Week in Review

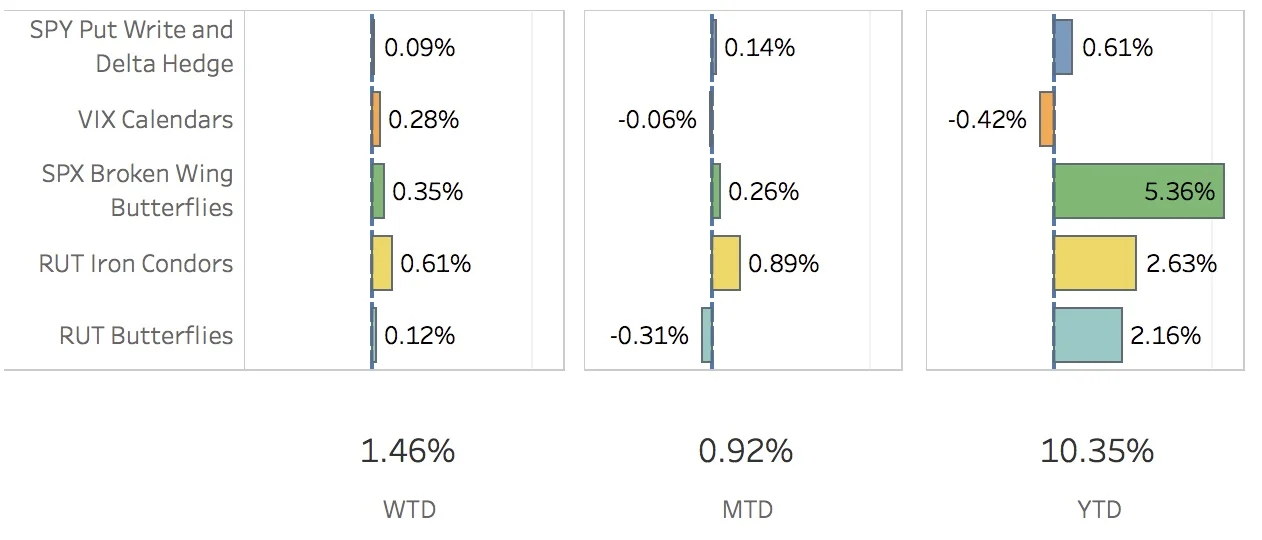

By Tuesday, I was starting to think this was going to be a terrible week. But then, something really rare and magical happened; the market stopped going up. It slowed down on Thursday and went down a bit on Friday. Crazy, right? The SPX (S&P 500) ended the week at 2384.20, up +1.51%, and the RUT (Russell 2000) ended the week at 1400.43, up +1.49%. The portfolio was up a little bit less than the indices finishing the week up +1.46%.

The SPY Put Write and Delta Hedge Strategy did reasonably well this week. I took the naked call delta hedge off on Monday when the portfolio swung from positive delta to negative delta as the market moved strongly higher. I took a small loss on that trade. At the end of the week, I closed out last week's put write, opened another one expiring next Friday, and added a naked put delta hedge. For the week, the strategy added 9 bps to the portfolio.

The VIX Calendars strategy actually made money this week! How weird is that? I don't expect it to last. For the week, the strategy added 28 bps to the portfolio.

The SPX Broken Wing Butterflies strategy continued it's consistent grinding away at the market, mining theta decay, and depositing it into my account. Two trades, Jun 9 and Jun 30, were closed out this week. I was going to milk the Jun 30 strategy but decided against it. As of right now, I only have two trades open, Jun 23 and Jul 21. I'll open more up as the new expirations become available. For the week, the strategy added 35 bps to the portfolio.

The RUT Iron Condors strategy did really well this week. It was pretty touch and go on Tuesday and Wednesday when the market moved higher. A lot of these trades were very negative delta and poised to lose a lot more money if the market moved higher. Thankfully, the market took a breather on Thursday and Friday. The Apr 28 weirdor expired on Friday for a modest gain. That leaves three other weirdors (May 19, Jun 2, Jun 16) and one nested iron condor open. For the week, this strategy added 61 bps to the portfolio.

Finally, the RUT Butterflies strategies held together this week and had a small gain. The May 19 trade will likely be closed out next Friday for a small gain or loss. The Jun 16 trade is doing fine and we will see how that goes. For the week, the strategy added 12 bps to the portfolio.

Hey! Don't forget to check out my charts and graphs on the Performance page. You can see my performance, trade statistics and contribution to return for any period of time!

Contribution to Return

Trade Activity

- CLOSED SPY Put Write Apr 28 +3.87%

- CLOSED Weirdor Iron Condor Apr 28 +1.51%

- CLOSED VXX Put May 5 -2.90%

- CLOSED SPY Delta Hedge May 5 -0.45%

- CLOSED SPX Broken Wing Butterfly Jun 9 +5.08%

- CLOSED SPX Broken Wing Butterfly Jun 30 +5.89%

SPX Broken Wing Butterfly Details

- ADJUSTED SPX Broken Wing Butterfly Jun 23 BOT +2 VERTICAL SPX 100 (Weeklys) 23 JUN 17 2370/2380 CALL @6.70

- ADJUSTED SPX Broken Wing Butterfly Jul 21 BOT +1 VERTICAL SPX 100 21 JUL 17 2360/2375 CALL @10.25

Milking

- No trades-a-milking