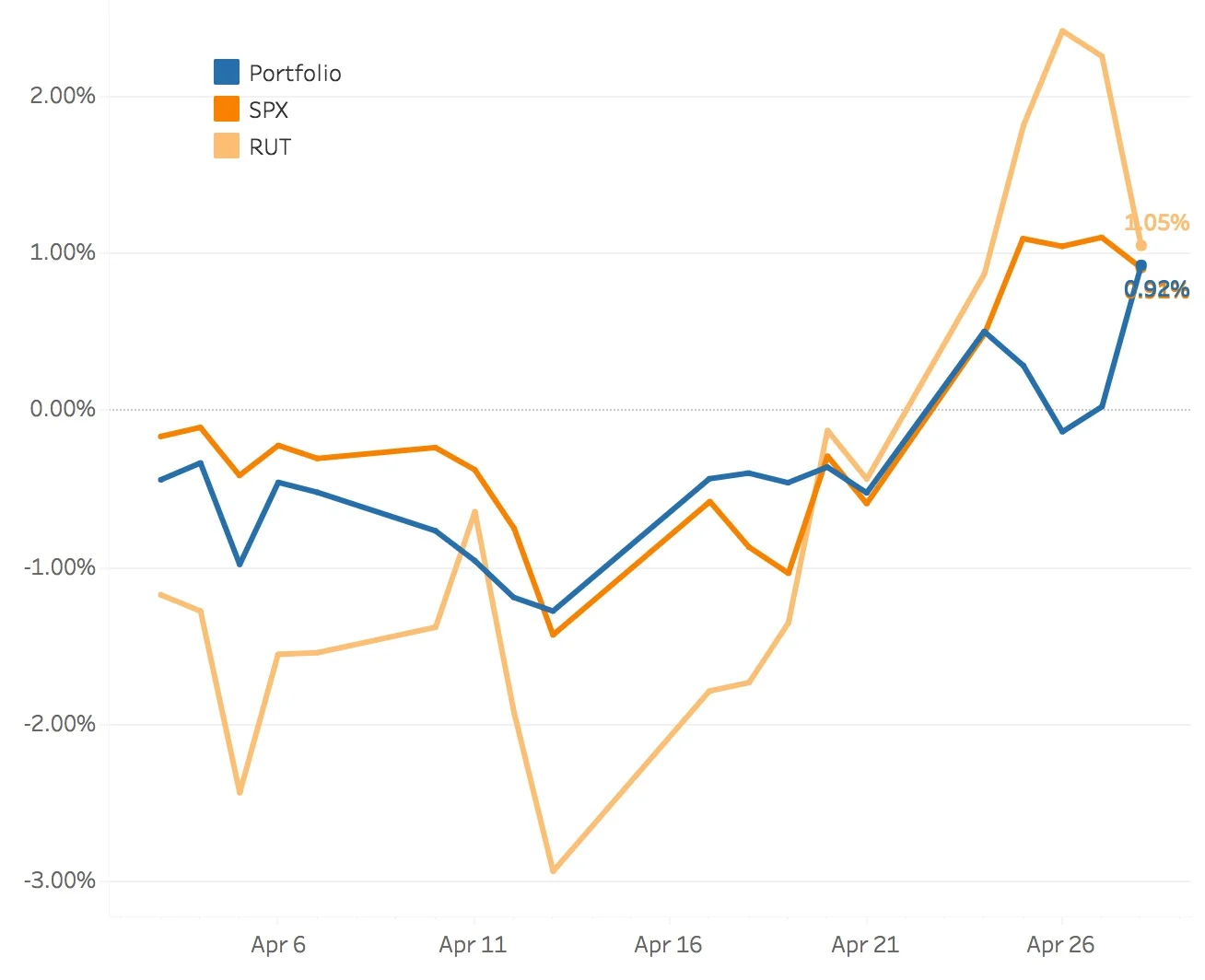

April 2017

The portfolio, SPX and the RUT all ended the month with virtually the same return but they did take a bit of a different route to get there. The portfolio was the least volatile and the RUT was all over the place. The portfolio returned +0.92% whereas the SPX and RUT returned +0.91% and +1.05% respectively.

The SPY Put Write and Delta Hedge strategy contributed 14 bps and the VIX Calendars strategy subtracted 6 bps from the portfolio's monthly return. The two butterflies strategies virtually offset one another with the SPX Broken Wing Butterflies contributing 26 bps and the RUT Butterflies subtracting 31 bps. The RUT Iron Condors strategy did the best this month adding 89 bps to the portfolio.

