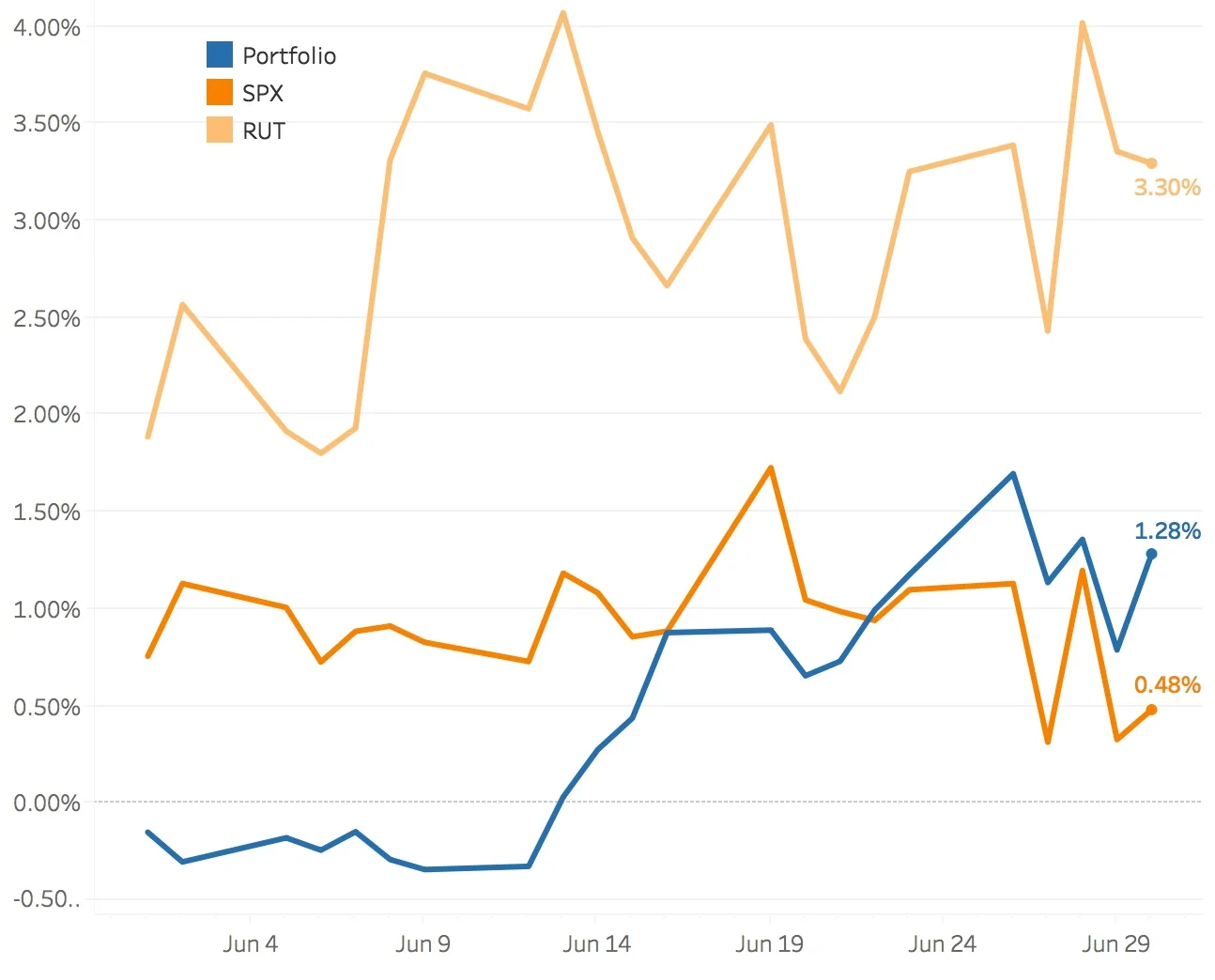

June 2017

This month the portfolio stumbled right out of the gate, not really gaining its footing until the middle of the month when it moved into positive territory. The RUT (Russell 2000) took off like a rocket early on and was all over the place but finished with a nice strong result, up +3.30% for the month of June. The SPX (S&P 500) started off more slowly and kind of just lumbered around finishing the month with a nice, respectable result, up +0.48%. The portfolio did better in the second half and still ended up fairly well, up +1.28% for June 2017.

With the market moving up, the SPY Put Write and Delta Hedge strategy was doing fairly well until the market turned kind of sour in the last week. It still managed to add 9 bps to the portfolio. The VIX Calendars strategy knocked me around a bit this month subtracting 14 bps from the portfolio. It was again the SPX Broken Wing Butterflies strategy that really pulled through this month with a very strong showing adding 92 bps to the portfolio. The RUT Iron Condors strategy hit a bit of a rough patch this month with strong up moves and down moves requiring adjustments on both sides of the condors effectively removing most of the profit from those trades. This strategy subtracted 19 bps from the portfolio. Finally, the RUT Butterflies strategy had a good month handling the volatility fairly well and adding 61 bps to the portfolio.

