Week in Review

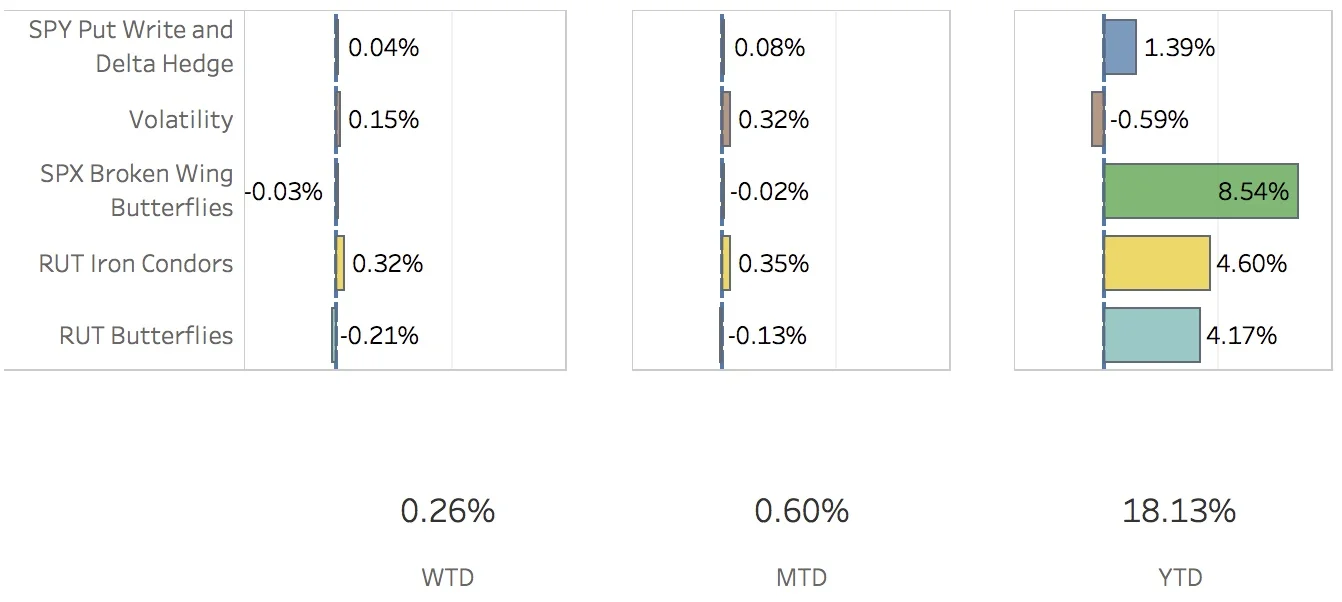

Meh again. Another busy week at work meant little trading again this week. That's probably a good thing since it keeps me from over reacting to things. Still, it was pretty quiet this week so there wasn't really anything that warranted over reacting. The SPX (S&P 500) ended the week at 2553.17, up +0.15%, and the RUT (Russell 2000) ended the week at 1502.66, down -0.50%. The portfolio was up +0.26% for the week.

The SPY Put Write and Delta Hedge strategy did well this week because of the move up in the SPX. Last week's put write was closed out for close to a max gain and a new one was opened this Friday expiring next Friday. No delta hedge was opened since the portfolio is sitting pretty delta neutral right now. For the week, the strategy added 4 bps to the portfolio.

The Volatility strategy also did well. There were gains in both the VIX calendars and in the VXX puts. For the week, the strategy added 15 bps.

The SPX Broken Wing Butterflies strategy was pretty quiet. I made an adjustment to the Dec 15 trade because the market was sitting fairly far down the right wing. I purchased some call debit spreads which raises that right wing up a bit. For the week, the strategy subtracted 3 bps from the overall portfolio return.

The RUT Iron Condors strategy had a good week. The Nov 17 trade was sitting negative delta last week and benefitted from a small pullback in the RUT. I opened a Nov 30 trade early this week to see if I could take advantage of a market that seems to have stalled out a bit. For the week, this strategy added 32 bps to the portfolio.

The RUT Butterflies strategy was the big loser this week. The trade was doing okay last week with recent strength in the RUT pushing the market up the call side of the trade. However, with the pullback in the RUT this week, it brought the market right back down and I suffered some losses. Rather than leave the trade as is, I adjusted it by moving the meat of the trade about 50 points higher. We'll see how that goes. For the week, this strategy subtracted 21 bps from the portfolio.

Contribution to Return

Trade Activity

- CLOSED SPY Put Write Oct 13 +1.58%

- CLOSED VXX Put Oct 13 +92.41%

- OPENED SPY Put Write Oct 20

- OPENED VXX Put Oct 27

- OPENED RUT Weirdor Nov 30

- ADJUSTED SPX Broken Wing Butterfly Dec 15

SPX Broken Wing Butterfly Activity

- ADJUSTED SPX Broken Wing Butterfly Dec 15 BOT +2 VERTICAL SPX 100 (Weeklys) 15 DEC 17 2520/2530 CALL @7.60

- ADJUSTED SPX Broken Wing Butterfly Dec 15 BOT +2 VERTICAL SPX 100 (Weeklys) 15 DEC 17 2525/2530 CALL @3.75

Milking

- No trades-a-milking