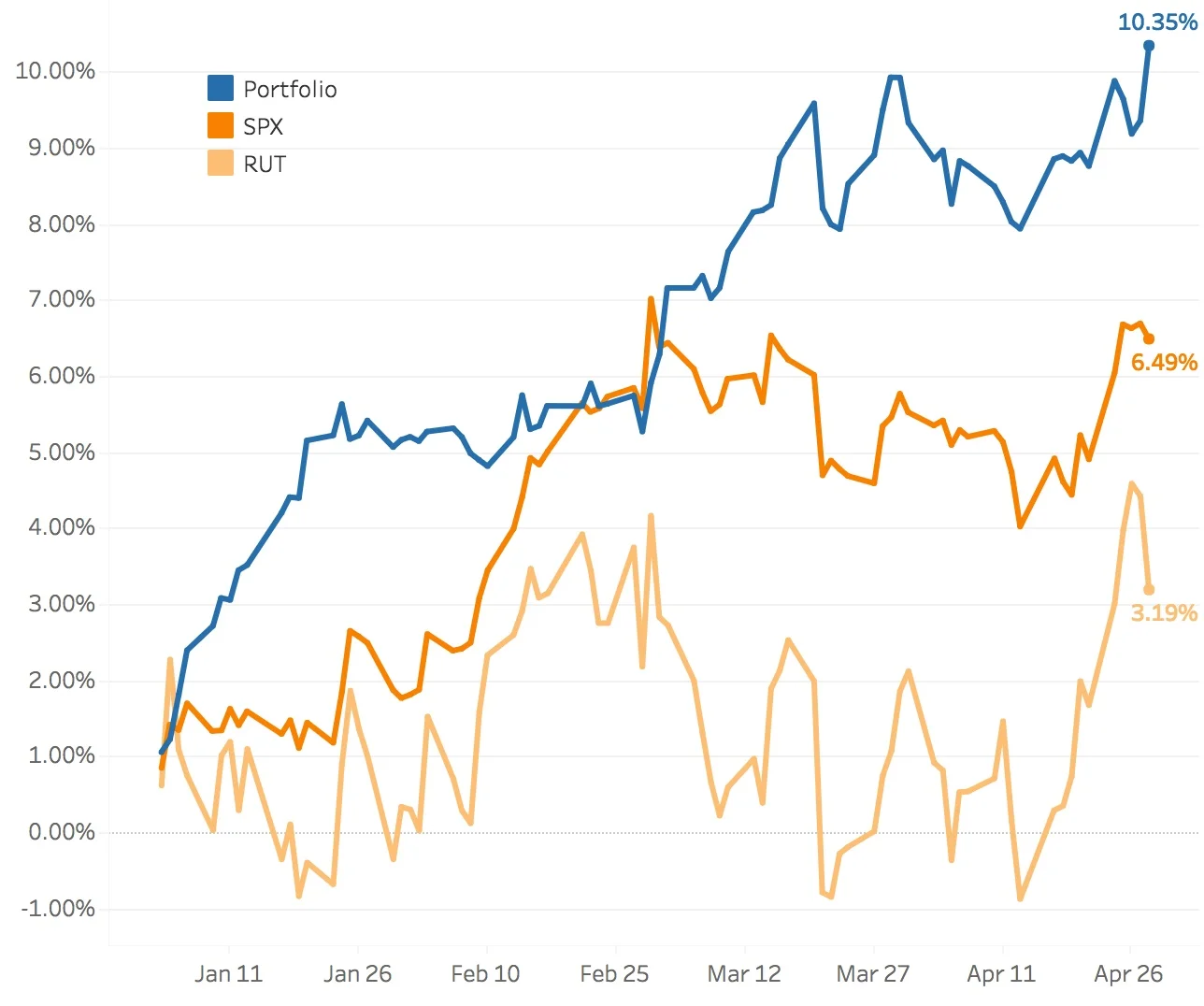

Year-to-Date

I've been pretty happy with the performance of the portfolio so far this year returning +10.35%. The SPX has gained +6.49% and the RUT is up +3.19%.

The SPY Put Write and Delta Hedge strategy added 61 bps to the portfolio and the VIX Calendars strategy subtracted 42 bps from the portfolio. The SPX Broken Wing Butterflies strategy was the biggest contributor adding 536 bps. This has also proven to be the most consistent strategy with only one losing trade so far this year. Finally, the RUT Iron Condors strategy and RUT Butterflies strategies added 263 bps and 216 bps respectively.

Hey! Check out the Performance page for interactive charts similar to the ones above where you can slice and dice the different time periods to see which strategies did well throughout the year!