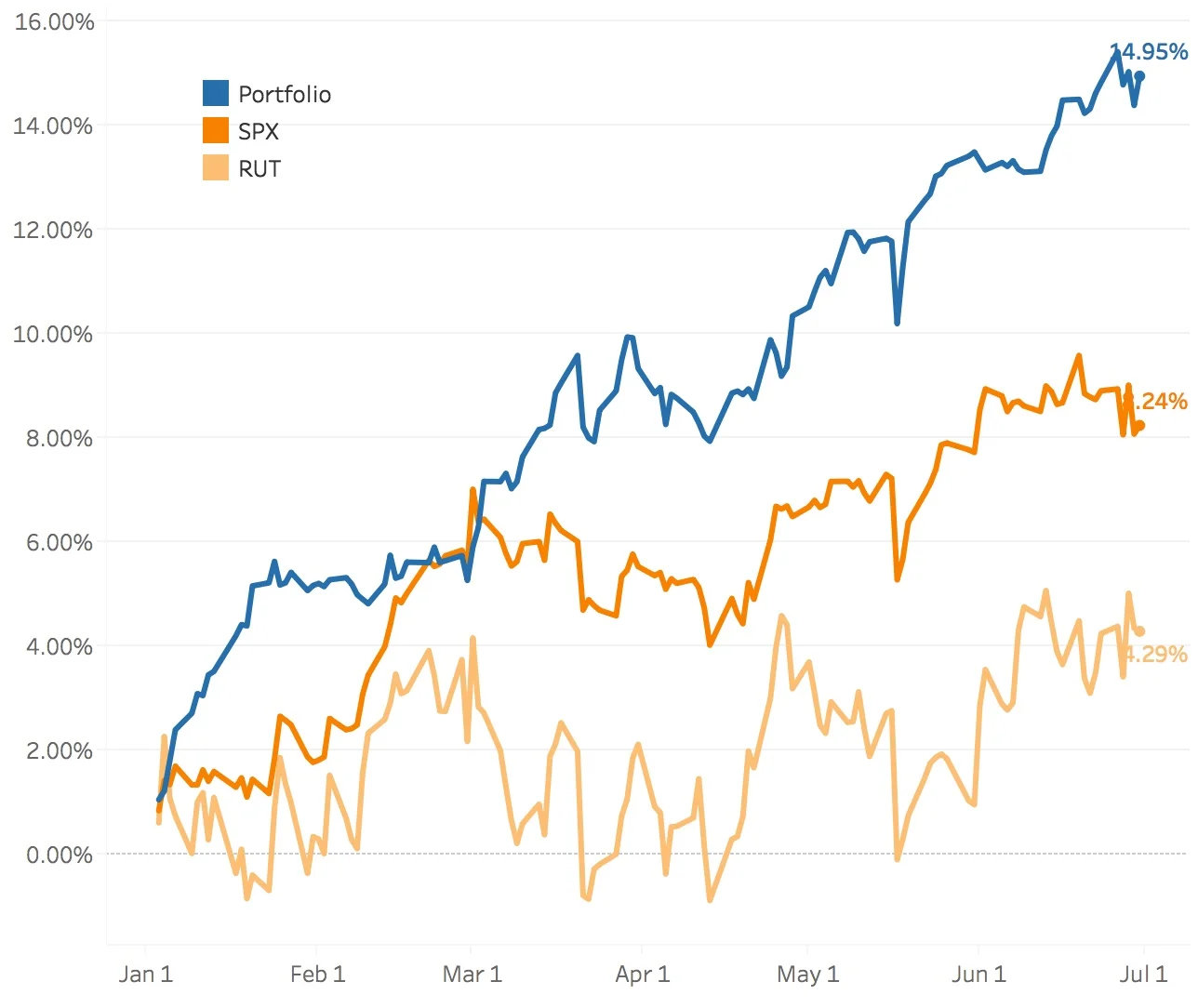

Year-to-Date

I'm feeling pretty good right now but I know the portfolio really hasn't been truly tested. There have really been no rough markets or major world crises that have highlighted any of the weak spots in the portfolio. That will come with time. For now however, the portfolio is up +14.95% for the first six months of the year. That's above the 12% goal (simple average arithmetic return of 2% per month) and it is above the 12.62% goal (geometric compounded return of 2% per month). In comparison, the SPX (S&P 500) is up +8.24% and the RUT (Russell 2000) is up +4.29%.

With the S&P for the most part moving up, that has played well with the SPY Put Write and Delta Hedge strategy which has added 93 bps to the portfolio this year. The VIX Calendars strategy has yet to prove itself subtracting 36 bps. The star of the show is the wonderfully consistent SPX Broken Wing Butterfly strategy which has added 697 bps to the portfolio. Also strong are the RUT Iron Condors and RUT Butterfly strategies which have added 391 bps and 348 bps respectively to the portfolio for the first six months of 2017.

Hey! Check out the Performance page for interactive charts similar to the ones above where you can slice and dice the different time periods to see which strategies did well throughout the year!