Delta Hedge May 26

- OPENED VXX Put Jun 2

- OPENED VIX Calendar Jul/Aug

- OPENED RUT Nested Iron Condor Jul 21

SPX Broken Wing Butterflies Details

- No activity

Milking

- No trades-a-milking