Week in Review

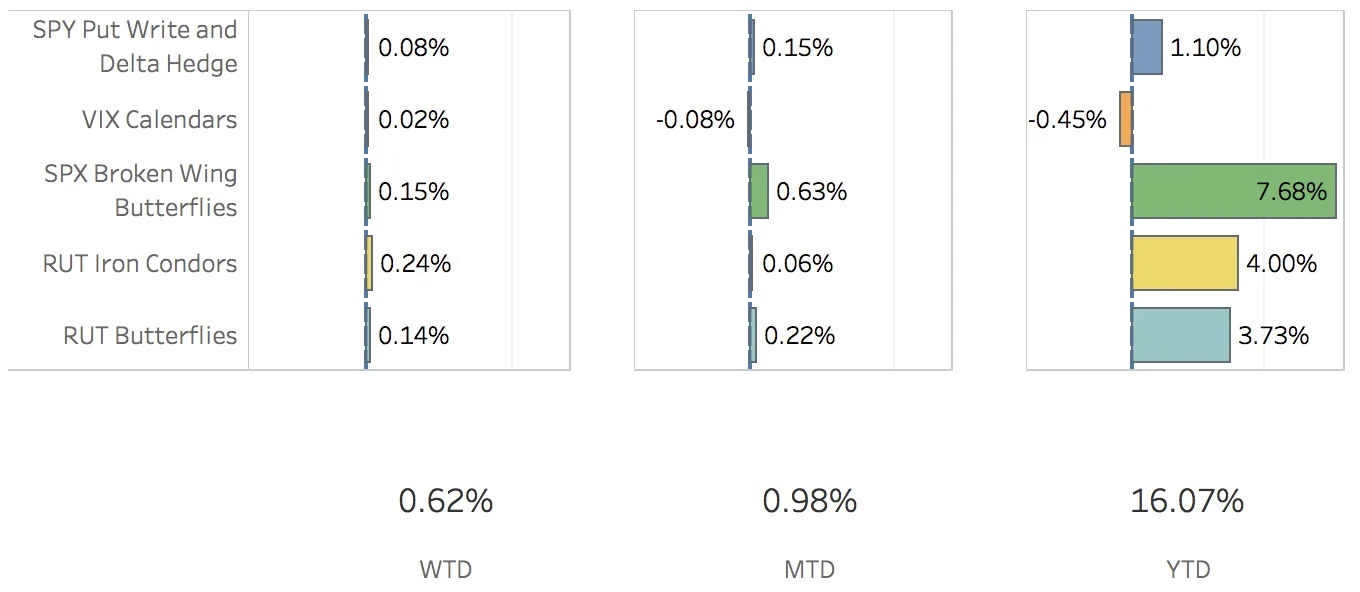

You would think that this would be my week what with Canadian Prime Minister (coming from where I used to live) delivering a keynote speech at the National Governors Association in Rhode Island (where I now live). It went well. The markets did better though. I won't complain. The SPX (S&P 500) ended the week at 2459.27, up +1.41%, and the RUT (Russell 2000) ended the week at 1428.82, up +0.92%. The portfolio was up a respectable +0.62%. Every strategy was a winner this week.

The SPY Put Write and Delta Hedge strategy had a good week with the market moving up. I ended up closing the put write for a nice gain. I didn't have a delta hedge on last week since the portfolio wasn't all that negative delta at the end of last week. Today, I added another put write and a delta hedge too. For the week, the strategy added 8 bps to the overall portfolio.

The VIX Calendars just kind of sat there this week. No activity and a little bit of gains. For the week, this strategy added 2 bps to the portfolio.

The SPX Broken Wing Butterflies strategy did better than I expected considering the SPX practically screamed upward this week. I closed the Sep 15 trade for +5.21% gain. I opened Sep 1 and Sep 29 trades. Finally, I ended up adjusting both the Jul 31 and Aug 18 trades. I adjusted both of them twice by purchasing call debit spreads, effectively raising the right wing of the butterfly. The strategy added 15 bps to the portfolio.

The RUT Iron Condors had a respectable week. I really don't like how the calls are in jeopardy for the nested iron condor and the two weirdors. No adjustments to the upside have been required for these trades as of yet. We'll see how the market responds to being at historic highs. Will it bounce off those highs and retreat downwards, keep pushing onwards and upwards, or settle down for a bit and let me pull in some theta? We shall see. The strategy added 24 bps to the portfolio this week.

Finally, the RUT Butterfly strategy had a reasonable week. I had to adjust the trade twice this week by purchasing some call debit spreads. The market is still sitting inside the tent of the butterfly but it's pretty darn close to the right edge of it. We're sitting about 5 weeks out from the expiration date, Aug 18. I might be able to let it go a bit next week but the two weeks after that are prime theta earning weeks and I need to make sure the market is sitting squarely in the middle of the tent during those two weeks. For this week, the strategy added 14 bps to the portfolio.

Contribution to Return

Trade Activity

- CLOSED SPY Put Write Jul 14 +2.37%

- CLOSED VXX Put Jul 21 -16.23%

- CLOSED SPX Broken Wing Butterfly Sep 15 +5.21%

- OPENED SPY Put Write Jul 21

- OPENED SPY Delta Hedge Jul 28

- OPENED VXX Put Aug 4

- OPENED SPX Broken Wing Butterfly Sep 1

- OPENED SPX Broken Wing Butterfly Sep 29

- ADJUSTED SPX Broken Wing Butterfly Jul 31

- ADJUSTED SPX Broken Wing Butterfly Aug 18

SPX Broken Wing Butterfly Details

- CLOSED SPX Broken Wing Butterfly Sep 15 BOT +2 IRON CONDOR SPX 100 15 SEP 17 2425/2470/2425/2350 CALL/PUT @42.25

- OPENED SPX Broken Wing Butterfly Sep 1 SOLD -2 IRON CONDOR SPX 100 (Weeklys) 1 SEP 17 2425/2465/2425/2350 CALL/PUT @38.20

- OPENED SPX Broken Wing Butterfly Sep 29 SOLD -2 IRON CONDOR SPX 100 (Quarterlys) 29 SEP 17 2425/2470/2425/2350 CALL/PUT @44.20

- ADJUSTED SPX Broken Wing Butterfly Jul 31 BOT +2 VERTICAL SPX 100 (Weeklys) 31 JUL 17 2405/2410 CALL @3.95

- ADJUSTED SPX Broken Wing Butterfly Jul 31 BOT +2 VERTICAL SPX 100 (Weeklys) 31 JUL 17 2395/2405 CALL @9.25

- ADJUSTED SPX Broken Wing Butterfly Aug 18 BOT +2 VERTICAL SPX 100 18 AUG 17 2405/2415 CALL @8.60

- ADJUSTED SPX Broken Wing Butterfly Aug 18 BOT +2 VERTICAL SPX 100 18 AUG 17 2395/2405 CALL @8.85

Milking

- No trades-a-milking